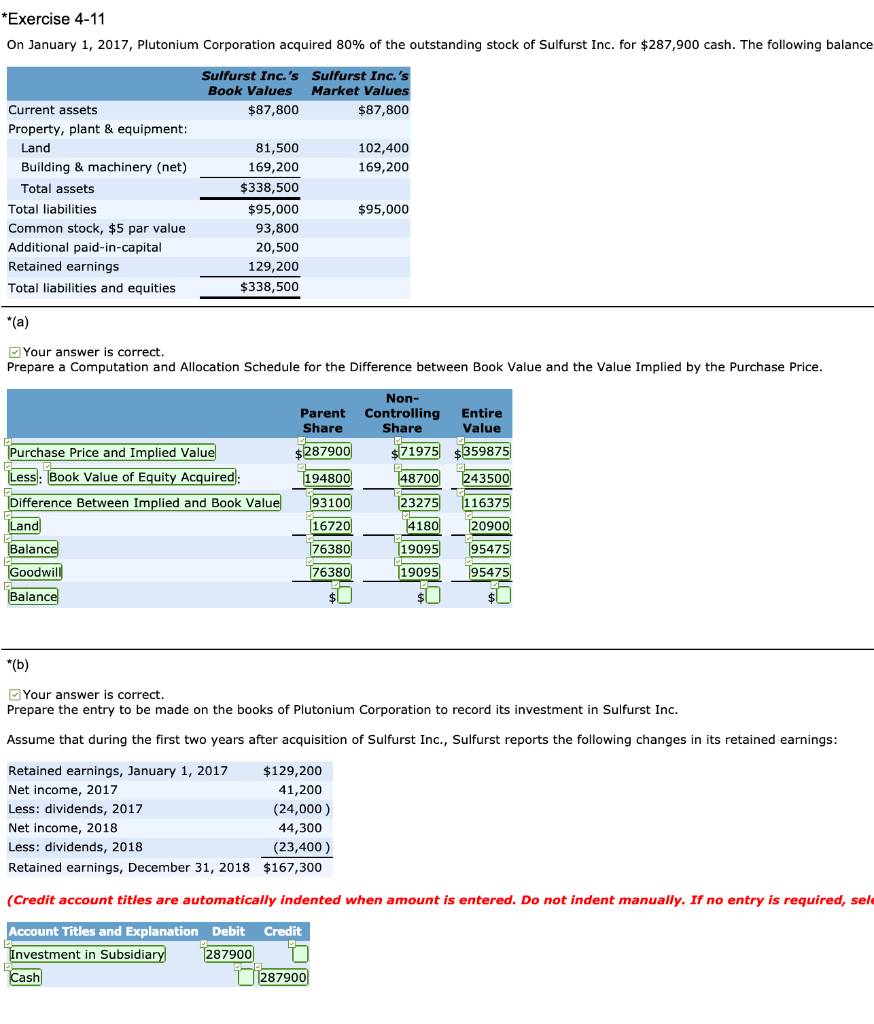

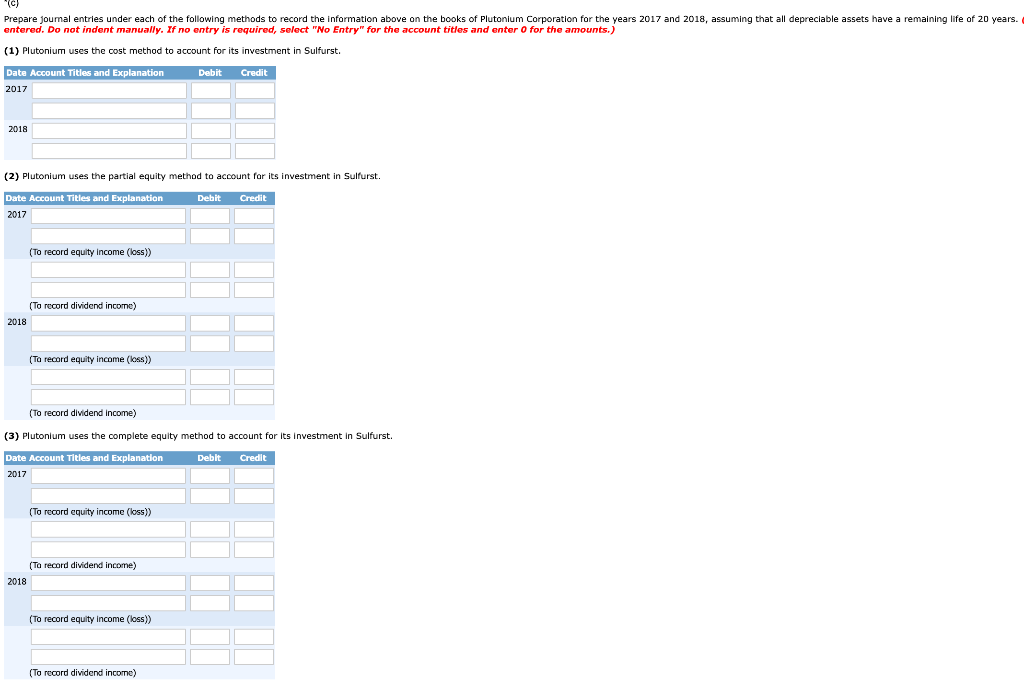

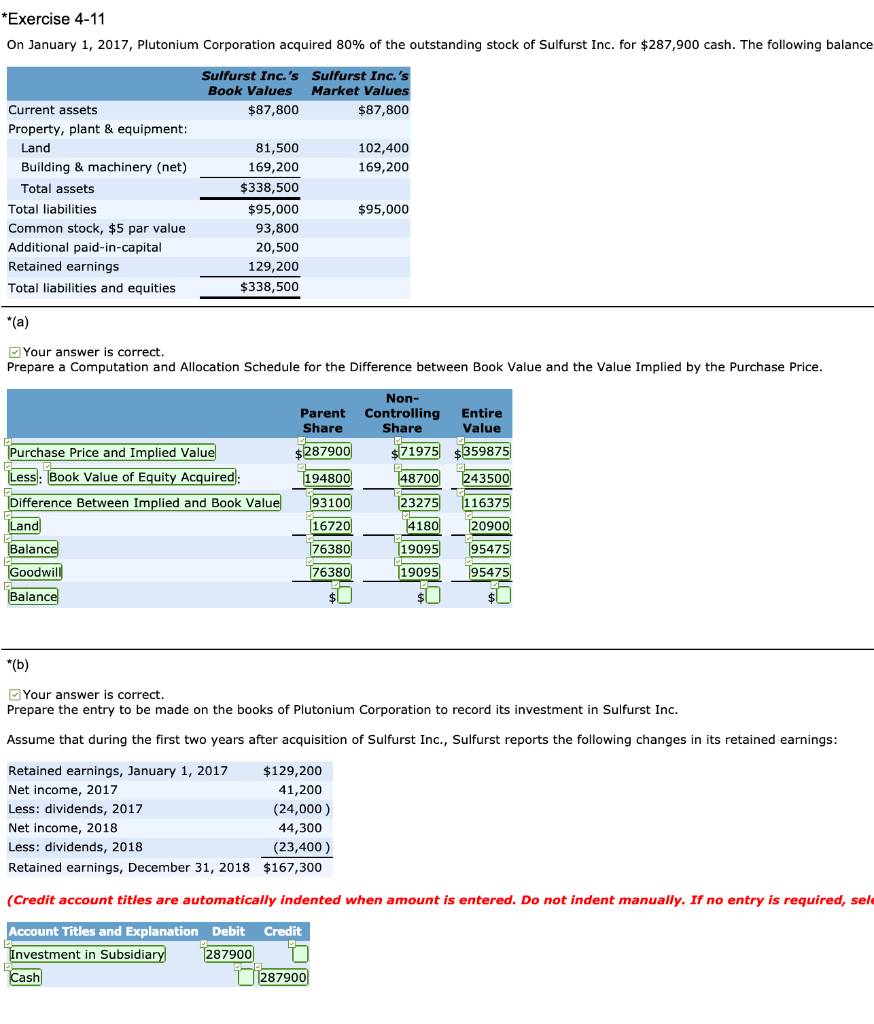

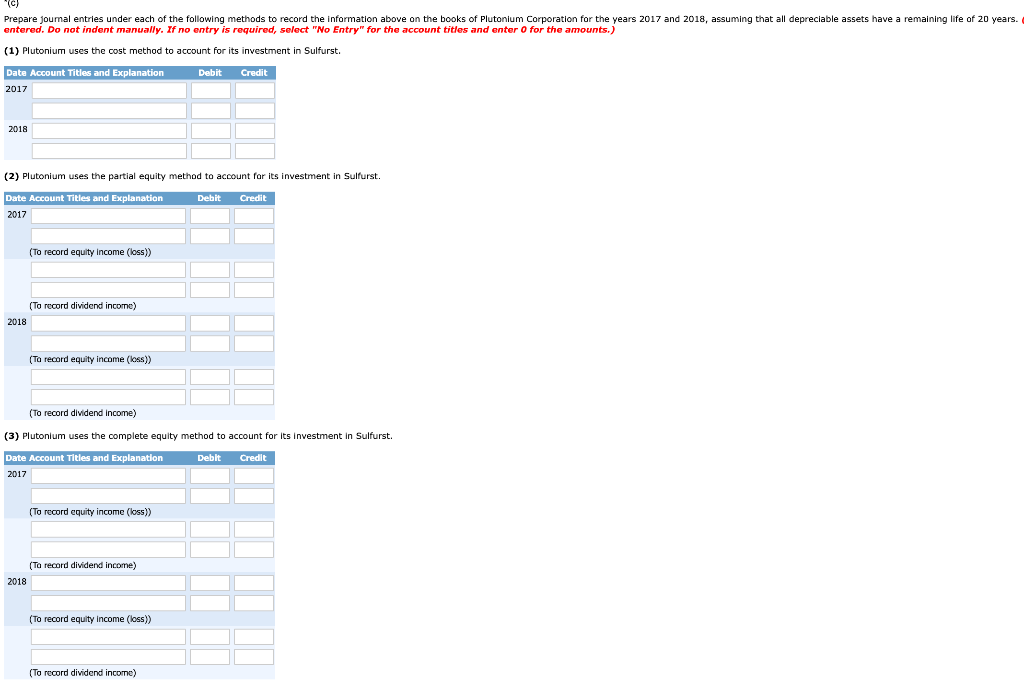

* Exercise 4-11 On January 1, 2017, Plutonium Corporation acquired 80% of the outstanding stock of Sulfurst Inc. for $287,900 cash. The following balance Sulfurst Inc.'s Sulfurst Inc.'s Book Values Market Values $87,800 $87,800 102,400 169,200 Current assets Property, plant & equipment: Land Building & machinery (net) Total assets Total liabilities Common stock, $5 par value Additional paid-in-capital Retained earnings Total liabilities and equities $95,000 81,500 169,200 $338,500 $95,000 93,800 20,500 129,200 $338,500 *(a) Your answer is correct. Prepare a Computation and Allocation Schedule for the Difference between Book Value and the Value Implied by the Purchase Price. Entire Value Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Between Implied and Book Value Land Balance Goodwill Balance Parent Share $287900 1194800 193100 16720 176380 176380 Non- Controlling Share $71975 148700 23275 14180 119095 119095 1243500 1116375 120900 95475 195475 $0 *(b) Your answer is correct. Prepare the entry to be made on the books of Plutonium Corporation to record its investment in Sulfurst Inc. Assume that during the first two years after acquisition of Sulfurst Inc., Sulfurst reports the following changes in its retained earnings: Retained earnings, January 1, 2017 $129,200 Net income, 2017 41,200 Less: dividends, 2017 (24,000) Net income, 2018 44,300 Less: dividends, 2018 (23,400) Retained earnings, December 31, 2018 $167,300 (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, sele Credit Account Titles and Explanation Investment in Subsidiary Debit 287900 Cash 1287900 Prepare journal entries under each of the following methods to record the information above on the books of Plutonium Corporation for the years 2017 and 2018, assuming that all depreciable assets have a remaining life of 20 years. entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) (1) Plutonium uses the cost method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Debit Credit 2018 (2) Plutonium uses the partial equity method to account for its investment in Sulfurst. Debit Credit Date Account Titles and Explanation 2017 (To record equity Income (loss)) (To record dividend income) 2018 (To record equity income (loss)) (To record dividend Income) (3) Plutonium uses the complete equity method to account for its investment in Sulfurst. Debit Credit Date Account Titles and Explanation 2017 (To record equity income (loss)) (To record dividend income) 2018 (To record equity Income (loss)) (To record dividend income)