Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 4-17 Complete accounting cycle (monthly) LO1, 2, 4, 5 Emily Lee grew up in Vancouver and loves to be a tourist in her own

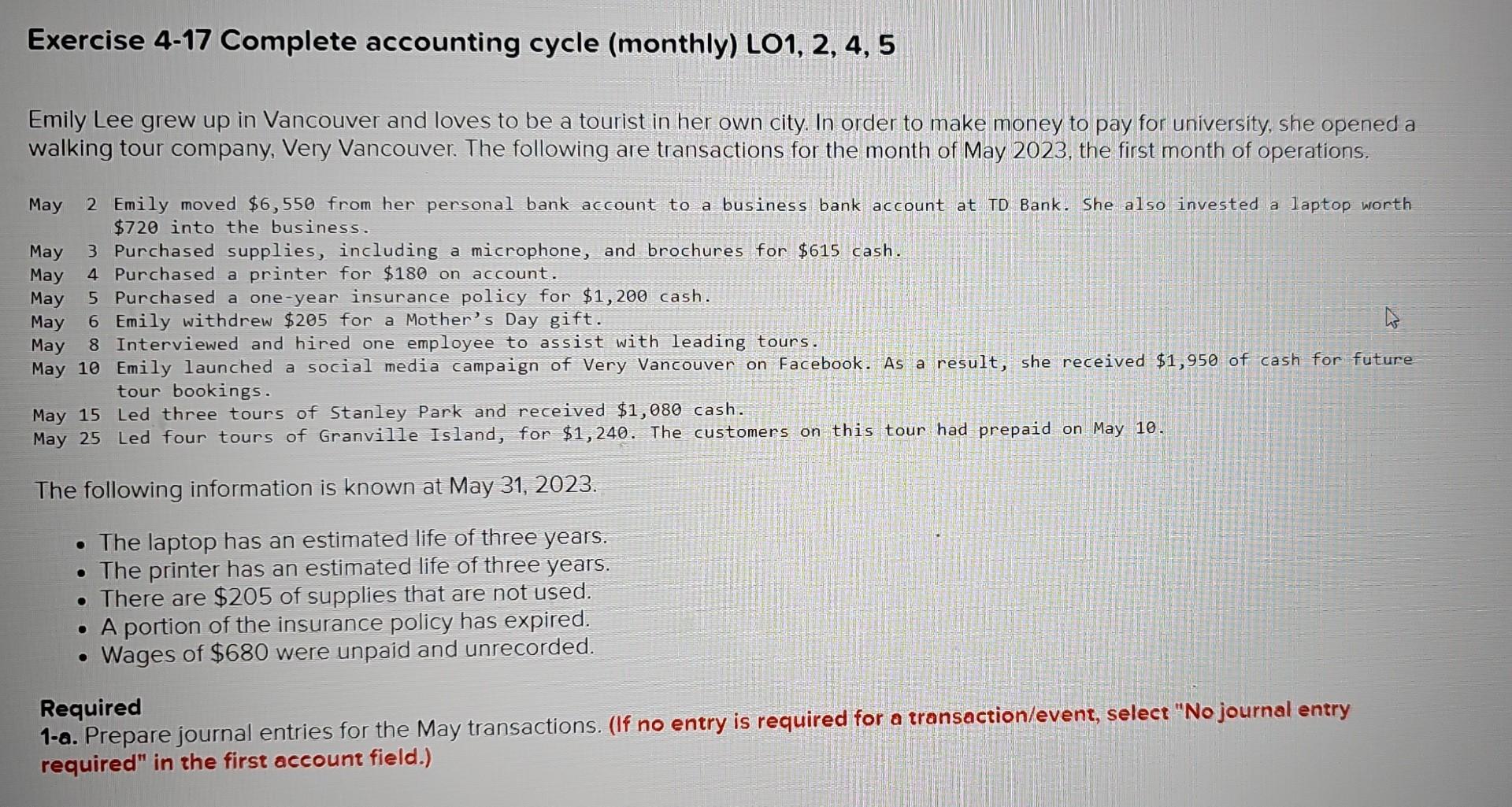

Exercise 4-17 Complete accounting cycle (monthly) LO1, 2, 4, 5 Emily Lee grew up in Vancouver and loves to be a tourist in her own city. In order to make money to pay for university, she opened a walking tour company, Very Vancouver. The following are transactions for the month of May 2023, the first month of operations. May 2 Emily moved $6,550 from her personal bank account to a business bank account at TD Bank. She also invested a laptop worth $720 into the business. May 3 Purchased supplies, including a microphone, and brochures for $615 cash. May 4 Purchased a printer for $180 on account. May 5 Purchased a one-year insurance policy for $1,200 cash. May 6 Emily withdrew $205 for a Mother's Day gift. May 8 Interviewed and hired one employee to assist with leading tours. May 10 Emily launched a social media campaign of Very Vancouver on Facebook. As a result, she received $1, 950 of cash for future tour bookings. May 15 Led three tours of Stanley Park and received $1,080 cash. May 25 Led four tours of Granville Island, for $1,240. The customers on this tour had prepaid on May 10. The following information is known at May 31, 2023. - The laptop has an estimated life of three years. - The printer has an estimated life of three years. - There are $205 of supplies that are not used. - A portion of the insurance policy has expired. - Wages of $680 were unpaid and unrecorded. 1-a. Prepare journal entries for the May transactions. (If no entry is required for a transaction/event, select "No journal entry Required required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started