12. Covered call writers often plan to buy back the written call if the stock price drops...

Question:

12. Covered call writers often plan to buy back the written call if the stock price drops sufficiently. The logic is that the written call at that point has little “upside,” and, if the stock recovers, the position could sustain a loss from the written call.

a. Explain in general how this buy-back strategy could be implemented using barrier options.

b. Suppose S = $50, σ = 0.3, r = 0.08, t = 1, and δ = 0. The premium of a written call with a $50 strike is $7.856. We intend to buy the option back if the stock hits $45. What is the net premium of this strategy?

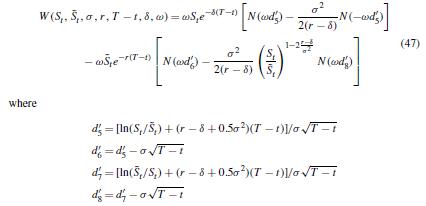

A European lookback call at maturity pays ST − ST . A European lookback put at maturity pays ST − ST . (Recall that ST and ST are the maximum and minimum prices over the life of the option.) Here is a formula that can be used to value both options:

The value of a lookback call is obtained by setting ˜St = St andω = 1. The value of a lookback put is obtained by setting ˜St = St and ω=−1.

Step by Step Answer:

Derivatives Markets Pearson New International Edition

ISBN: 978-1292021256

3rd Edition

Authors: Robert L. Mcdonald