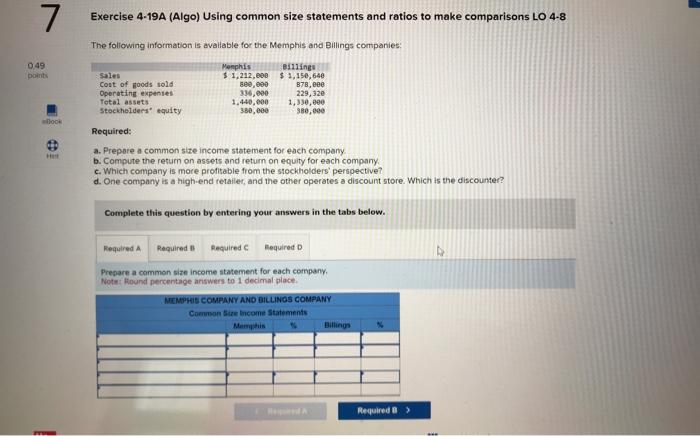

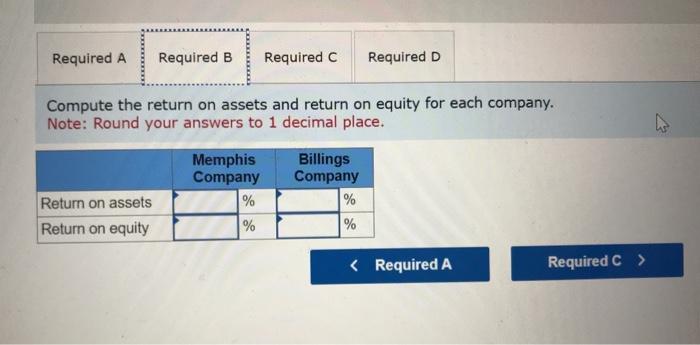

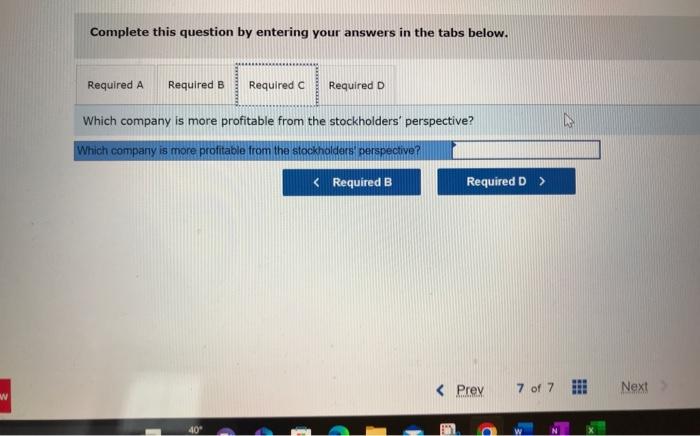

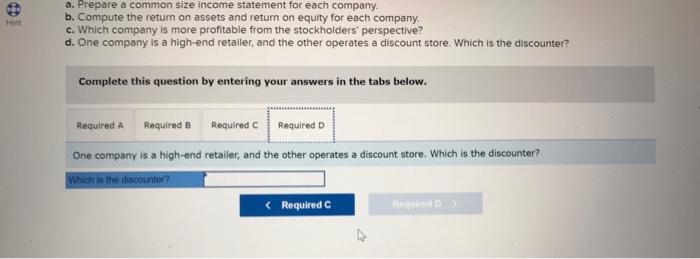

Exercise 4-19A (Algo) Using common size statements and ratios to make comparisons LO 4-8 The foliowing information is avaliable for the Memphis and Bulings companies: Required: a. Prepore a common size income statement for each company. b. Compute the return on assets and return on equity for each company. c. Which company is more profitable from the stockholders' perspective? d. One company is a high-end revailet, and the other operates a discount store. Which is the discounter? Complete this question by entering your answers in the tabs below. Prepare a common sizn income statement for each company. Notet Round percentage arswers to 1 decimal place. Compute the return on assets and return on equity for each company. Note: Round your answers to 1 decimal place. Complete this question by entering your answers in the tabs below. Which company is more profitable from the stockholders' perspective? Which company is more profitable from the stockholders' perspective? a. Prepare a common size income statement for each company. b. Compute the return on assets and return on equity for each company. c. Which company is more profitable from the stockholders' perspective? d. One company is a high-end retailer, and the other operates a discount store. Which is the discounter? Complete this question by entering your answers in the tabs below. One company is a high-end retailer, and the other operates a discount store. Which is the discounter? Exercise 4-19A (Algo) Using common size statements and ratios to make comparisons LO 4-8 The foliowing information is avaliable for the Memphis and Bulings companies: Required: a. Prepore a common size income statement for each company. b. Compute the return on assets and return on equity for each company. c. Which company is more profitable from the stockholders' perspective? d. One company is a high-end revailet, and the other operates a discount store. Which is the discounter? Complete this question by entering your answers in the tabs below. Prepare a common sizn income statement for each company. Notet Round percentage arswers to 1 decimal place. Compute the return on assets and return on equity for each company. Note: Round your answers to 1 decimal place. Complete this question by entering your answers in the tabs below. Which company is more profitable from the stockholders' perspective? Which company is more profitable from the stockholders' perspective? a. Prepare a common size income statement for each company. b. Compute the return on assets and return on equity for each company. c. Which company is more profitable from the stockholders' perspective? d. One company is a high-end retailer, and the other operates a discount store. Which is the discounter? Complete this question by entering your answers in the tabs below. One company is a high-end retailer, and the other operates a discount store. Which is the discounter