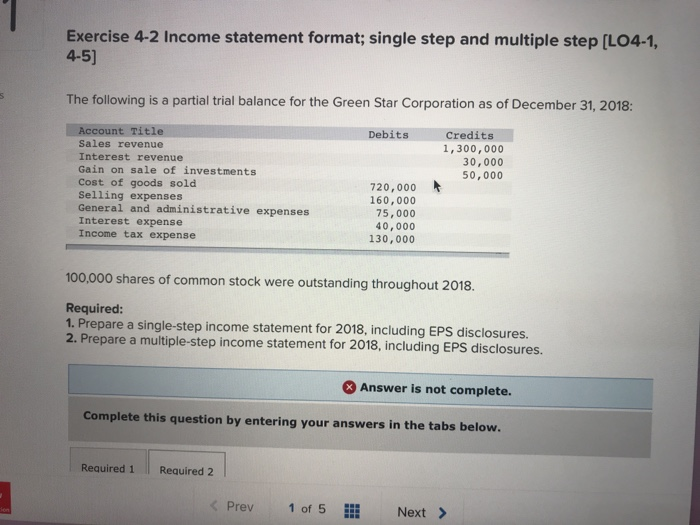

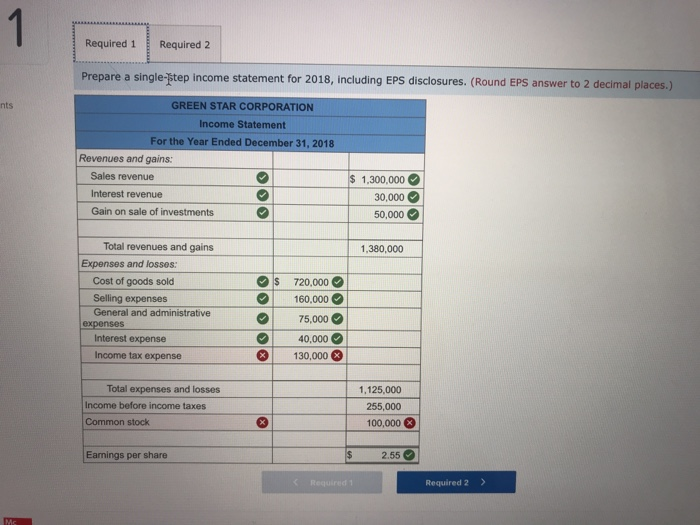

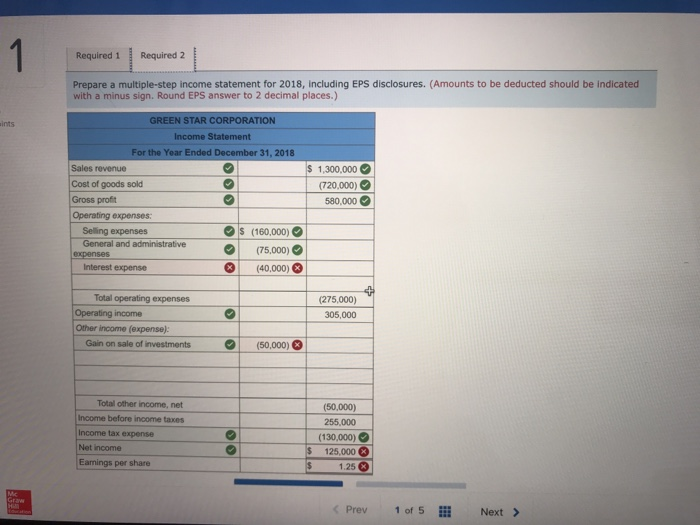

Exercise 4-2 Income statement format; single step and multiple step [LO4-1, 4-5) The following is a partial trial balance for the Green Star Corporation as of December 31, 2018: Credits Debits count Title Sales revenue Interest revenue Gain on sale of investments Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense 1,300,00o 30,000 50,000 720,000 160,000 75,000 40,000 130,000 100,000 shares of common stock were outstanding throughout 2018. Required: 1. Prepare a single-step income statement for 2018, including EPS disclosures. 2. Prepare a multiple-step income statement for 2018, including EPS disclosures. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 1 Required 2 Prepare a single-tep income statement for 2018, including EPS disclosures. (Round EPS answer to 2 decimal places.) GREEN STAR CORPORATION Income Statement For the Year Ended December 31, 2018 nts Revenues and gains: Sales revenue Interest revenue Gain on sale of investments 1,300,000 0,000 50,000 Total revenues and gains 1,380,000 Expenses and losses: Os 720.0000 Cost of goods sold Selling expenses General and administrative 160,000 75,000 40,000 130,000 Interest expense Income tax expense Total expenses and losses 1,125,000 Income before income taxes 255,000 Common stock 100,000 2.55 Eamings per share Required 2 Required 1 Required 2 Prepare a multiple-step income statement for 2018, including EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. Round EPS answer to 2 decimal places.) GREEN STAR CORPORATION Income Statement For the Year Ended December 31, 2018 ints Sales revenue Cost of goods sold Gross profit Operating expenses: 1,300.000 (720,000) 580,000 Seling expenses (160,000) General and administrative(75,000) Interest expense expenses (40,000) 4 Total operating expenses (275,000) 305,000 Operating income Other income (expense): Gain on sale of investments (50,000) - Total other income, net (50,000) 255,000 (130,000) Income before income taxes ncome tax expense Net income Eamings per share 125.000 1.25 Prev 1 of 5 Next >