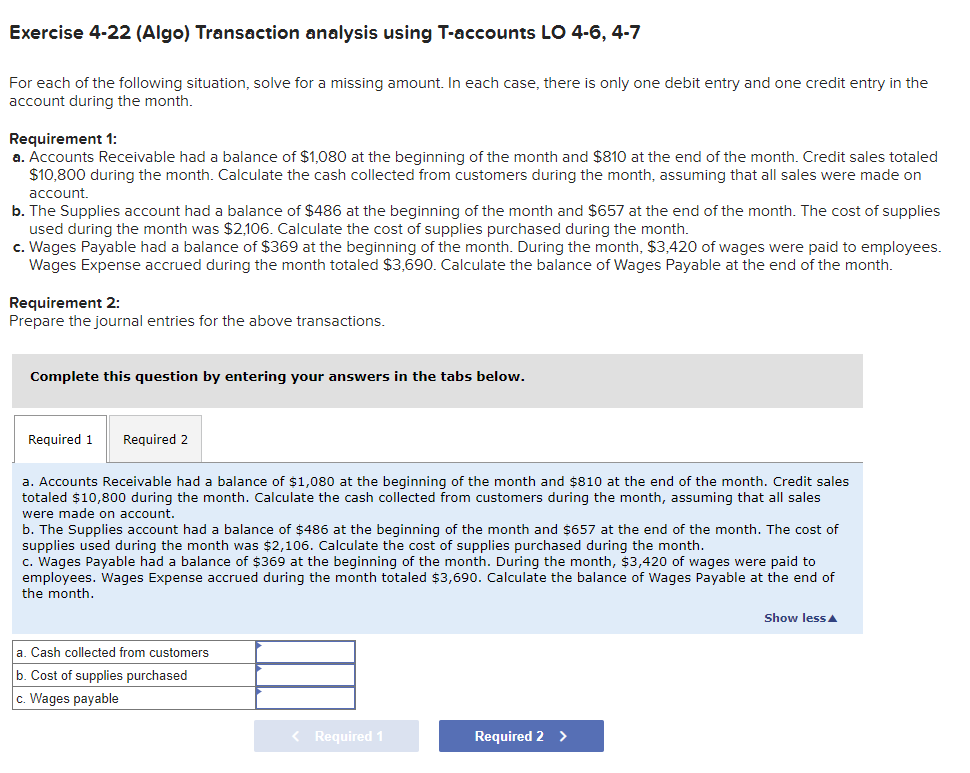

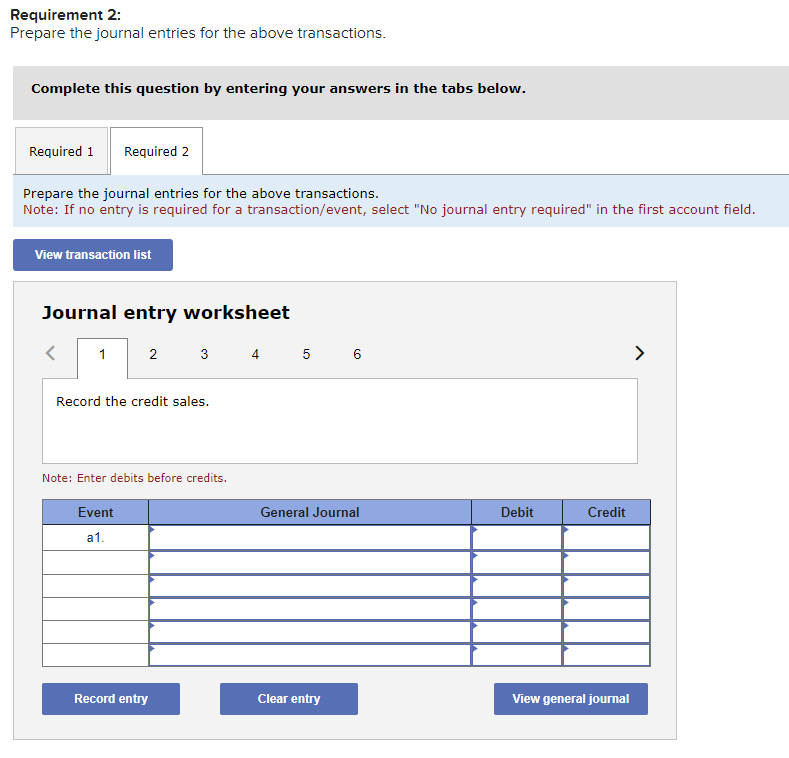

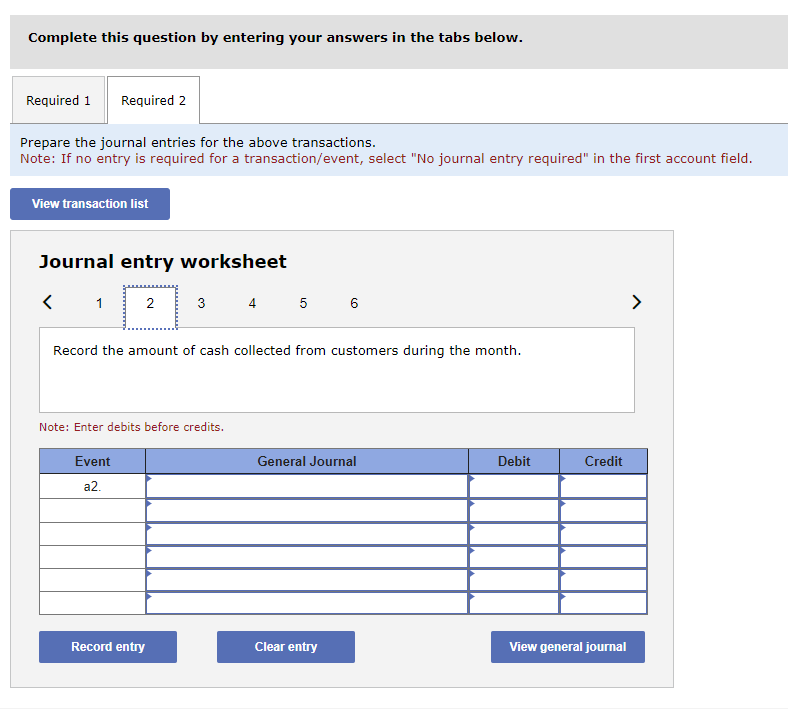

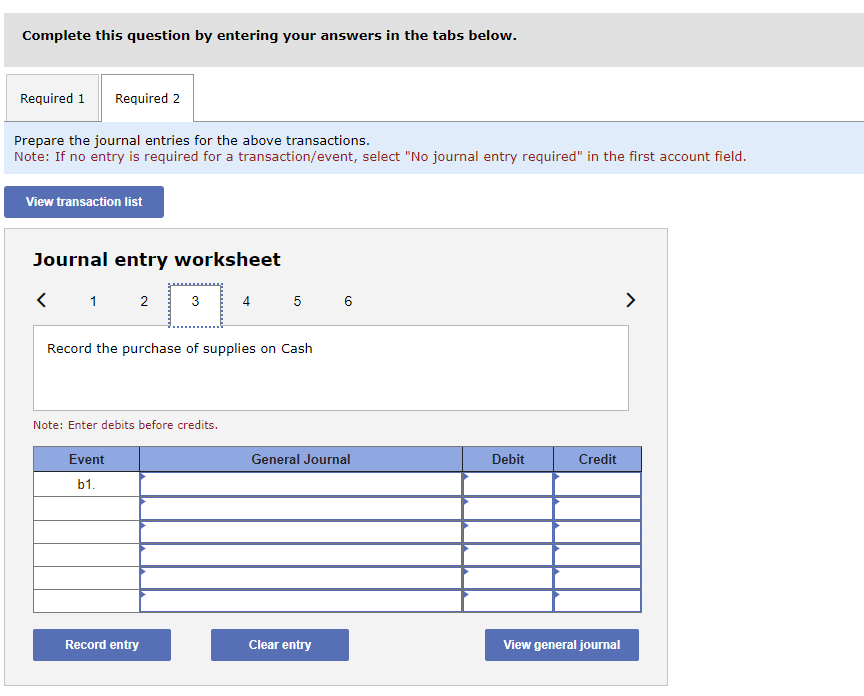

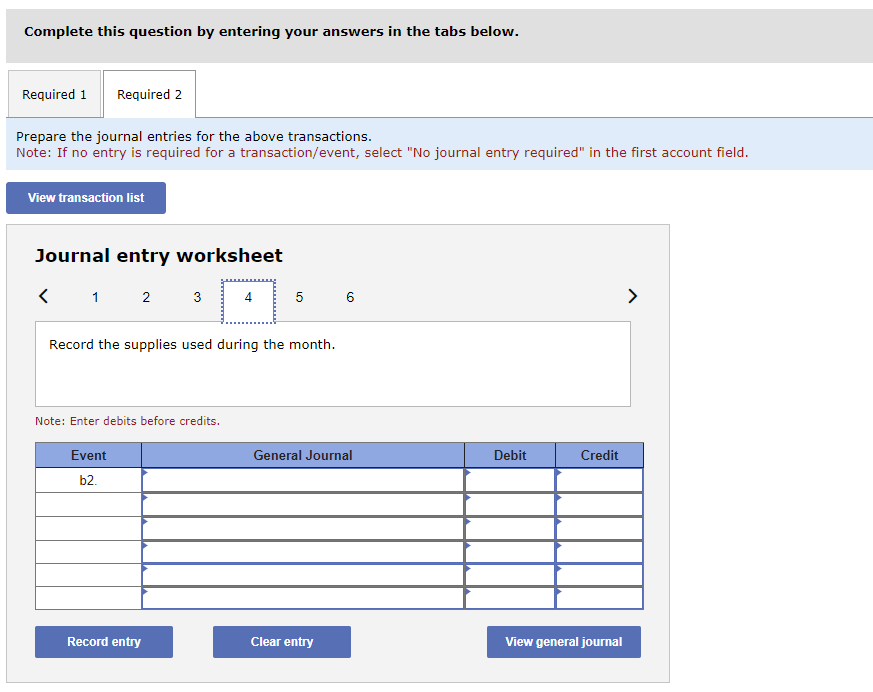

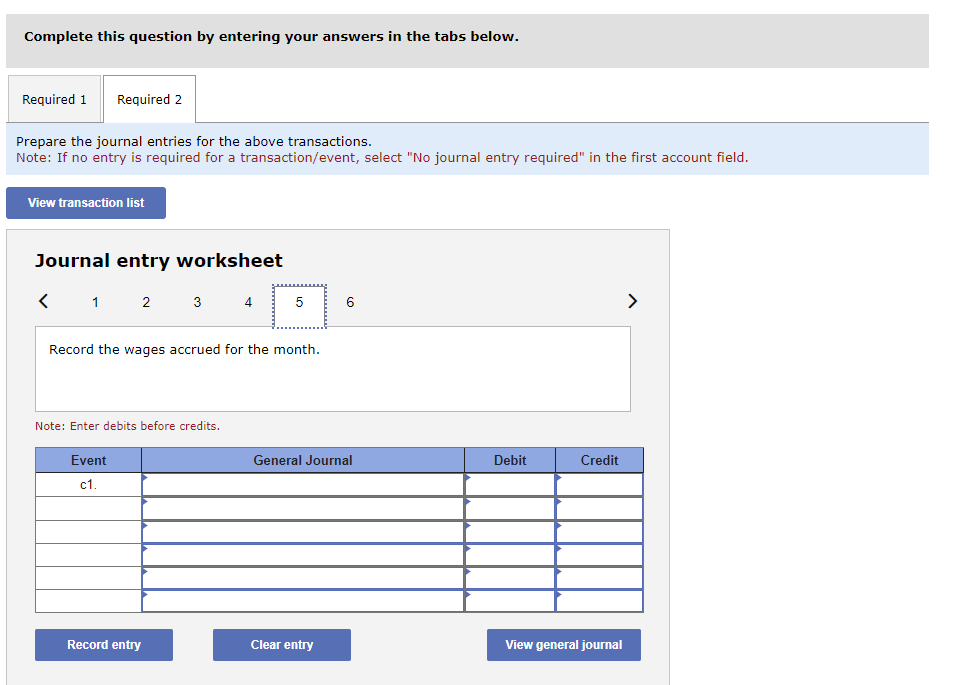

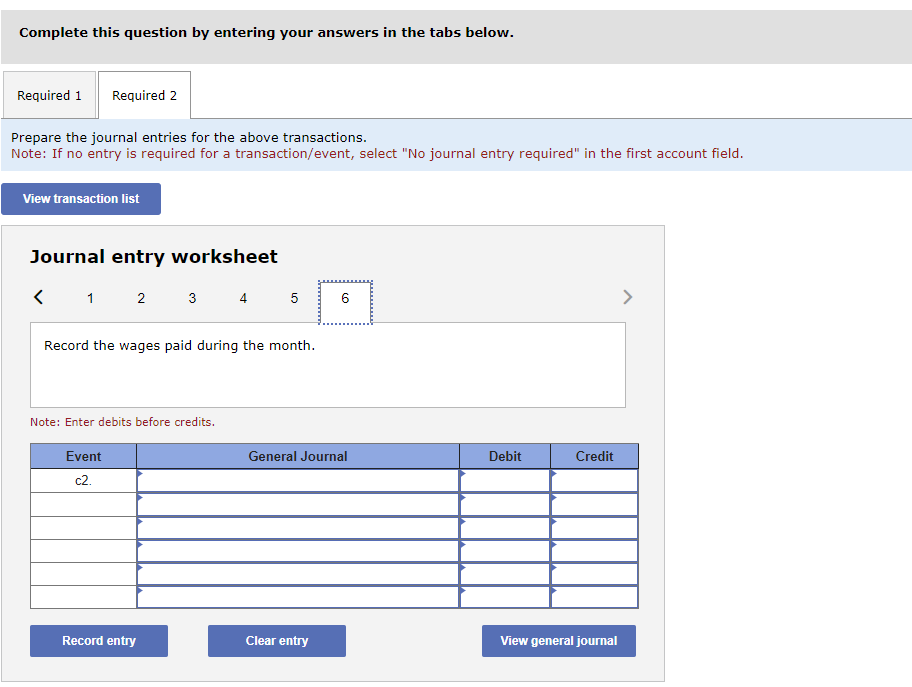

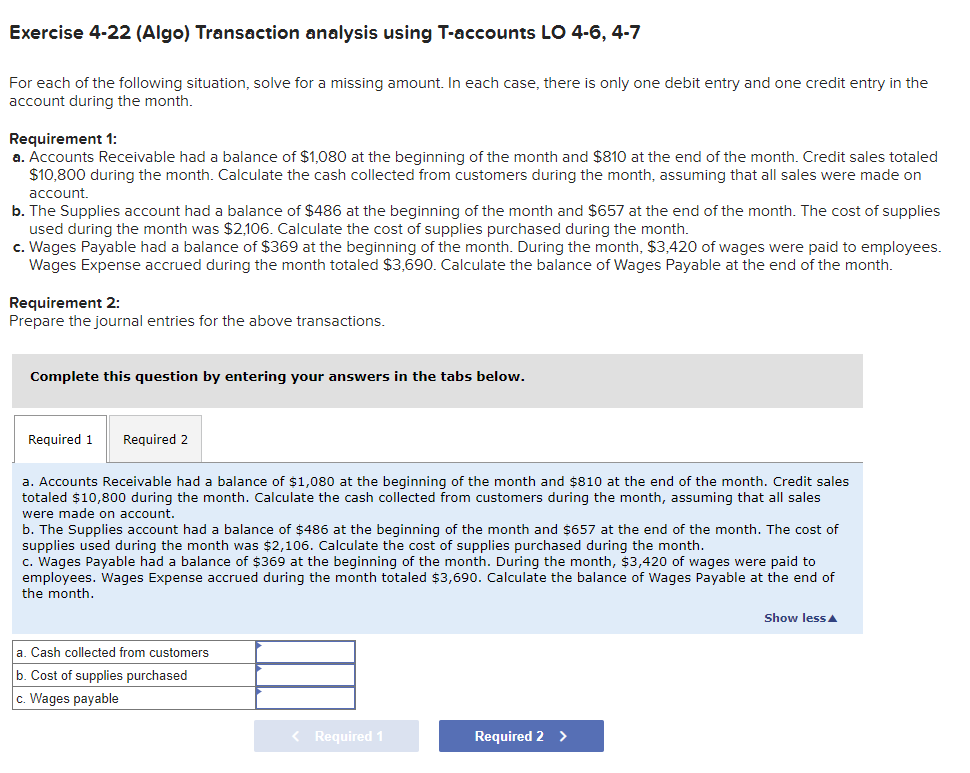

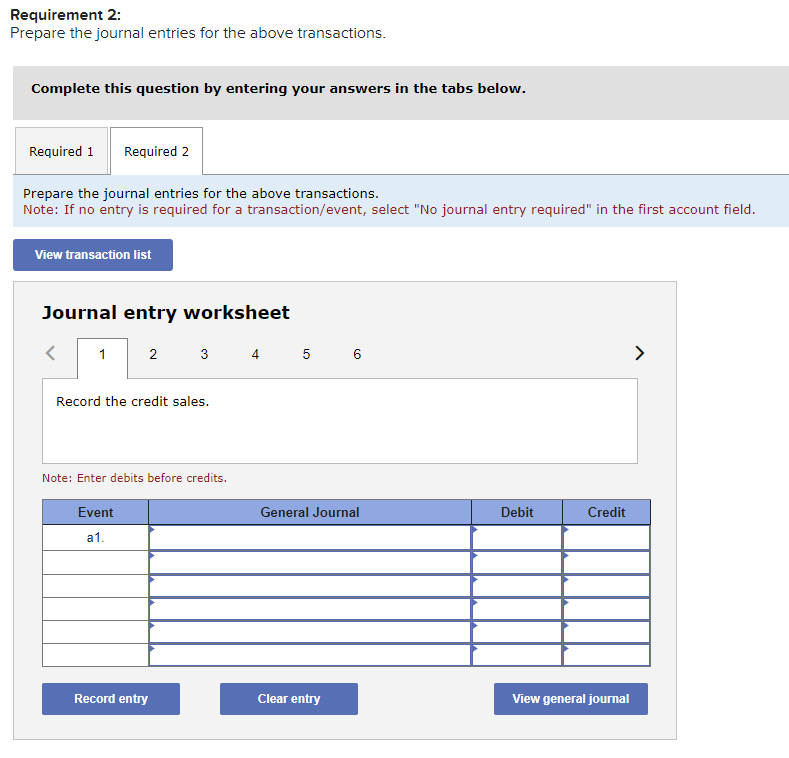

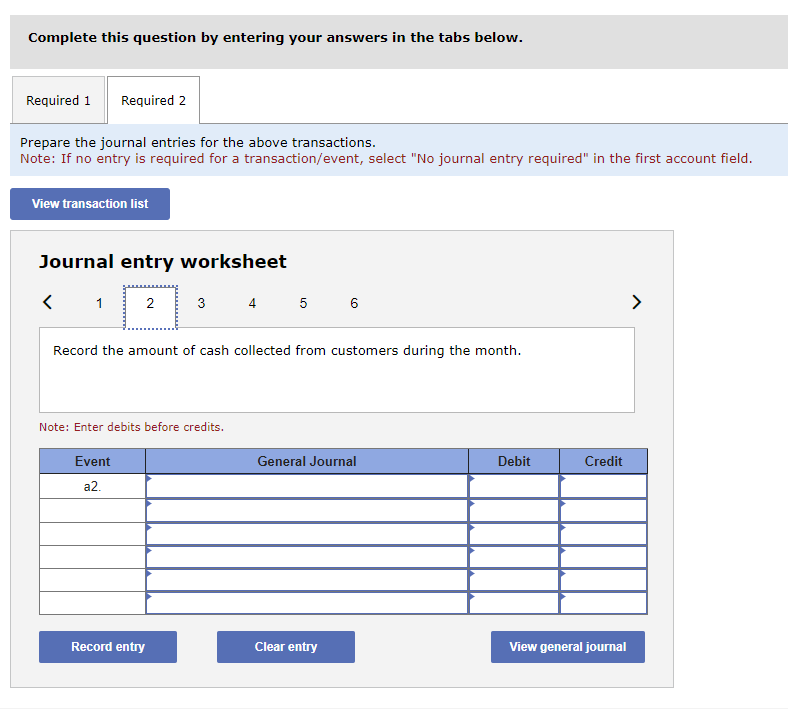

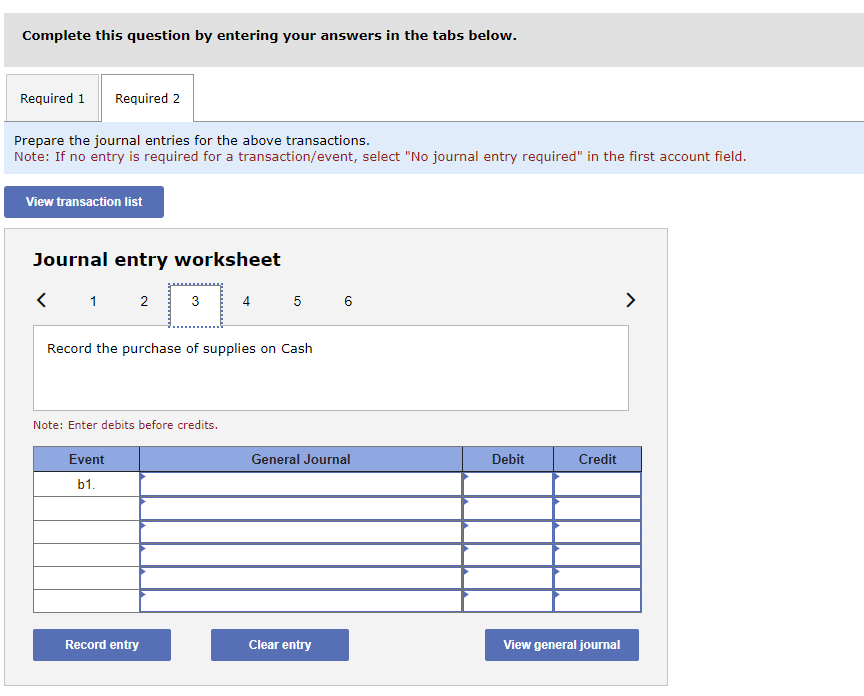

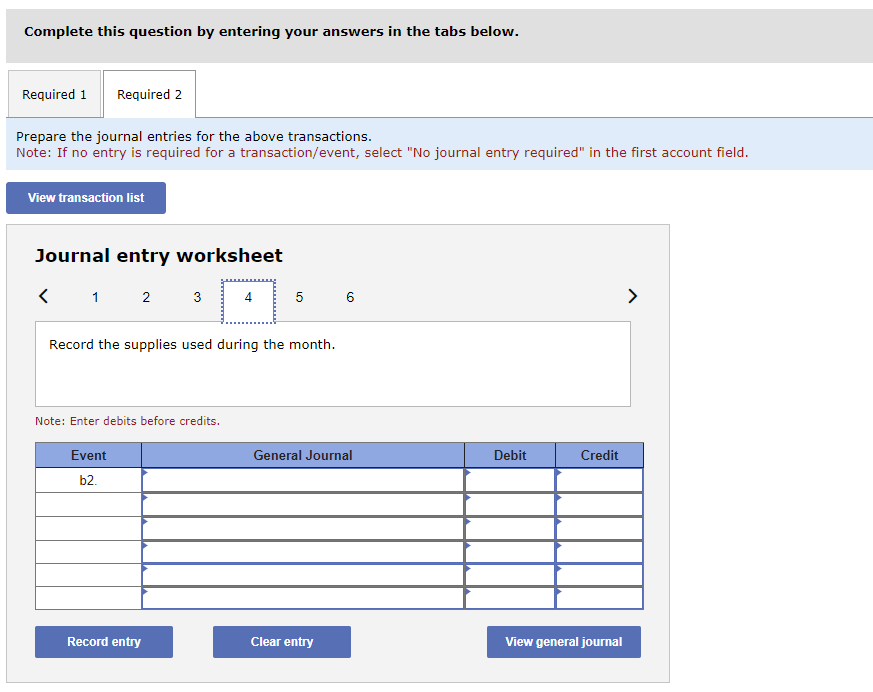

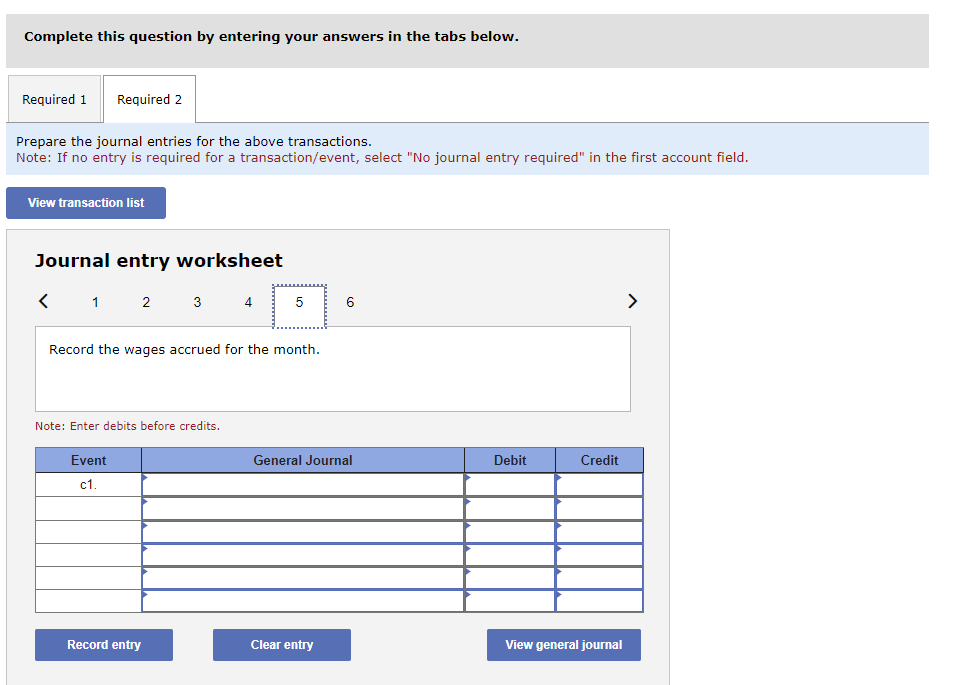

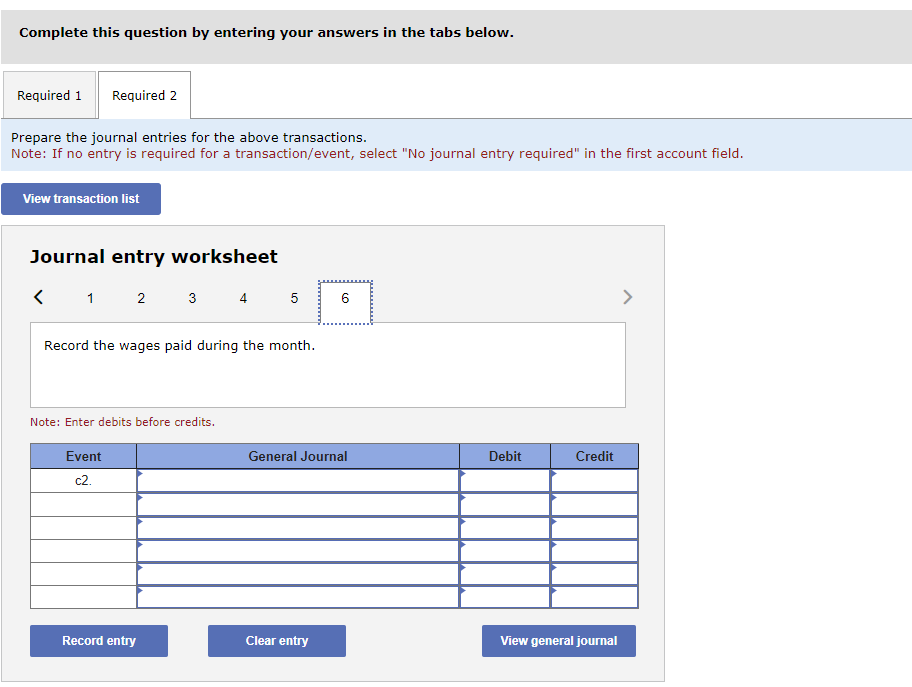

Exercise 4-22 (Algo) Transaction analysis using T-accounts LO 4-6, 4-7 For each of the following situation, solve for a missing amount. In each case, there is only one debit entry and one credit entry in the account during the month. Requirement 1: a. Accounts Receivable had a balance of $1,080 at the beginning of the month and $810 at the end of the month. Credit sales totaled $10,800 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account. b. The Supplies account had a balance of $486 at the beginning of the month and $657 at the end of the month. The cost of supplies used during the month was $2,106. Calculate the cost of supplies purchased during the month. c. Wages Payable had a balance of $369 at the beginning of the month. During the month, $3,420 of wages were paid to employees. Wages Expense accrued during the month totaled \$3,690. Calculate the balance of Wages Payable at the end of the month. Requirement 2: Prepare the journal entries for the above transactions. Complete this question by entering your answers in the tabs below. a. Accounts Receivable had a balance of $1,080 at the beginning of the month and $810 at the end of the month. Credit sales totaled $10,800 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account. b. The Supplies account had a balance of $486 at the beginning of the month and $657 at the end of the month. The cost of supplies used during the month was $2,106. Calculate the cost of supplies purchased during the month. c. Wages Payable had a balance of $369 at the beginning of the month. During the month, $3,420 of wages were paid to employees. Wages Expense accrued during the month totaled $3,690. Calculate the balance of Wages Payable at the end of the month. Requirement 2: Prepare the journal entries for the above transactions. Complete this question by entering your answers in the tabs below. Prepare the journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the amount of cash collected from customers during the month. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet