Question

Exercise 4-6 (Algo) Discontinued operations [LO4-4, 4-5] Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are

Exercise 4-6 (Algo) Discontinued operations [LO4-4, 4-5]

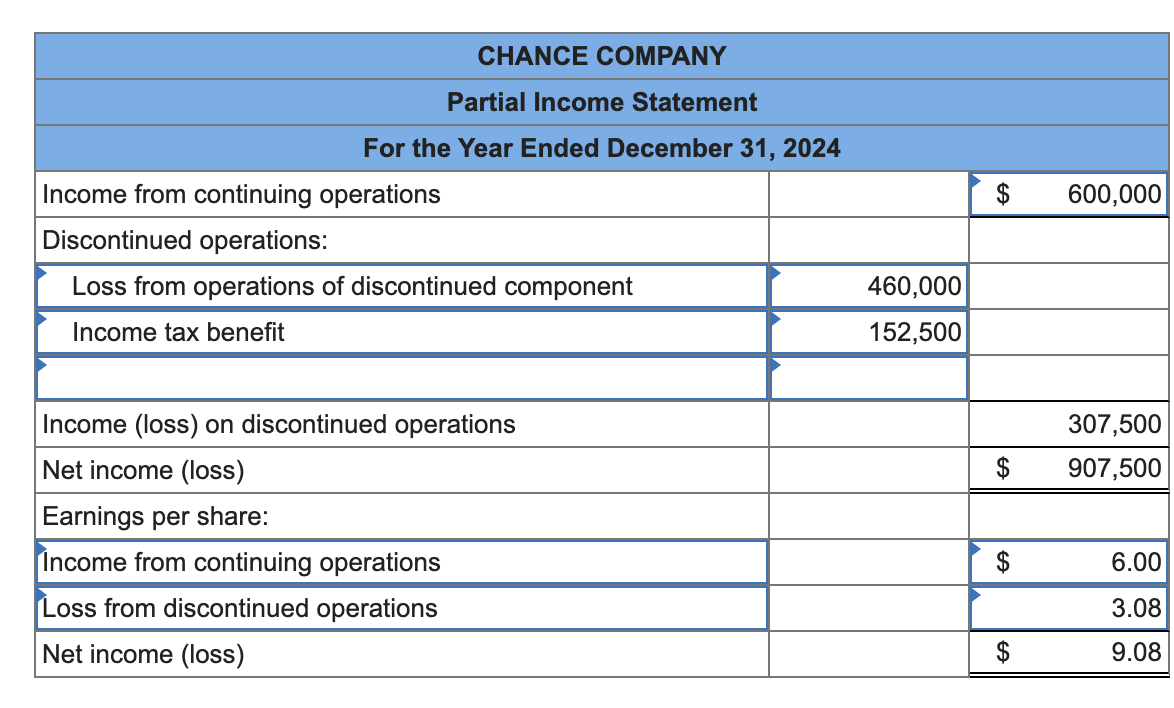

Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2024, the company adopted a plan to sell the assets of the division.

Consider the following:

- The actual sale was completed on December 15, 2024, at a price of $650,000. The book value of the divisions assets was $1,110,000, resulting in a before-tax loss of $460,000 on the sale.

- The division incurred a before-tax operating loss from operations of $150,000 from the beginning of the year through December 15.

- Chances after-tax income from its continuing operations is $600,000.

- The income tax rate is 25%.

Required:

Prepare an income statement beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year.

Note: Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places.

THE PROBLEM SHOWS THE LOSS FROM OPERATIONS $460,000 (ORIGINALLY PUT $610,000); BOTH OF THOSE WERE WRONG. IN ADDITION, THE LOSS FROM DISCONTINUED OPERATIONS OF $3.08 IS ALSO WRONG. EVERYTHING ELSE WAS CORRECT.

THE PROBLEM SHOWS THE LOSS FROM OPERATIONS $460,000 (ORIGINALLY PUT $610,000); BOTH OF THOSE WERE WRONG. IN ADDITION, THE LOSS FROM DISCONTINUED OPERATIONS OF $3.08 IS ALSO WRONG. EVERYTHING ELSE WAS CORRECT.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started