Exercise 4-7A (Algo) Treatment of NSF check LO 4-3 is followed by 2 multiple choice questions.

Also need help with question 3 & 4. Question of number is located on upper left.

Thank you!

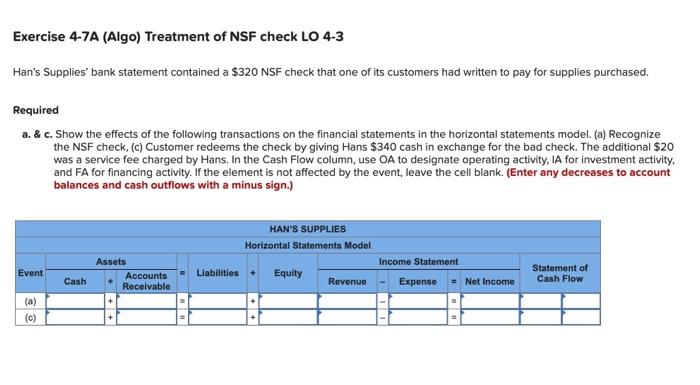

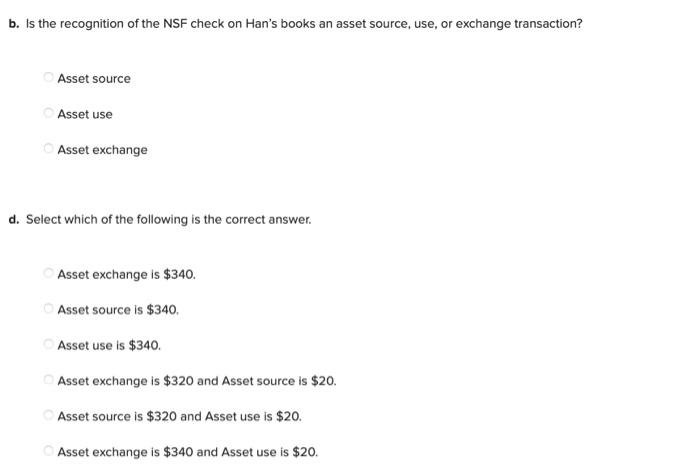

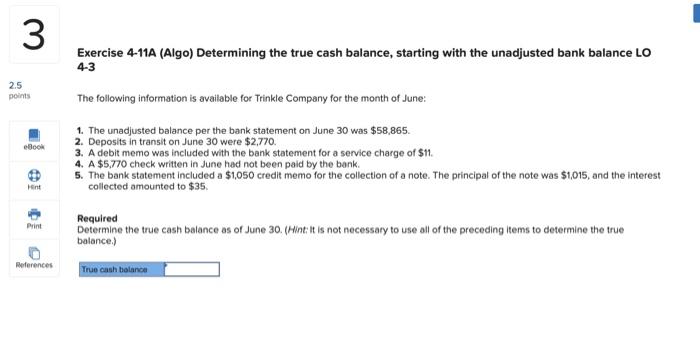

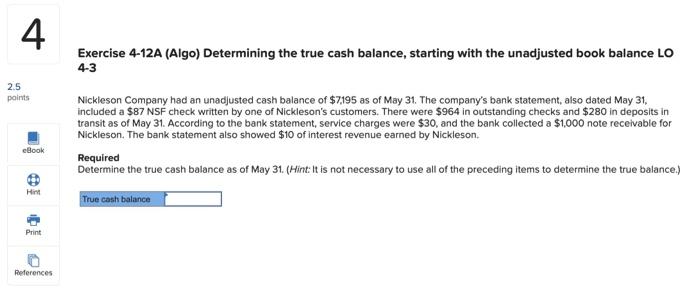

Exercise 4-7A (Algo) Treatment of NSF check LO 4-3 Han's Supplies' bank statement contained a $320 NSF check that one of its customers had written to pay for supplies purchased. Required a.& c. Show the effects of the following transactions on the financial statements in the horizontal statements model: (a) Recognize the NSF check, (c) Customer redeems the check by giving Hans $340 cash in exchange for the bad check. The additional $20 was a service fee charged by Hans. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, and FA for financing activity. If the element is not affected by the event, leave the cell blank. (Enter any decreases to account balances and cash outflows with a minus sign.) HAN'S SUPPLIES Horizontal Statements Model Equity Income Statement Event Assets Accounts Receivable Liabilities Statement of Cash Flow Cash Revenue Expense Net Income (a) (c) @ = b. Is the recognition of the NSF check on Han's books an asset source, use, or exchange transaction? Asset source Asset use Asset exchange d. Select which of the following is the correct answer. Asset exchange is $340. Asset source is $340. Asset use is $340. Asset exchange is $320 and Asset source is $20. Asset source is $320 and Asset use is $20. Asset exchange is $340 and Asset use is $20. 3 Exercise 4-11A (Algo) Determining the true cash balance, starting with the unadjusted bank balance LO 4-3 2.5 points The following information is available for Trinkle Company for the month of June: eBook 1. The unadjusted balance per the bank statement on June 30 was $58,865. 2. Deposits in transit on June 30 were $2,770. 3. A debit memo was included with the bank statement for a service charge of $11. 4. A $5,770 check written in June had not been paid by the bank. 5. The bank statement included a $1,050 credit memo for the collection of a note. The principal of the note was $1,015, and the intere collected amounted to $35. Hint Print Required Determine the true cash balance as of June 30. (Hint: It is not necessary to use all of the preceding items to determine the true balance) References True cash balance 4 Exercise 4-12A (Algo) Determining the true cash balance, starting with the unadjusted book balance LO 4-3 2.5 points Nickleson Company had an unadjusted cash balance of $7.195 as of May 31. The company's bank statement, also dated May 31, included a $87 NSF check written by one of Nickleson's customers. There were $964 in outstanding checks and $280 in deposits in transit as of May 31. According to the bank statement, service charges were $30, and the bank collected a $1,000 note receivable for Nickleson. The bank statement also showed $10 of interest revenue earned by Nickleson, Required Determine the true cash balance as of May 31 (Hint: It is not necessary to use all of the preceding items to determine the true balance.) eBook Hint True cash balance Print References