Answered step by step

Verified Expert Solution

Question

1 Approved Answer

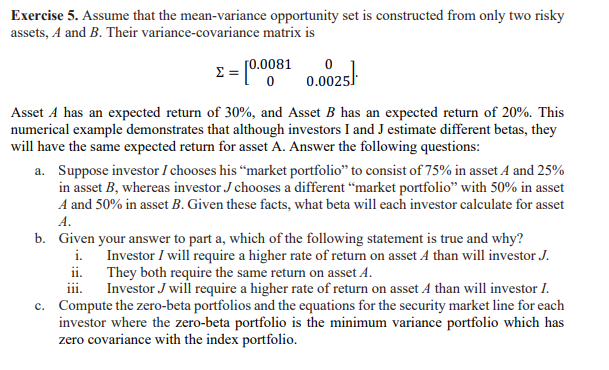

Exercise 5 . Assume that the mean - variance opportunity set is constructed from only two risky assets, A and B . Their variance -

Exercise Assume that the meanvariance opportunity set is constructed from only two risky

assets, A and Their variancecovariance matrix is

Asset A has an expected return of and Asset B has an expected return of This

numerical example demonstrates that although investors I and J estimate different betas, they

will have the same expected return for asset A Answer the following questions:

a Suppose investor I chooses his market portfolio to consist of in asset A and

in asset B whereas investor J chooses a different market portfolio with in asset

A and in asset B Given these facts, what beta will each investor calculate for asset

A

b Given your answer to part a which of the following statement is true and why?

i Investor I will require a higher rate of return on asset A than will investor J

ii They both require the same return on asset A

iii. Investor J will require a higher rate of return on asset A than will investor I.

c Compute the zerobeta portfolios and the equations for the security market line for each

investor where the zerobeta portfolio is the minimum variance portfolio which has

zero covariance with the index portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started