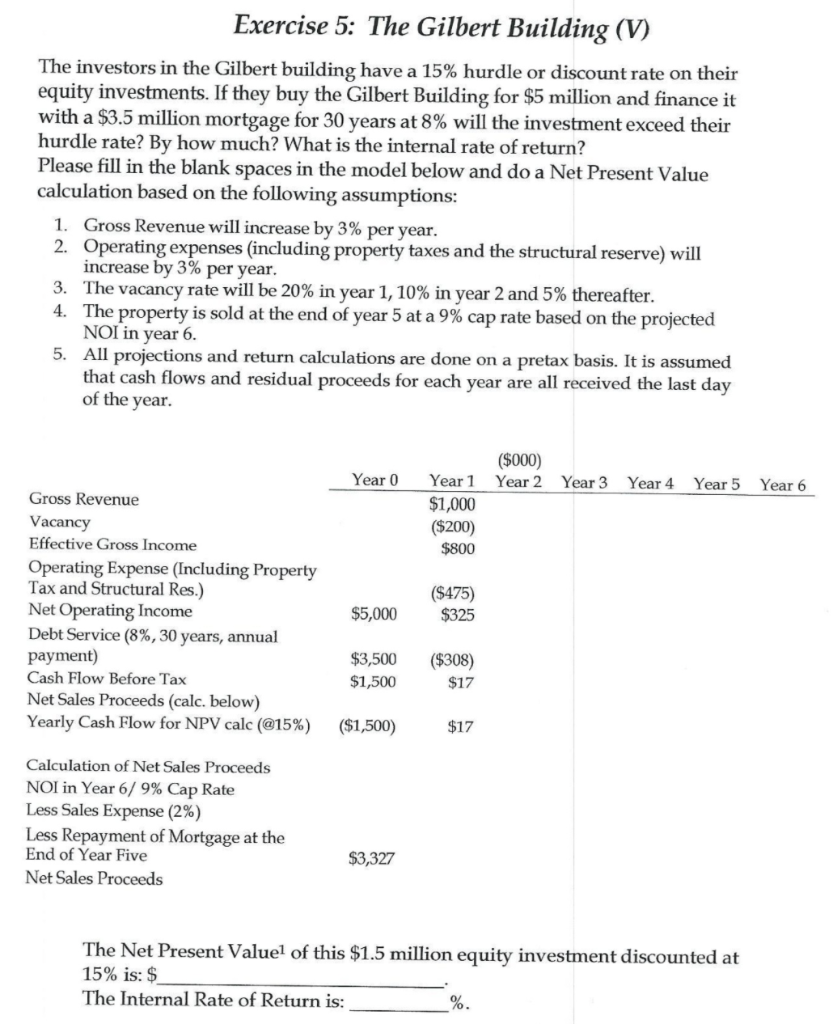

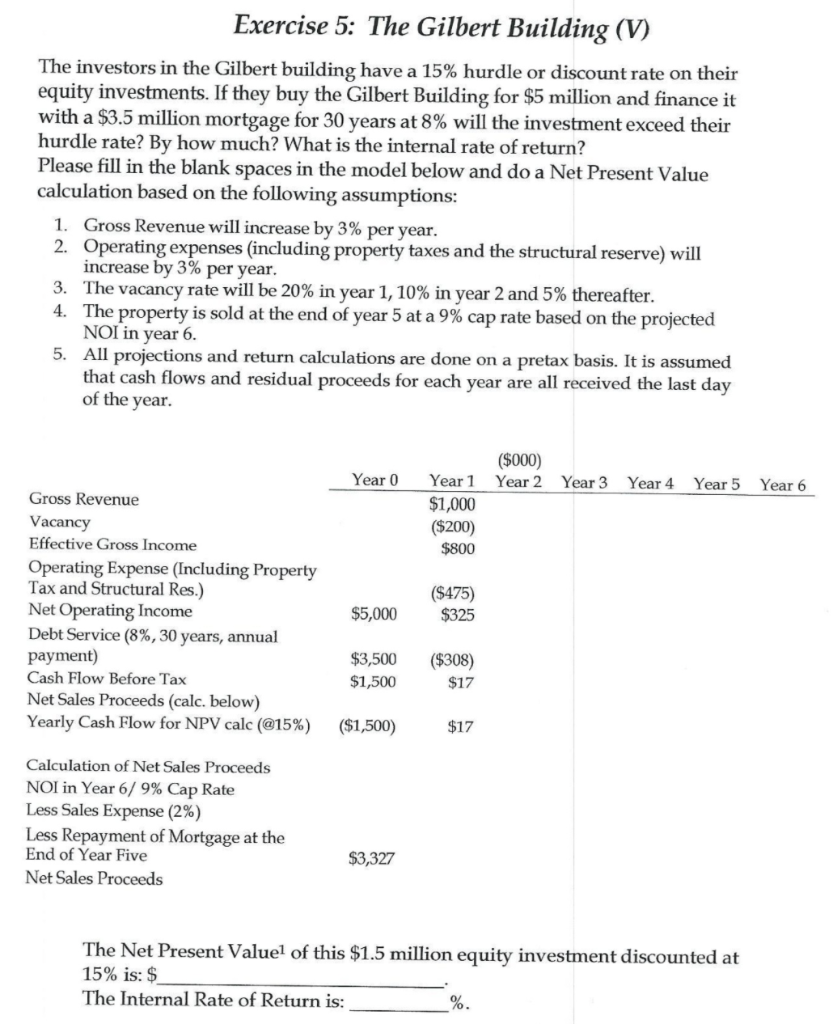

Exercise 5: The Gilbert Building (V) The investors in the Gilbert building have a 15% hurdle or discount rate on their equity investments. If they buy the Gilbert Building for $5 million and finance it with a $3.5 million mortgage for 30 years at 8% will the investment exceed their hurdle rate? By how much? What is the internal rate of return? Please fill in the blank spaces in the model below and do a Net Present Value calculation based on the following assumptions: 1. Gross Revenue will increase by 3% per year. 2. Operating expenses (including property taxes and the structural reserve) will increase by 3% per year, 3. The vacancy rate will be 20% in year 1, 10% in year 2 and 5% thereafter. 4. The property is sold at the end of year 5 at a 9% cap rate based on the projected NOI in year 6. 5. All projections and return calculations are done on a pretax basis. It is assumed that cash flows and residual proceeds for each year are all received the last day of the year. Year 0 ($000) Year 2 Year 3 Year 4 Year 5 Year 6 Year 1 $1,000 ($200) $800 Gross Revenue Vacancy Effective Gross Income Operating Expense (Including Property Tax and Structural Res.) Net Operating Income Debt Service (8%, 30 years, annual payment) Cash Flow Before Tax Net Sales Proceeds (calc. below) Yearly Cash Flow for NPV calc (@15%) ($475) $325 $5,000 $3,500 $1,500 ($308) $17 ($1,500) $17 Calculation of Net Sales Proceeds NOI in Year 6/9% Cap Rate Less Sales Expense (2%) Less Repayment of Mortgage at the End of Year Five Net Sales Proceeds $3,327 The Net Present Value of this $1.5 million equity investment discounted at 15% is: $ The Internal Rate of Return is: %. Exercise 5: The Gilbert Building (V) The investors in the Gilbert building have a 15% hurdle or discount rate on their equity investments. If they buy the Gilbert Building for $5 million and finance it with a $3.5 million mortgage for 30 years at 8% will the investment exceed their hurdle rate? By how much? What is the internal rate of return? Please fill in the blank spaces in the model below and do a Net Present Value calculation based on the following assumptions: 1. Gross Revenue will increase by 3% per year. 2. Operating expenses (including property taxes and the structural reserve) will increase by 3% per year, 3. The vacancy rate will be 20% in year 1, 10% in year 2 and 5% thereafter. 4. The property is sold at the end of year 5 at a 9% cap rate based on the projected NOI in year 6. 5. All projections and return calculations are done on a pretax basis. It is assumed that cash flows and residual proceeds for each year are all received the last day of the year. Year 0 ($000) Year 2 Year 3 Year 4 Year 5 Year 6 Year 1 $1,000 ($200) $800 Gross Revenue Vacancy Effective Gross Income Operating Expense (Including Property Tax and Structural Res.) Net Operating Income Debt Service (8%, 30 years, annual payment) Cash Flow Before Tax Net Sales Proceeds (calc. below) Yearly Cash Flow for NPV calc (@15%) ($475) $325 $5,000 $3,500 $1,500 ($308) $17 ($1,500) $17 Calculation of Net Sales Proceeds NOI in Year 6/9% Cap Rate Less Sales Expense (2%) Less Repayment of Mortgage at the End of Year Five Net Sales Proceeds $3,327 The Net Present Value of this $1.5 million equity investment discounted at 15% is: $ The Internal Rate of Return is: %