Answered step by step

Verified Expert Solution

Question

1 Approved Answer

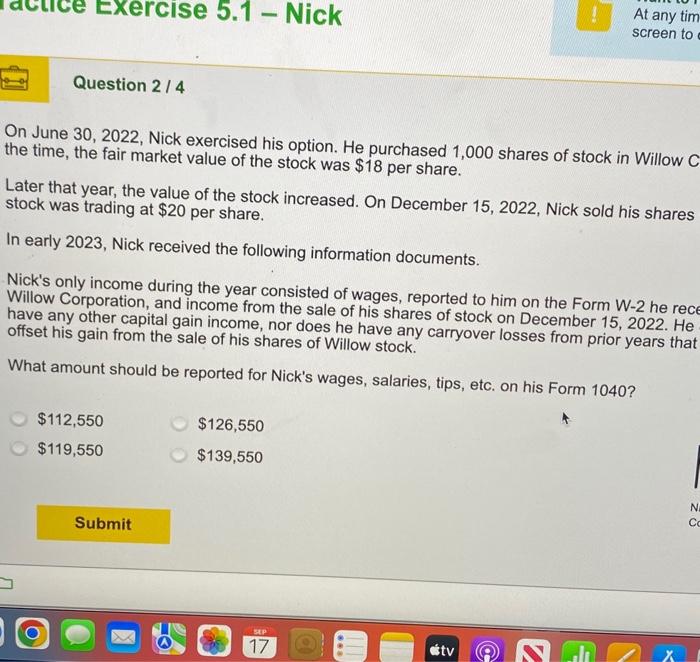

Exercise 5.1 - Nick Question 2/4 On June 30, 2022, Nick exercised his option. He purchased 1,000 shares of stock in Willow C the time,

Exercise 5.1 - Nick Question 2/4 On June 30, 2022, Nick exercised his option. He purchased 1,000 shares of stock in Willow C the time, the fair market value of the stock was $18 per share. Later that year, the value of the stock increased. On December 15, 2022, Nick sold his shares stock was trading at $20 per share. In early 2023, Nick received the following information documents. Nick's only income during the year consisted of wages, reported to him on the Form W-2 he rece Willow Corporation, and income from the sale of his shares of stock on December 15, 2022. He have any other capital gain income, nor does he have any carryover losses from prior years that offset his gain from the sale of his shares of Willow stock. What amount should be reported for Nick's wages, salaries, tips, etc. on his Form 1040? $112,550 $119,550 Submit $126,550 $139,550 SEP 17 At any tim screen to tv V W X N Co

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started