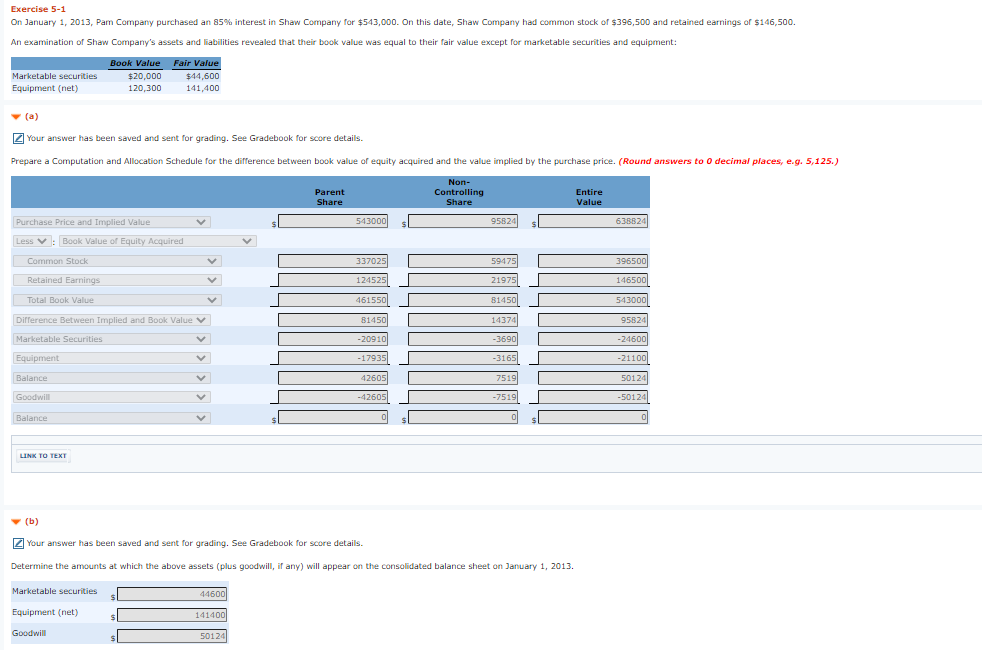

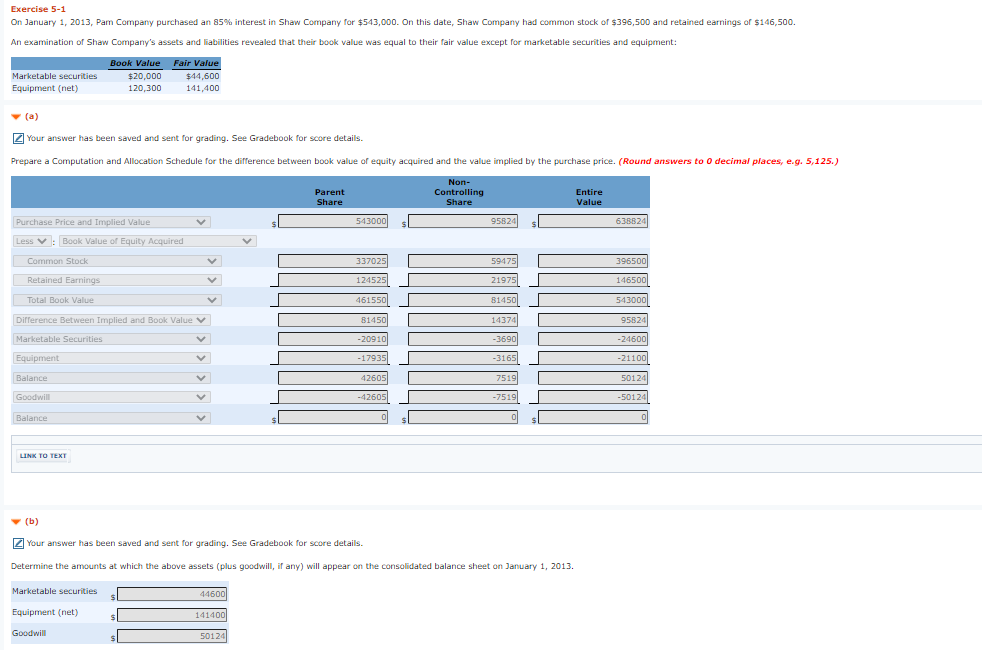

Exercise 5-1 On January 1, 2013, Pam Company purchased an 85% interest in Shaw Company for $543,000. On this date, Shaw Company had common stock of $396,500 and retained earnings of $146,500. An examination of Shaw Company's assets and liabilities revealed that their book value was equal to their fair value except for marketable securities and equipment: Marketable securities Equipment (net) Book Value Fair Value $20,000 $44,600 120,300 141,400 ZYour answer has been saved and sent for grading. See Gradebook for score details. Prepare a Computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. (Round answers to 0 decimal places, e.g. 5,125.) Parent Share Non- Controlling Share Entire Value 543000 95824 638824 Purchase Price and Implied Value Less : Book Value of Equity Acquired Common Stock 337025 59475 396500 Retained Earnings 124525 21975 146500 Total Book Value 461550 1 814500 5430001 81450 143741 95824 Difference Between Implied and Book Value Marketable Securities -20910 -3690 -24600 Equipment -17935 -3165 -21100 Balance 42605 7519 50124 Goodwill -42605 -7519 -50124 Balance s 0 s! LINK TO TEXT (b) ZYour answer has been saved and sent for grading. See Gradebook for score details. Determine the amounts at which the above assets (plus goodwill, if any) will appear on the consolidated balance sheet on January 1, 2013. Marketable securities 44600 Equipment (net) $ 141400 Goodwill 50124 Exercise 5-1 On January 1, 2013, Pam Company purchased an 85% interest in Shaw Company for $543,000. On this date, Shaw Company had common stock of $396,500 and retained earnings of $146,500. An examination of Shaw Company's assets and liabilities revealed that their book value was equal to their fair value except for marketable securities and equipment: Marketable securities Equipment (net) Book Value Fair Value $20,000 $44,600 120,300 141,400 ZYour answer has been saved and sent for grading. See Gradebook for score details. Prepare a Computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. (Round answers to 0 decimal places, e.g. 5,125.) Parent Share Non- Controlling Share Entire Value 543000 95824 638824 Purchase Price and Implied Value Less : Book Value of Equity Acquired Common Stock 337025 59475 396500 Retained Earnings 124525 21975 146500 Total Book Value 461550 1 814500 5430001 81450 143741 95824 Difference Between Implied and Book Value Marketable Securities -20910 -3690 -24600 Equipment -17935 -3165 -21100 Balance 42605 7519 50124 Goodwill -42605 -7519 -50124 Balance s 0 s! LINK TO TEXT (b) ZYour answer has been saved and sent for grading. See Gradebook for score details. Determine the amounts at which the above assets (plus goodwill, if any) will appear on the consolidated balance sheet on January 1, 2013. Marketable securities 44600 Equipment (net) $ 141400 Goodwill 50124