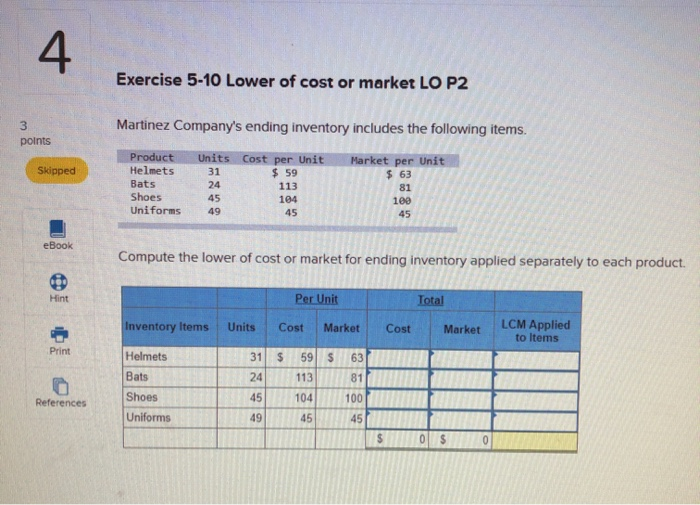

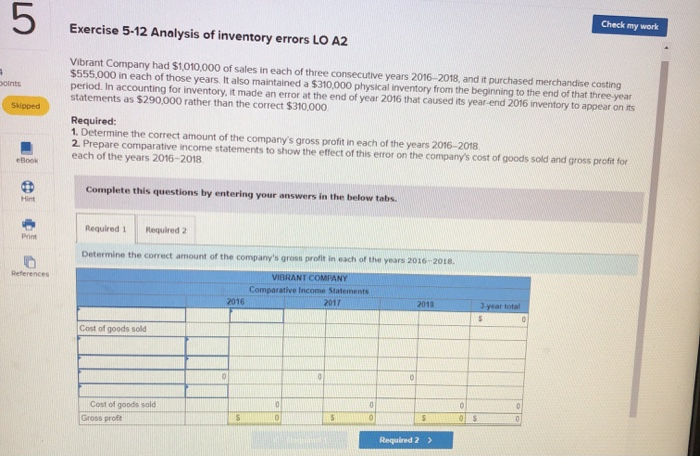

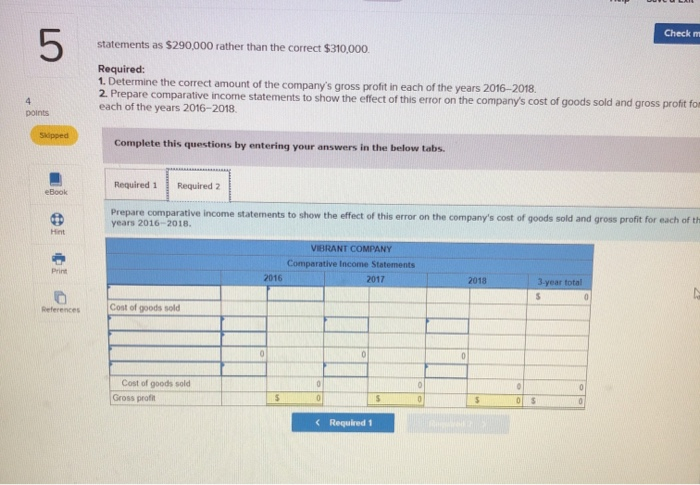

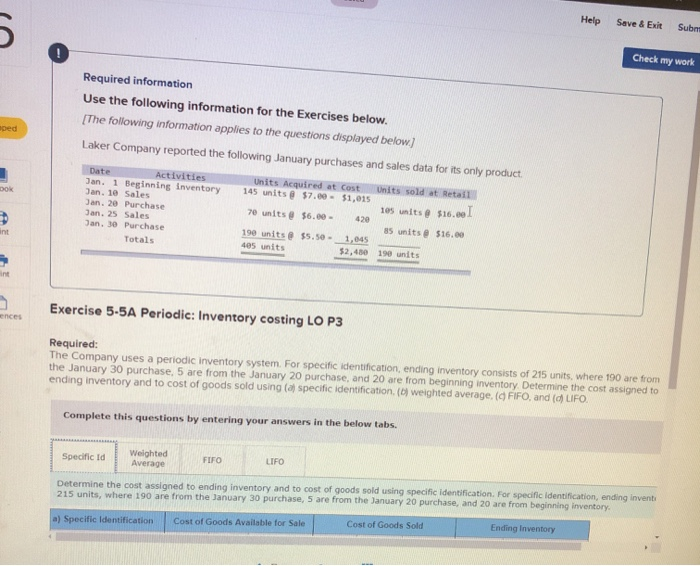

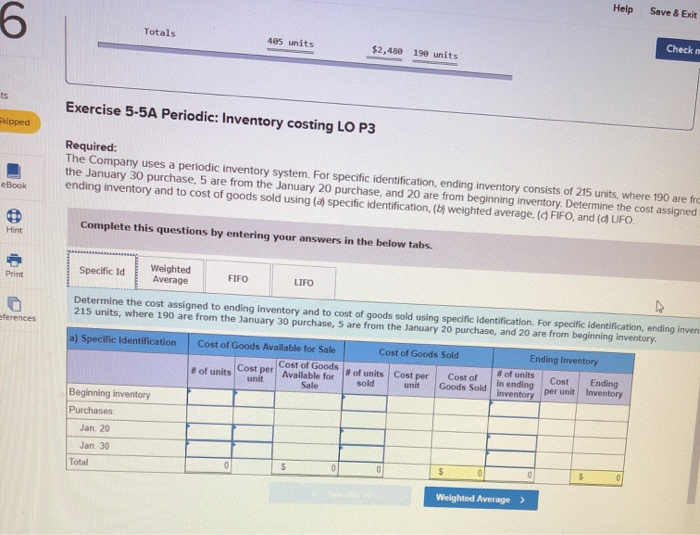

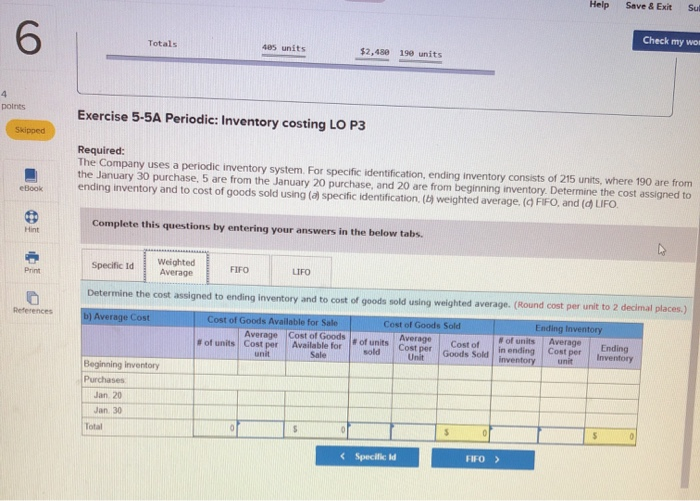

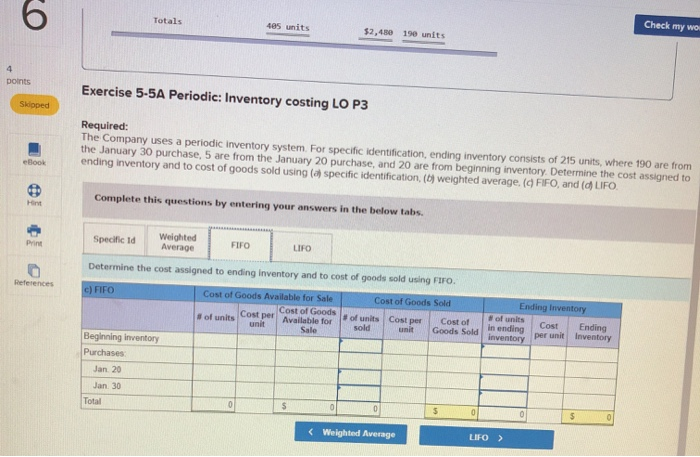

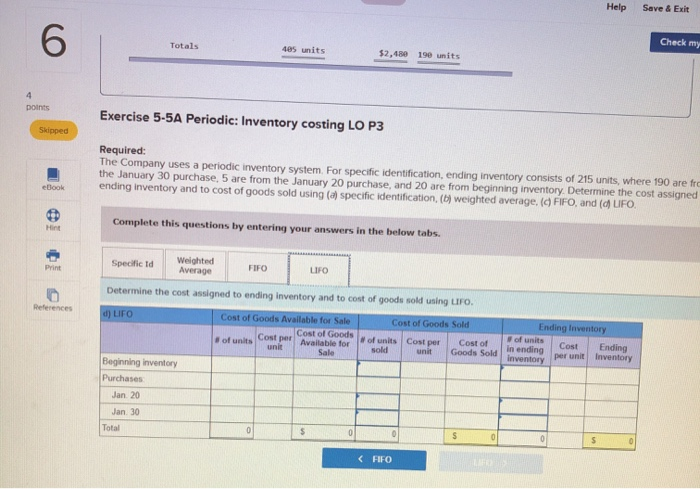

Exercise 5-10 Lower of cost or market LO P2 Martinez Company's ending inventory includes the following items. points Market per Unit $ 63 Skipped Product Helmets Bats Shoes Uniforms Units Cost per Unit 31 $ 59 113 100 45 eBook Compute the lower of cost or market for ending inventory applied separately to each product. Hint Per Unit Total Inventory Items Units Cost Market Cost Market LCM Applied to Items Print Helmets $ 59 $ 63 Bats References Shoes Uniforms Exercise 5-12 Analysis of inventory errors LO A2 Check my work Vibrant Company had $1,010,000 of sales in each of three consecutive years 2016-2018, and it purchased merchandise costing $555,000 in each of those years. It also maintained a $310,000 physical inventory from the beginning to the end of that three-year period. In accounting for inventory, it made an error at the end of year 2016 that caused its year-end 2016 inventory to appear on its statements as $290,000 rather than the correct $310.000 Required: 1. Determine the correct amount of the company's gross profit in each of the years 2016-2018 2. Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of the years 2016-2018 Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Determine the correct amount of the company's gross profit in each of the years 2016-2018. VIBRANT COMPANY Comparative Income Statements 2016 2017 od of goods sold Cost of goods sold Gross proft Required 2 > Check m statements as $290,000 rather than the correct $310,000 Required: 1. Determine the correct amount of the company's gross profit in each of the years 2016-2018 2. Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit fon each of the years 2016-2018 Complete this questions by entering your answers in the below tabs. Required 1 Required 2 19 Prepare comparative Income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of th years 2016 2018 VIBRANT COMPANY Comparative Income Statements 2017 3 year total l Cont of goods sold Cost of goods sold Gross profit Help Save & Exit Sul 6 Total 405 units Check my won $2,489 190 units points Exercise 5-5A Periodic: Inventory costing LO P3 Skipped Required: The Company uses a periodic inventory system. For specific identification, ending Inventory consists of 215 units, where 190 are from the January 30 purchase, 5 are from the January 20 purchase, and 20 are from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold using a specific identification () weighted average. (FIFO, and (UFO. Complete this questions by entering your answers in the below tabs. Print Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending Inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) References b) Average Cost Cost of Goods Available for Sale Average Cost of Goods of units Cost per Available for Cost of Goods Sold of units Average Cost of Bald Cost per i Unit Goods Sold Ending Inventory of units Average n ending Cost per Ending inventory Inventory Beginning inventory Specificid FIFO > Check my wel Totals 405 units $2.40 190 units points Exercise 5-5A Periodic: Inventory costing LO P3 Skipped Required: The Company uses a periodic inventory system. For specific identification, ending inventory consists of 215 units, where 190 are from the January 30 purchase, 5 are from the January 20 purchase, and 20 are from beginning inventory Determine the cost assigned to ending inventory and to cost of goods sold using a specific identification, () weighted average. (FIFO, and (LIFO. Complete this questions by entering your answers in the below tabs. Specific 10 Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. References c) FIFO Cost of Goods Available for Sale Cost of Goods of units cost per Available for unit Sale Cost of Goods Sold of units Cost per Cost of sold unit Goods Sold Ending Inventory of units Cost Ending In ending per unit inventory inventory Beginning inventory Purchases Jan 20 Jan 30 00 Total Help Save & Exit Totals Check my 405 units $2,189 190 units points Exercise 5-5A Periodic: Inventory costing LO P3 Skipped Required: The Company uses a periodic inventory system. For specific identification, ending inventory consists of 215 units, where 190 are fro the January 30 purchase, 5 are from the January 20 purchase, and 20 are from beginning inventory. Determine the cost assigned ending inventory and to cost of goods sold using a specific identification, (b) weighted average. (FIFO, and ( UFO. Complete this questions by entering your answers in the below tabs Specific id Weighted Average FIFO LIFO Determine the cost assigned to ending Inventory and to cost of goods sold using UFO. d) LIFO Cost of Goods Sold Cost of Goods Available for Sale of units Cost per Cost of Goods Available for of units Cost per Ending Inventory of units In ending Cost Ending Inventory per unit Inventory Cost of Goods Sold unit Beginning inventory Purchases Jan. 20 Jan. 30 Total