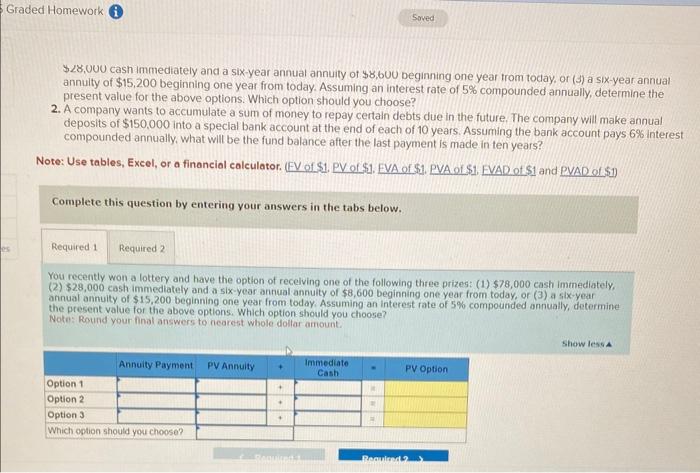

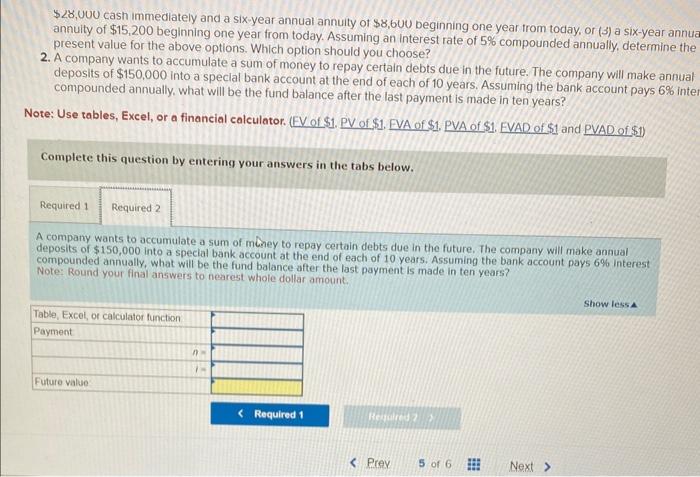

Exercise 5-15 (Algo) Future and present value [ LO5-3, 5-7, 5-8] Answer each of the following independent questions. 1. You recently won a lottery and have the option of recelving one of the following three prizes: (1) $78.000 cash immediately, (2) $28,000 cash immediately and a six-year annual annuity of $8,600 beginning one year from today, or (3) a six-year annual annuity of $15,200 beginning one year from today. Assuming an interest rate of 5% compounded annually. determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $150,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 6% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (EV of \$1. PV of \$1, EVA of \$1. PVA of S1. EVAD of \$1 and PVAD of \$1) Complete this question by entering your answers in the tabs below. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $78,000 cash immediately, (2) \$28,000 cash immediately and a six-yeor annual annulty of $8,600 beginning one year from today, or (3) a six-year annual annulty of $15,200 beginning one year from today. Assuming an interest rate of 5% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole dollar amount. $28,000 cash immediately and a six-year annual annuity of $8,600 beginning one year from today, or (3) a six-year annuat annulty of $15,200 beginning one year from today. Assuming an interest rate of 5% compounded annually, determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $150,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 6% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of \$1. EVA of $1. PVA of $1, EVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. You recently won a lottery and have the option of recelving one of the following three prizes: (1) $78,000 cash immediately, (2) $28,000 cash immediately and a six-year annual annuity of $8,600 beginning one year from today, or (3) a six-year annual annuity of $15,200 beginning one year from today. Assuming an interest rate of 5% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole doillar amount. $28,000 cash immediately and a six-year annual annuity of \$8,6uU beginning one year trom today, or (3) a six-year ann annuity of $15,200 beginning one year from today. Assuming an interest rate of 5% compounded annually, determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annua deposits of $150,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 6% int compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1 ) Complete this question by entering your answers in the tabs below. A company wants to accumulate a sum of miney to repay certain debts due in the future. The company will make annual deposits of $150,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 6% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Round your final answers to nearest whole dollar amount