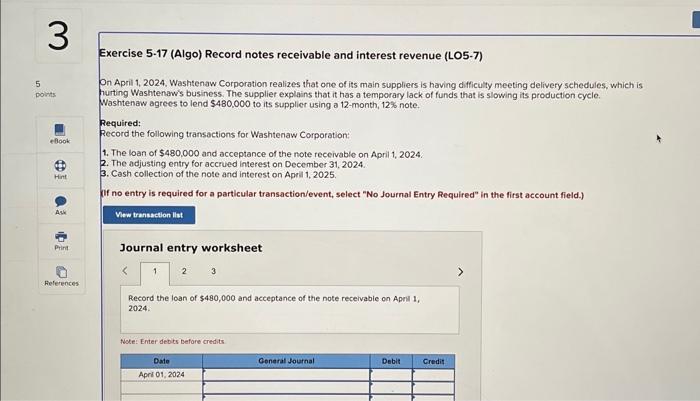

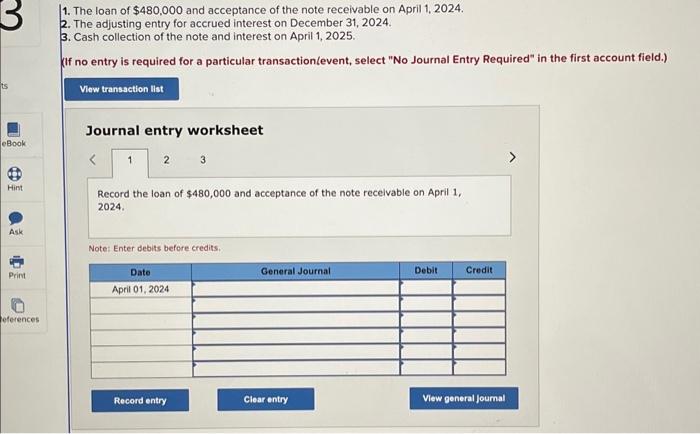

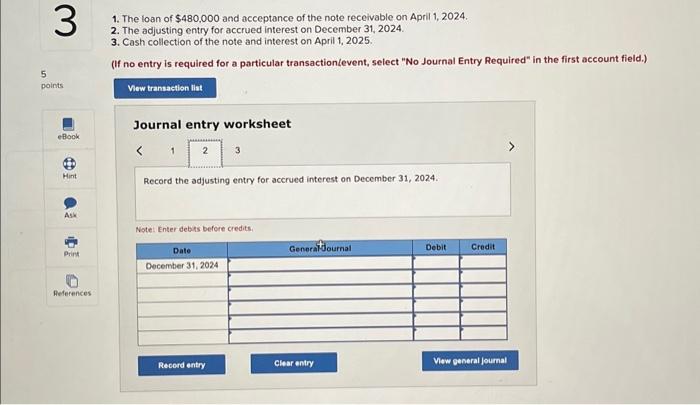

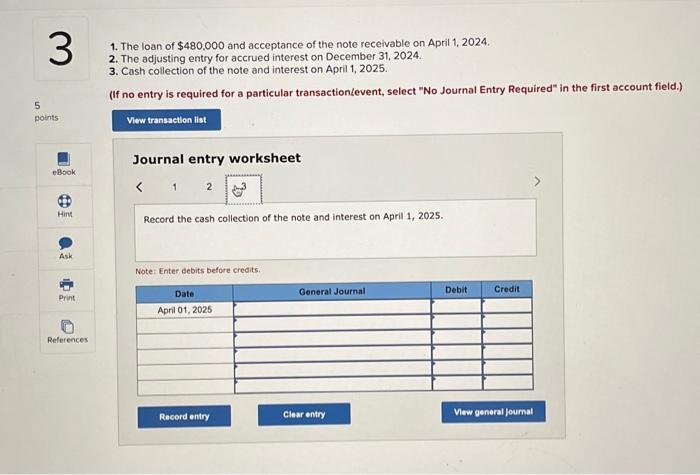

Exercise 5.17 (Algo) Record notes receivable and interest revenue (LO5-7) On April 1, 2024, Washtenaw Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is nurting Washtenaw's business. The supplier explains that it has a temporary lack of funds that is slowing its production cycie. Washtenaw agrees to lend $480,000 to its supplier using a 12 -month, 12% note. Required: Record the following transactions for Washtenaw Corporation: 1. The loan of $480,000 and acceptance of the note receivable on April 1, 2024. 2. The adjusting entry for accrued interest on December 31,2024 . 3. Cash collection of the note and interest on April 1, 2025. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the loan of $480,000 and acceptance of the note receivabie on Aprill 1, 2024. Wote: Enter debts before credits 1. The loan of $480,000 and acceptance of the note receivable on April 1, 2024 . 2. The adjusting entry for accrued interest on December 31,2024. 3. Cash collection of the note and interest on April 1, 2025. (If no entry is required for a particular transaction(event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the loan of $480,000 and acceptance of the note recelvable on April 1, 2024. Note: Enter debits before credits. 1. The loan of $480,000 and acceptance of the note receivable on April 1, 2024 . 2. The adjusting entry for accrued interest on December 31, 2024. 3. Cash collection of the note and interest on April 1, 2025. (If no entry is required for a particular transactionLevent, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for accrued interest on December 31, 2024. Note: Enter debis before credits. 1. The loan of $480,000 and acceptance of the note receivable on April 1, 2024. 2. The adjusting entry for accrued interest on December 31,2024 . 3. Cash collection of the note and interest on April 1, 2025. (If no entry is required for a particular transactionlevent, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the cash collection of the note and interest on April 1, 2025. Note: Enter debits before credits