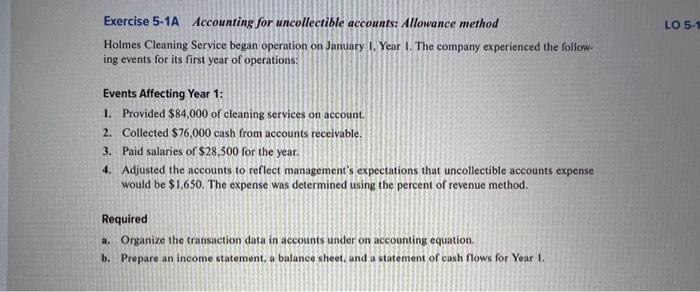

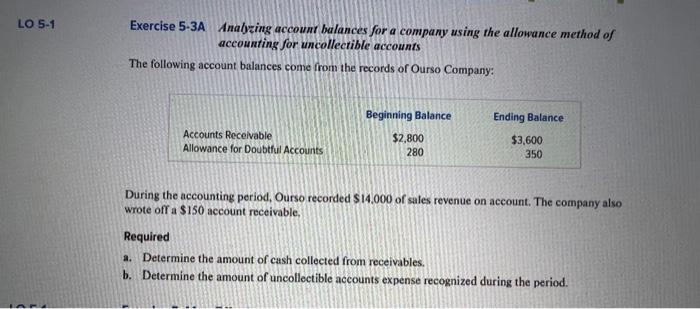

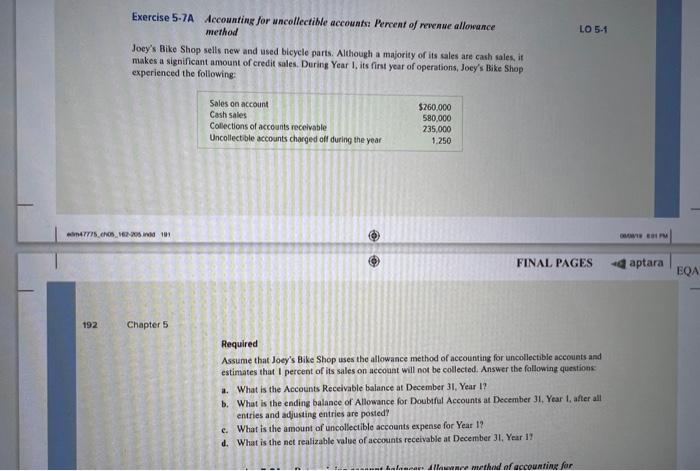

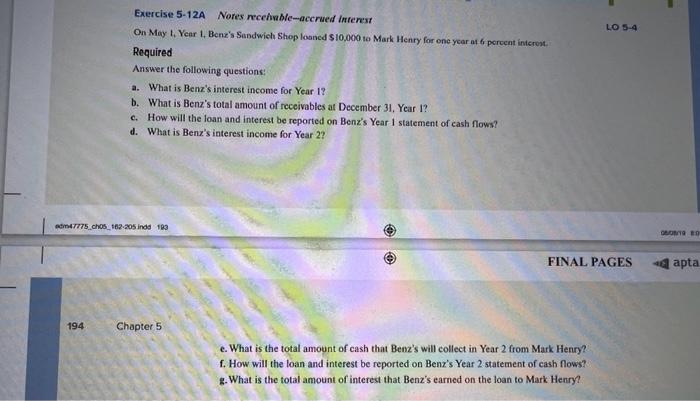

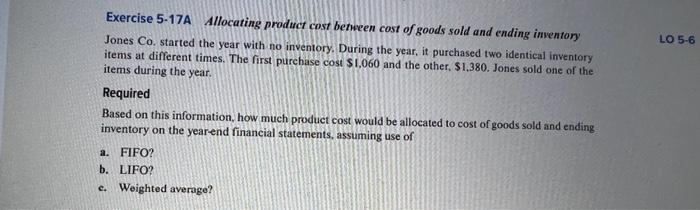

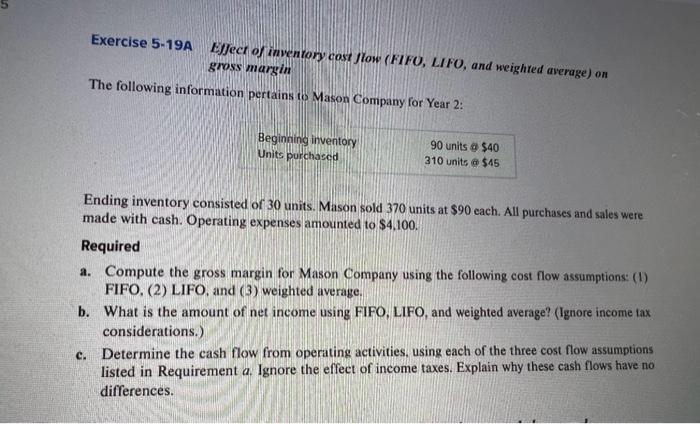

Exercise 5-1A Accounting for uncollectible accounts: Allowance method Holmes Cleaning Service began operation on January 1. Year 1. The company experienced the follow. ing events for its first year of operations: Events Affecting Year 1: 1. Provided $84,000 of cleaning services on account. 2. Collected $76,000 cash from accounts receivable. 3. Paid salaries of $28,500 for the year. 4. Adjusted the accounts to reflect management's expectations that uncollectible accounts expense would be $1,650. The expense was determined using the percent of revenue method. Required a. Organize the transaction data in accounts under on accounting equation. b. Prepare an income statement, a balance sheet, and a statement of cash flows for Year 1. Exercise 5-3A Anabzing account balances for a company using the allowance method of accounting for uncollectible accounts The following account balances come from the records of Ourso Company: During the accounting period, Ourso recorded $14.000 of sales revenue on account. The company also wrote off a $150 account receivable. Required a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. Exercise 5-7A Accounting for uncollectikle accounts: Percent of nevenwe allowance method Jocy's Bike Shop sells new and used blcycle paris. Although a majority of its cales are cash sales, it makes a significant amount of credit sales. During Year I, its firat year of operations, Joey's Bike Shop experienced the following: Chapter 5 Required Assume that Joey's Bike Shop uses the allowance method of accounting for uncollectible accounts and estimates that I percent of its sales on accoant will not be collected. Answer the following quetions: a. What is the Accounts Receivable balance at December 3I, Year 1 ? b. What is the ending balance of Allowance for Doubtful Accounts at December 31, Year 1 , after all entries and adjusting entries are posted? c. What is the amount of uncollectible accounts expense for Year 1? d. What is the net realizable value of accounts receivable at Decembet 31 , Year 11 Exercise 5-12A Nores recehable-accrued intenest On May 1, Ycar 1, Benz's Sandwich Shop loaned $10,000 to Mark Henry for one year at 6 percent interext. Required Answer the following questions: a. What is Benz's interest income for Year 1 ? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year I statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry? Exercise 5-17A Allocating product cost between cost of goods sold and ending inventory Jones Co. started the year with no inventory. During the year, it purchased two identical inventory items at different times. The first purchase cost $1,060 and the other, $1,380. Jones sold one of the items during the year. Required Based on this information, how much product cost would be allocated to cost of goods sold and ending inventory on the yearend financial statements, assuming use of a. FIFO? b. LIFO? c. Weighted average? Exercise 5-19A Eject of inventony cost flow (F1FU, LIFO, and weighted average) on gross margin The following information pertains to Mason Company for Year 2: Ending inventory consisted of 30 units. Mason sold 370 units at $90 each. All purchases and sales were made with cash. Operating expenses amounted to $4,100. Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. What is the amount of net income using FIFO, LIFO, and weighted average? (Ignore income tax considerations.) c. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement a. Ignore the effect of income taxes. Explain why these cash flows have no differences