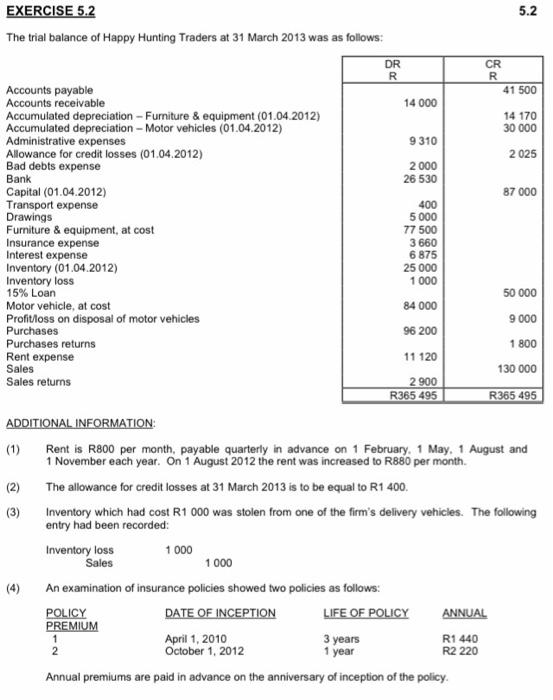

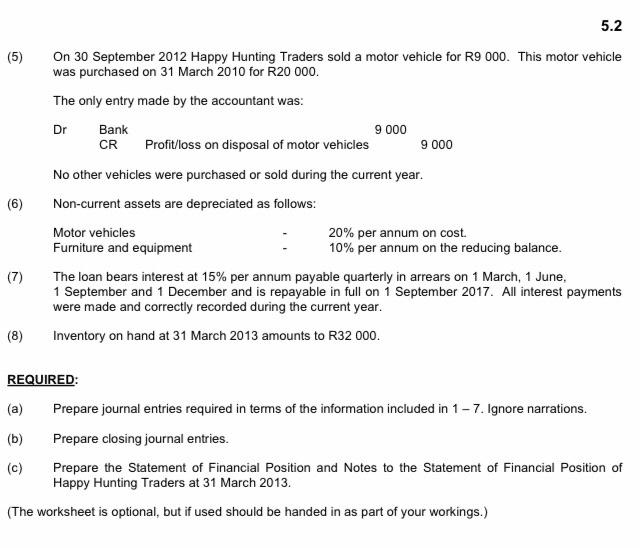

EXERCISE 5.2 5.2 The trial balance of Happy Hunting Traders at 31 March 2013 was as follows: DR R 41 500 Accounts payable Accounts receivable 14 000 14 170 Accumulated depreciation - Furniture & equipment (01.04.2012) Accumulated depreciation - Motor vehicles (01.04.2012) 30 000 Administrative expenses 9310 Allowance for credit losses (01.04.2012) 2 025 Bad debts expense 2 000 Bank 26 530 Capital (01.04.2012) 87 000 Transport expense 400 Drawings Furniture & equipment, at cost Insurance expense 5 000 77 500 3660 6 875 25 000 1000 Interest expense Inventory (01.04.2012) Inventory loss 15% Loan 50 000 Motor vehicle, at cost 84 000 9 000 Profit/loss on disposal of motor vehicles Purchases 96 200 Purchases returns 1800 11 120 Rent expense Sales 130 000 Sales returns 2 900 R365 495 R365 495 ADDITIONAL INFORMATION: (1) Rent is R800 per month, payable quarterly in advance on 1 February. 1 May. 1 August and 1 November each year. On 1 August 2012 the rent was increased to R880 per month. (2) The allowance for credit losses at 31 March 2013 is to be equal to R1 400. (3) Inventory which had cost R1 000 was stolen from one of the firm's delivery vehicles. The following entry had been recorded: 1.000 Inventory loss Sales 1000 An examination of insurance policies showed two policies as follows: DATE OF INCEPTION LIFE OF POLICY ANNUAL POLICY PREMIUM 1 April 1, 2010 3 years 1 year R1 440 R2 220 2 October 1, 2012 Annual premiums are paid in advance on the anniversary of inception of the policy. CR R 5.2 (5) On 30 September 2012 Happy Hunting Traders sold a motor vehicle for R9 000. This motor vehicle was purchased on 31 March 2010 for R20 000. The only entry made by the accountant was: Dr Bank 9 000 CR Profit/loss on disposal of motor vehicles 9 000 No other vehicles were purchased or sold during the current year. (6) Non-current assets are depreciated as follows: Motor vehicles 20% per annum on cost. Furniture and equipment 10% per annum on the reducing balance. (7) The loan bears interest at 15% per annum payable quarterly in arrears on 1 March, 1 June, 1 September and 1 December and is repayable in full on 1 September 2017. All interest payments were made and correctly recorded during the current year. (8) Inventory on hand at 31 March 2013 amounts to R32 000. REQUIRED: (a) Prepare journal entries required in terms of the information included in 1-7. Ignore narrations. (b) Prepare closing journal entries. (c) Prepare the Statement of Financial Position and Notes to the Statement of Financial Position of Happy Hunting Traders at 31 March 2013. (The worksheet is optional, but if used should be handed in as part of your workings.)