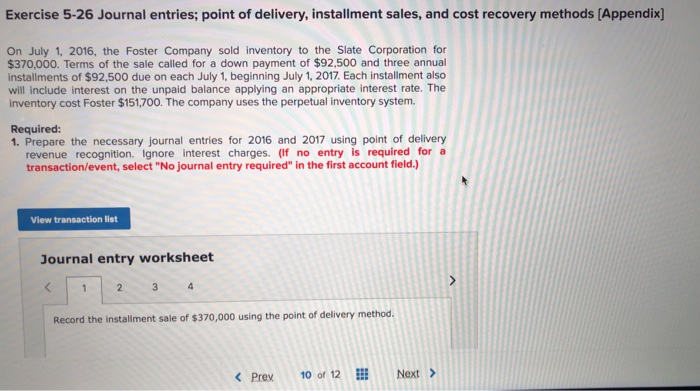

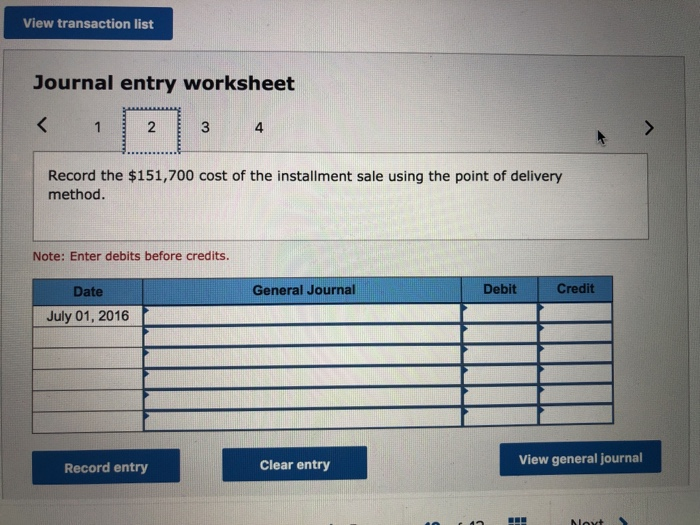

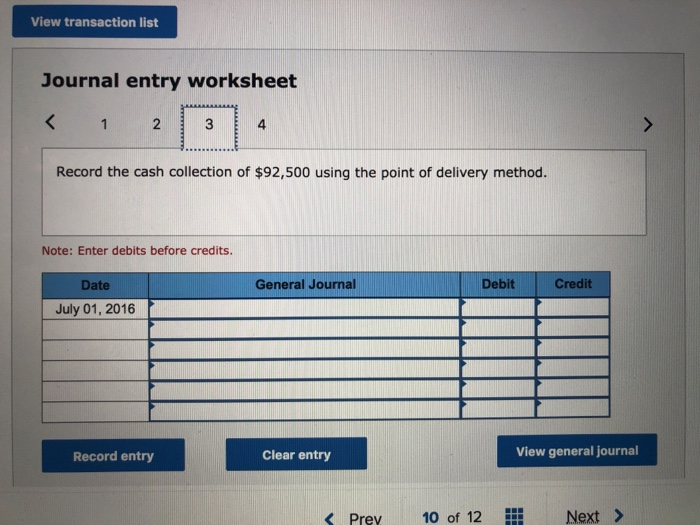

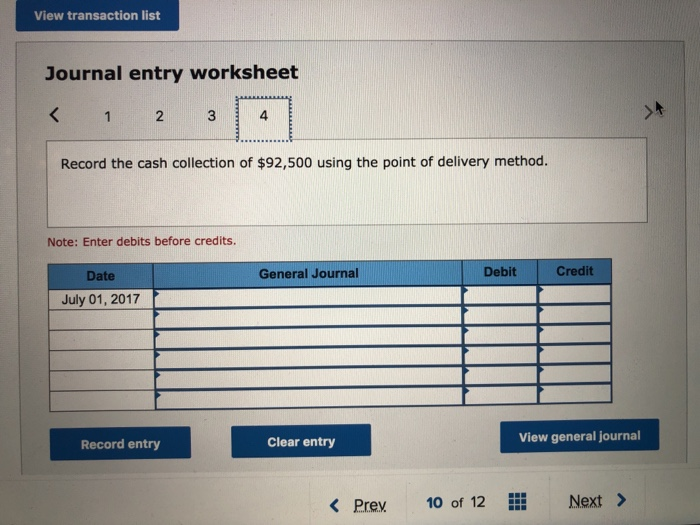

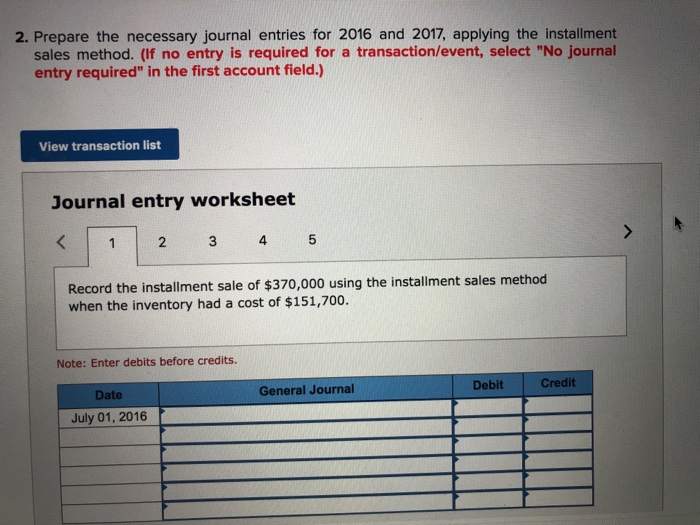

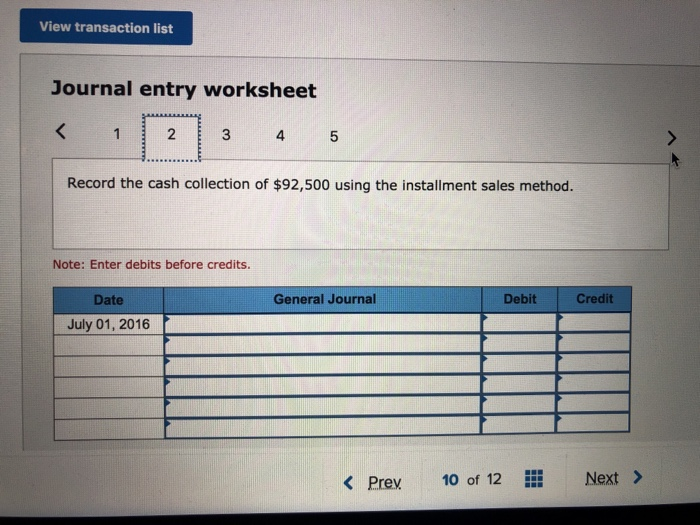

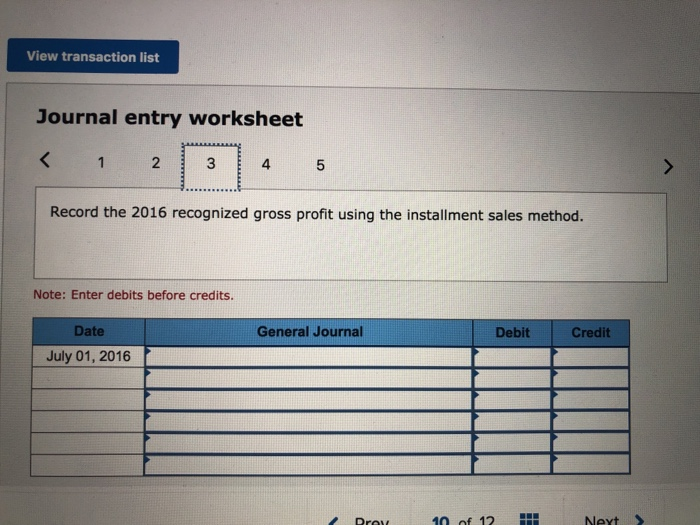

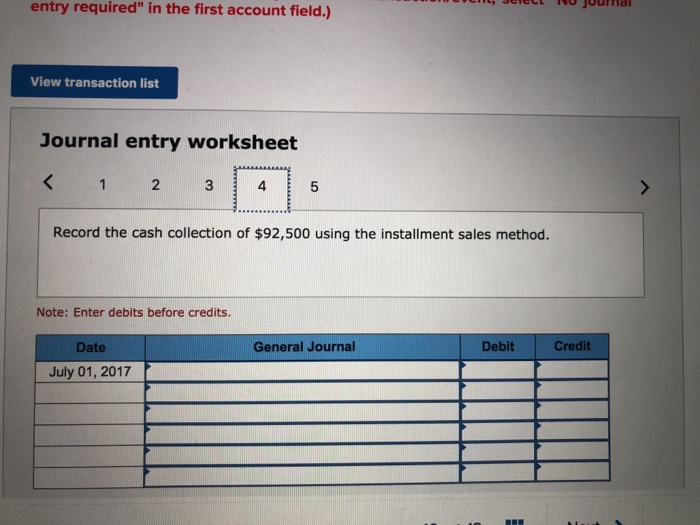

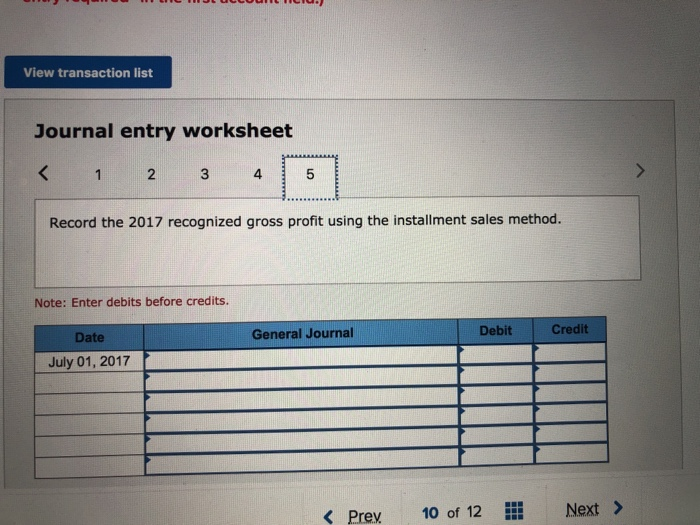

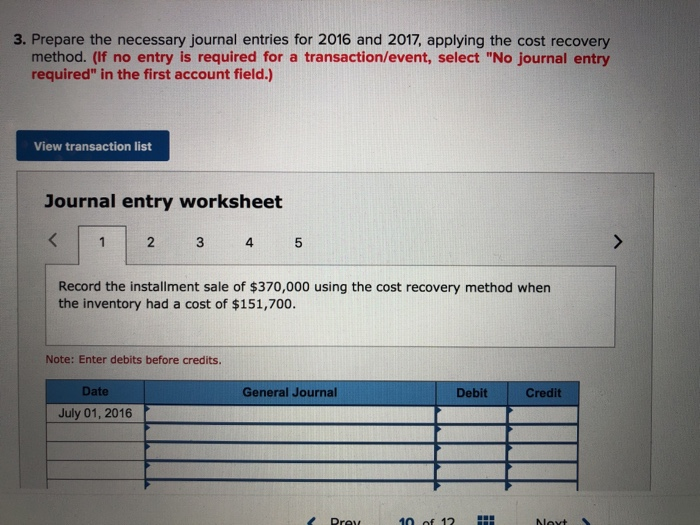

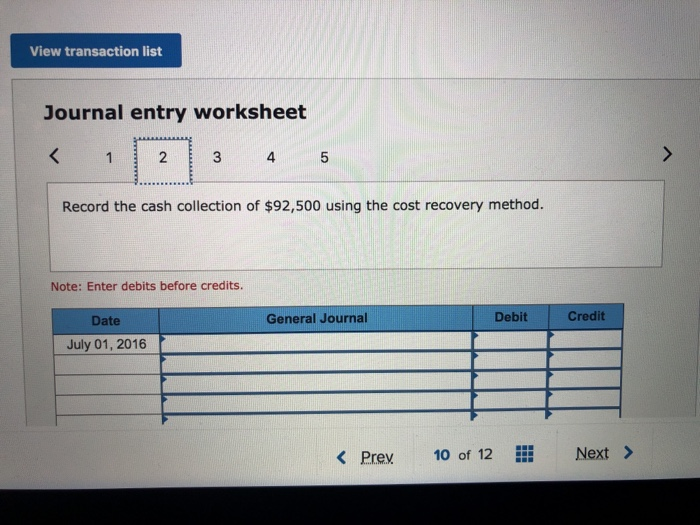

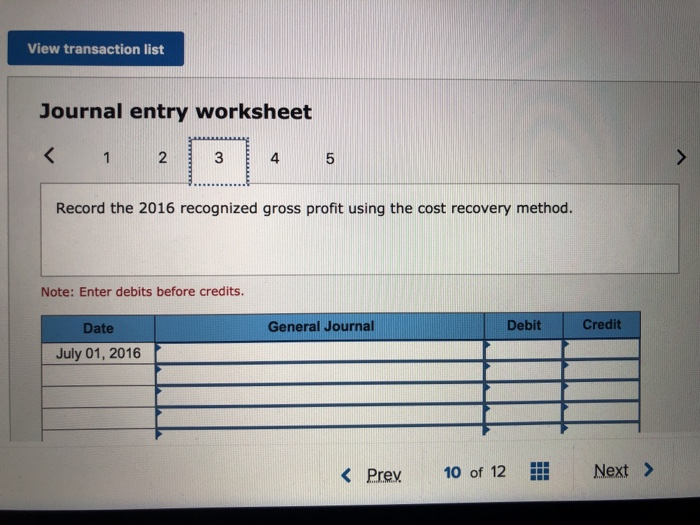

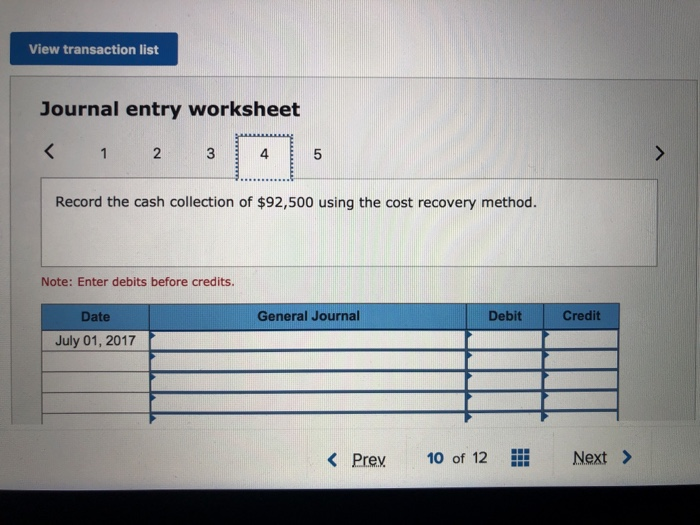

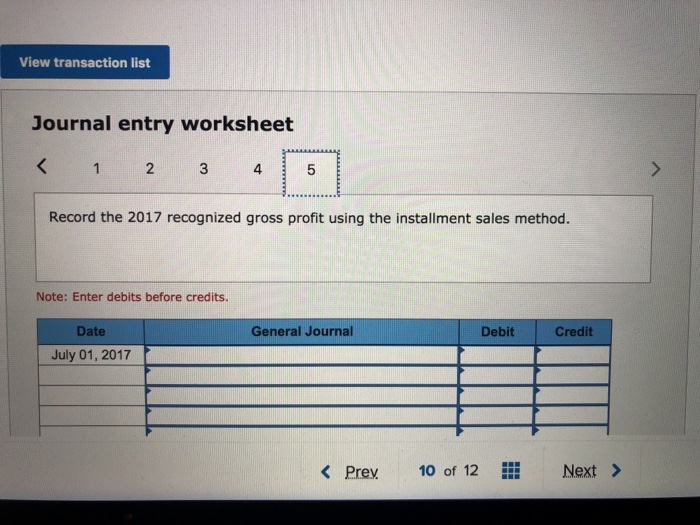

Exercise 5-26 Journal entries; point of delivery, installment sales, and cost recovery methods [Appendix) On July 1, 2016, the Foster Company sold inventory to the Slate Corporation for $370,000. Terms of the sale called for a down payment of $92,500 and three annual installments of $92,500 due on each July 1, beginning July 1, 2017. Each installment also will include interest on the unpaid balance applying an appropriate interest rate. The inventory cost Foster $151,700. The company uses the perpetual inventory system. Required: 1. Prepare the necessary journal entries for 2016 and 2017 using point of delivery revenue recognition. Ignore interest charges. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the installment sale of $370,000 using the point of delivery method K Prev 10 of 12 Next View transaction list Journal entry worksheet 2 4 Record the $151,700 cost of the installment sale using the point of delivery method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2016 Clear entry View general journal Record entry View transaction list Journal entry worksheet Record the cash collection of $92,500 using the point of delivery method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2016 Record entry Clear entry View general journal Prev 10 of 12 li Next > View transaction list Journal entry worksheet 4 Record the cash collection of $92,500 using the point of delivery method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2017 Record entry Clear entry View general journal K Prev 10 of 12 Next> View transaction list Journal entry worksheet 2 4 5 Record the cash collection of $92,500 using the installment sales method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2016 entry required" in the first account field.) View transaction list Journal entry worksheet 4 Record the cash collection of $92,500 using the installment sales method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2017 View transaction list Journal entry worksheet 2 4 5 Record the 2017 recognized gross profit using the installment sales method. Note: Enter debits before credits. General Journal Debit Credit Date July 01, 2017 K Prev 10 of 12l Next> 3. Prepare the necessary journal entries for 2016 and 2017, applying the cost recovery method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 4 5 Record the installment sale of $370,000 using the cost recovery method when the inventory had a cost of $151,700. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2016 12 4 View transaction list Journal entry worksheet 4 5 Record the 2016 recognized gross profit using the cost recovery method. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2016 K Prev10 10 of 12 l Next >