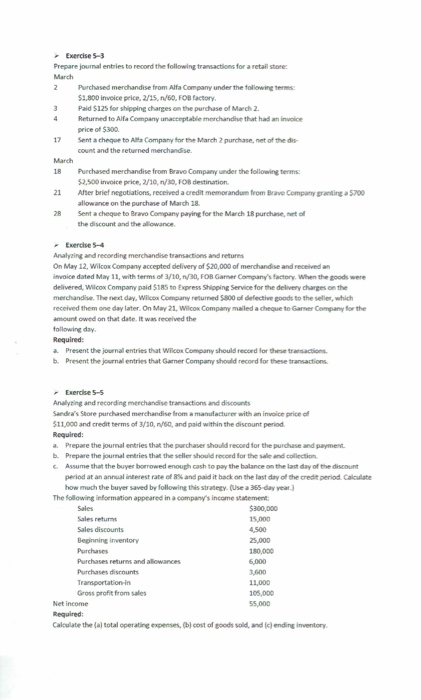

Exercise 5-3 Prepare journal entries to record the following transactions for a retail store: March 2 Purchased merchandise from Alla Company under the following terms: $1,800 invece price, 2/15, 160, FOB factory 3 Paid $125 for shipping charges on the purchase of March 2 Returned to Alfa Company unacceptable merchandise that had an invoice price of $300 17 Sent a cheque to A Company for the March 2 purchase, net of the dis- count and the returned merchandise March 18 Purchased merchandise from Bravo Company under the following terms: $2,500 invoice price, 2/10, 1/30, FOB destination 21 After brief negotiations, received a credit memorandum from Brave Company granting a 5700 allowance on the purchase of March 18 Sent a cheque to Bravo Company paying for the March 18 purchase of the discount and the allowance - Exercise Analyzing and recording merchandise transactions and returns On May 12, Wilcox Company accepted delivery of $20,000 of merchandise and received an invoice dated May 11, with terms of 1/10, ,FOB Gamer Company's factory. When the goods were delivered, Wilcox Company paid $185 to Express Shipping Service for the delivery charges on the merchandise. The next day. Wilcox Company returned $800 of defective goods to the seller, which received them one day later. On May 21, Wilcox Company mailed a cheque to Garner Company for the amount owed on that date. It was received the following day Required: a Present the journal entries that Wilcox Company should record for these transactions b. Present the journal entries that Gamer Company should record for these transactions Exercise 5-5 Analyzing and recording merchandise transactions and discounts Sandra's Store purchased merchandise from a manufacturer with an invoice price of $11,000 and credit terms of 3/10, 1/50, and paid within the discount period Required: a. Prepare the journal entries that the purchaser should record for the purchase and payment Prepare the journal entries that the seller should record for the sale and collection Assume that the buyer borrowed enough cash to pay the balance on the last day of the discount period at an annual interest rate of 8% and paid it back on the last day of the credit period. Calculate how much the buyer saved by following this strategy. (Use a 365 day year.) The following information appeared in a company's income statement: $300,000 Sales returns 15.000 Sales discounts 4,500 Beginning inventory 25,000 Purchases 180.000 Purchases returns and allowances 6,000 Purchases discounts Transportation in 11,000 Gross profit from sales 105,000 55.000 Required: Calculate the total operating expenses, cost of goods sold, and I ending inventory Exercise 5-3 Prepare journal entries to record the following transactions for a retail store: March 2 Purchased merchandise from Alla Company under the following terms: $1,800 invece price, 2/15, 160, FOB factory 3 Paid $125 for shipping charges on the purchase of March 2 Returned to Alfa Company unacceptable merchandise that had an invoice price of $300 17 Sent a cheque to A Company for the March 2 purchase, net of the dis- count and the returned merchandise March 18 Purchased merchandise from Bravo Company under the following terms: $2,500 invoice price, 2/10, 1/30, FOB destination 21 After brief negotiations, received a credit memorandum from Brave Company granting a 5700 allowance on the purchase of March 18 Sent a cheque to Bravo Company paying for the March 18 purchase of the discount and the allowance - Exercise Analyzing and recording merchandise transactions and returns On May 12, Wilcox Company accepted delivery of $20,000 of merchandise and received an invoice dated May 11, with terms of 1/10, ,FOB Gamer Company's factory. When the goods were delivered, Wilcox Company paid $185 to Express Shipping Service for the delivery charges on the merchandise. The next day. Wilcox Company returned $800 of defective goods to the seller, which received them one day later. On May 21, Wilcox Company mailed a cheque to Garner Company for the amount owed on that date. It was received the following day Required: a Present the journal entries that Wilcox Company should record for these transactions b. Present the journal entries that Gamer Company should record for these transactions Exercise 5-5 Analyzing and recording merchandise transactions and discounts Sandra's Store purchased merchandise from a manufacturer with an invoice price of $11,000 and credit terms of 3/10, 1/50, and paid within the discount period Required: a. Prepare the journal entries that the purchaser should record for the purchase and payment Prepare the journal entries that the seller should record for the sale and collection Assume that the buyer borrowed enough cash to pay the balance on the last day of the discount period at an annual interest rate of 8% and paid it back on the last day of the credit period. Calculate how much the buyer saved by following this strategy. (Use a 365 day year.) The following information appeared in a company's income statement: $300,000 Sales returns 15.000 Sales discounts 4,500 Beginning inventory 25,000 Purchases 180.000 Purchases returns and allowances 6,000 Purchases discounts Transportation in 11,000 Gross profit from sales 105,000 55.000 Required: Calculate the total operating expenses, cost of goods sold, and I ending inventory