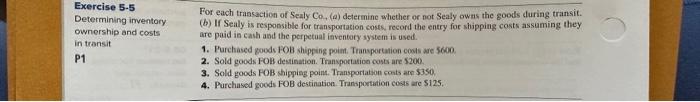

Exercise 5-5 Determining inventory ownership and costs in transit P1 For each transaction of Sealy Co., (a) determine whether or not Sealy owns the goods during transit. (b) If Sealy is responsible for transportation costs, record the entry for shipping costs assuming they are paid in cash and the perpetual inventory system is used. 1. Purchased goods FOB shipping point. Transportation costs are $600. 2. Sold goods FOB destination. Transportation costs are $200. 3. Sold goods FOB shipping point. Transportation costs are $350. 4. Purchased goods FOB destination. Transportation costs are $125.

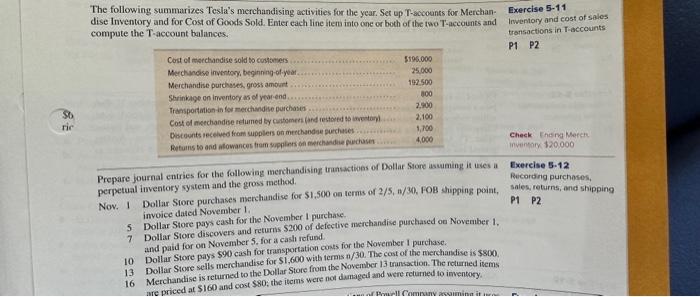

Exercise 5-5 Determining imventory ownership and costs in transit P1 For each transaction of Sealy Co,(a) determine whether or not Sealy owns the goods during transit. (b) If Sealy is responsible for transportation costs, record the entry for shipping costs assuming they are paid is cath and the perpetual inventery system is used. 1. Purchased goods 10B shipping poimt. Transportaion costs are 5600. 2. Sold goods FOB destination. Transportation costs are $200. 3. Sold goods FOB shippisg point. Transportation conts are 5350 . 4. Purchased goods FOB destination. Transportation costs are $125. The following summarizes Tesla's merchandising activities for the year. Set up T-accounts for Merchandise Inventory and for Cost of Goods Sold. Enter each line itema iato one or boch of the two T-accounts and compute the T-account balances. Exercise 5-11 Iwventory and cost of sales transactions in T-accounts P1 P2 Prepare journal entries for the followiag merchandising transactioes of Dollar Store usuaging it uses a perpetual inventory system and the gross method. Nov, I Dollar Store purchases merchandise for $1.500 on terms of 2/5,n/30,108 shipping point, invoice dated Nowember 1 5. Dollar Store pays cash for the November 1 purchave. 7 Dollar Store discovers and returis $200 of detective merchandise purchased on Noveruber 1. and paid for on November 5. for a casti refund. 10 Dollar Store pays $90 cash for transportation cons for the November I purchise. 13 Dollar Store sells merchandise for $1,600 with terms n/30. The cost of the merchandise is $800. 16 Merchandise is returned to the Dollar Store from the November 13 transstion. The returned items Check Ending Merch. inventory 120000 Exereise 5.12 Recording purchoses, sales, returns, and shipping P1 P2 Exercise 5-5 Determining imventory ownership and costs in transit P1 For each transaction of Sealy Co,(a) determine whether or not Sealy owns the goods during transit. (b) If Sealy is responsible for transportation costs, record the entry for shipping costs assuming they are paid is cath and the perpetual inventery system is used. 1. Purchased goods 10B shipping poimt. Transportaion costs are 5600. 2. Sold goods FOB destination. Transportation costs are $200. 3. Sold goods FOB shippisg point. Transportation conts are 5350 . 4. Purchased goods FOB destination. Transportation costs are $125. The following summarizes Tesla's merchandising activities for the year. Set up T-accounts for Merchandise Inventory and for Cost of Goods Sold. Enter each line itema iato one or boch of the two T-accounts and compute the T-account balances. Exercise 5-11 Iwventory and cost of sales transactions in T-accounts P1 P2 Prepare journal entries for the followiag merchandising transactioes of Dollar Store usuaging it uses a perpetual inventory system and the gross method. Nov, I Dollar Store purchases merchandise for $1.500 on terms of 2/5,n/30,108 shipping point, invoice dated Nowember 1 5. Dollar Store pays cash for the November 1 purchave. 7 Dollar Store discovers and returis $200 of detective merchandise purchased on Noveruber 1. and paid for on November 5. for a casti refund. 10 Dollar Store pays $90 cash for transportation cons for the November I purchise. 13 Dollar Store sells merchandise for $1,600 with terms n/30. The cost of the merchandise is $800. 16 Merchandise is returned to the Dollar Store from the November 13 transstion. The returned items Check Ending Merch. inventory 120000 Exereise 5.12 Recording purchoses, sales, returns, and shipping P1 P2