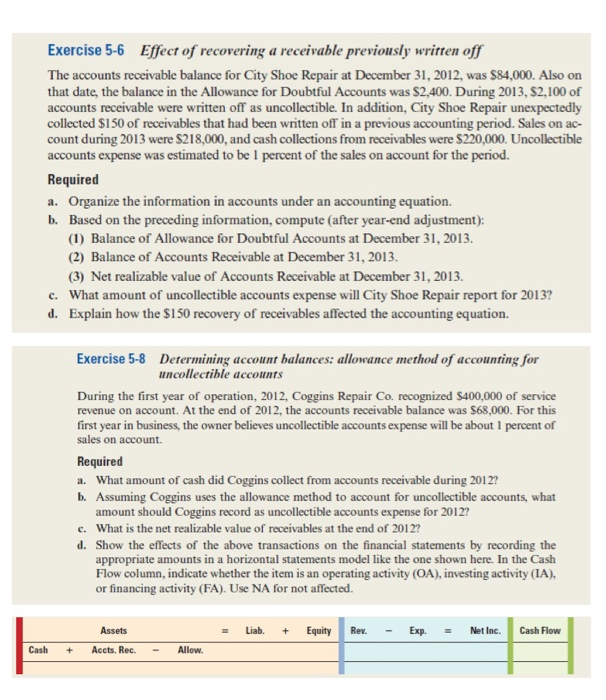

Exercise 5-6 Effect of recovering a receivable previously written off The accounts receivable balance for City Shoe Repair at December 31, 2012, was $84,000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,400. During 2013, $2,100 of accounts receivable were written off as uncollectible. In addition, City Shoe Repair unexpectedly collected $150 of receivables that had been written off in a previous accounting period. Sales on ac- count during 2013 were $218,000, and cash collections from receivables were $220,000. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required a. Organize the information in accounts under an accounting equation. b. Based on the preceding information, compute (after year-end adjustment): (1) Balance of Allowance for Doubtful Accounts at December 31, 2013. (2) Balance of Accounts Receivable at December 31, 2013. (3) Net realizable value of Accounts Receivable at December 31, 2013. c. What amount of uncollectible accounts expense will City Shoe Repair report for 2013? d. Explain how the $150 recovery of receivables affected the accounting equation. Exercise 5-8 Determining account balances: allowance method of accounting for uncollectible accounts During the first year of operation, 2012, Coggins Repair Co. recognized $400,000 of service revenue on account. At the end of 2012, the accounts receivable balance was $68,000. For this first year in business, the owner believes uncollectible accounts expense will be about 1 percent of sales on account. Required a. What amount of cash did Coggins collect from accounts receivable during 2012? b. Assuming Coggins uses the allowance method to account for uncollectible accounts, what amount should Coggins record as uncollectible accounts expense for 2012? e. What is the net realizable value of receivables at the end of 2012? Show the effects of the above transactions on the financial statements by recording the appropriate amounts in a horizontal statements model like the one shown here. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA for not affected. - Liab. + Equity Rex. - Exp. = Net Inc. Cash Flow Assets Accts. Rec. Cash + - Allow