Answered step by step

Verified Expert Solution

Question

1 Approved Answer

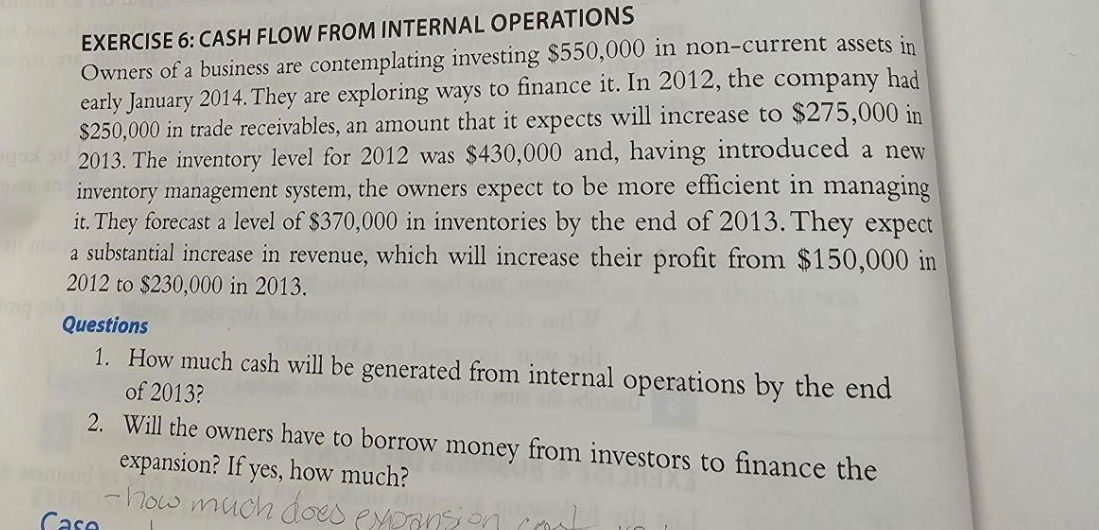

EXERCISE 6 : CASH FLOW FROM INTERNAL OPERATIONS Owners of a business are contemplating investing $ 5 5 0 , 0 0 0 in non

EXERCISE : CASH FLOW FROM INTERNAL OPERATIONS

Owners of a business are contemplating investing $ in noncurrent assets in

early January They are exploring ways to finance it In the company had

$ in trade receivables, an amount that it expects will increase to $ in

The inventory level for was $ and, having introduced a new

inventory management system, the owners expect to be more efficient in managing

it They forecast a level of $ in inventories by the end of They expect

a substantial increase in revenue, which will increase their profit from $ in

to $ in

Questions

How much cash will be generated from internal operations by the end

of

Will the owners have to borrow money from investors to finance the

expansion? If yes, how much?

how much does expansion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started