Answered step by step

Verified Expert Solution

Question

1 Approved Answer

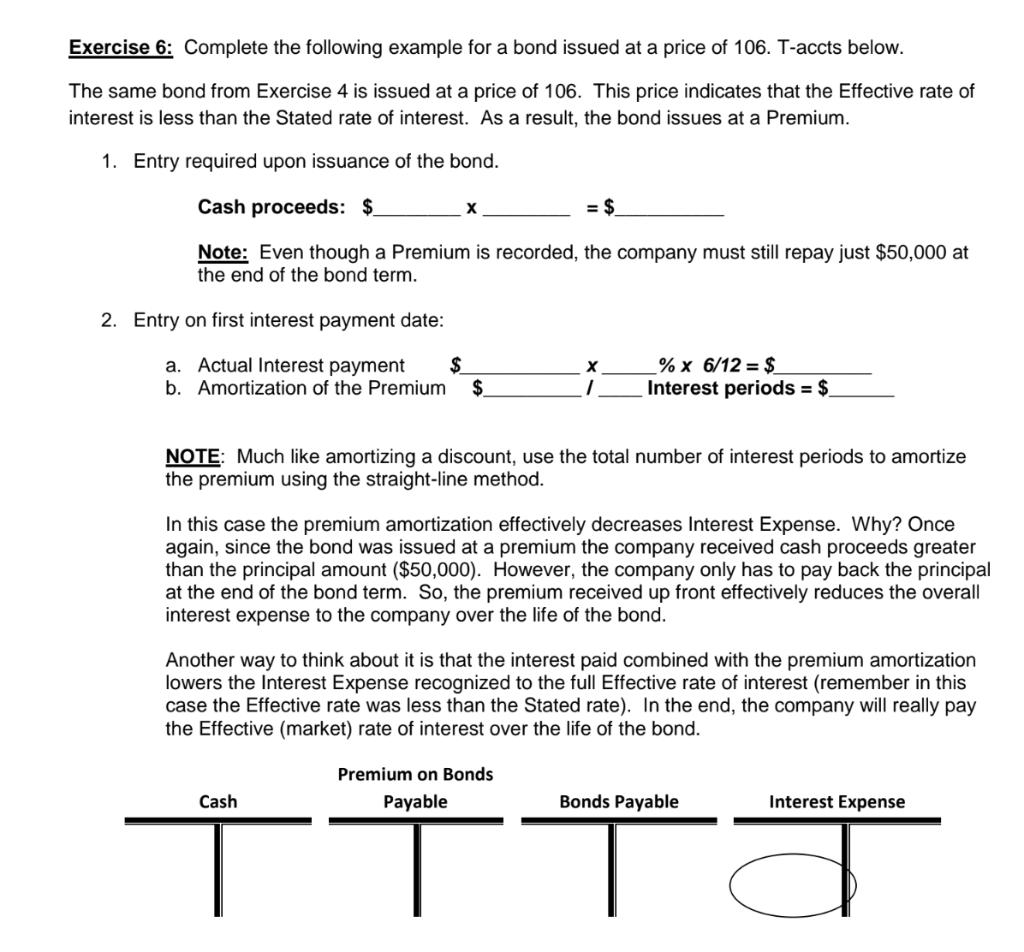

Exercise 6: Complete the following example for a bond issued at a price of 106. T-accts below. The same bond from Exercise 4 is

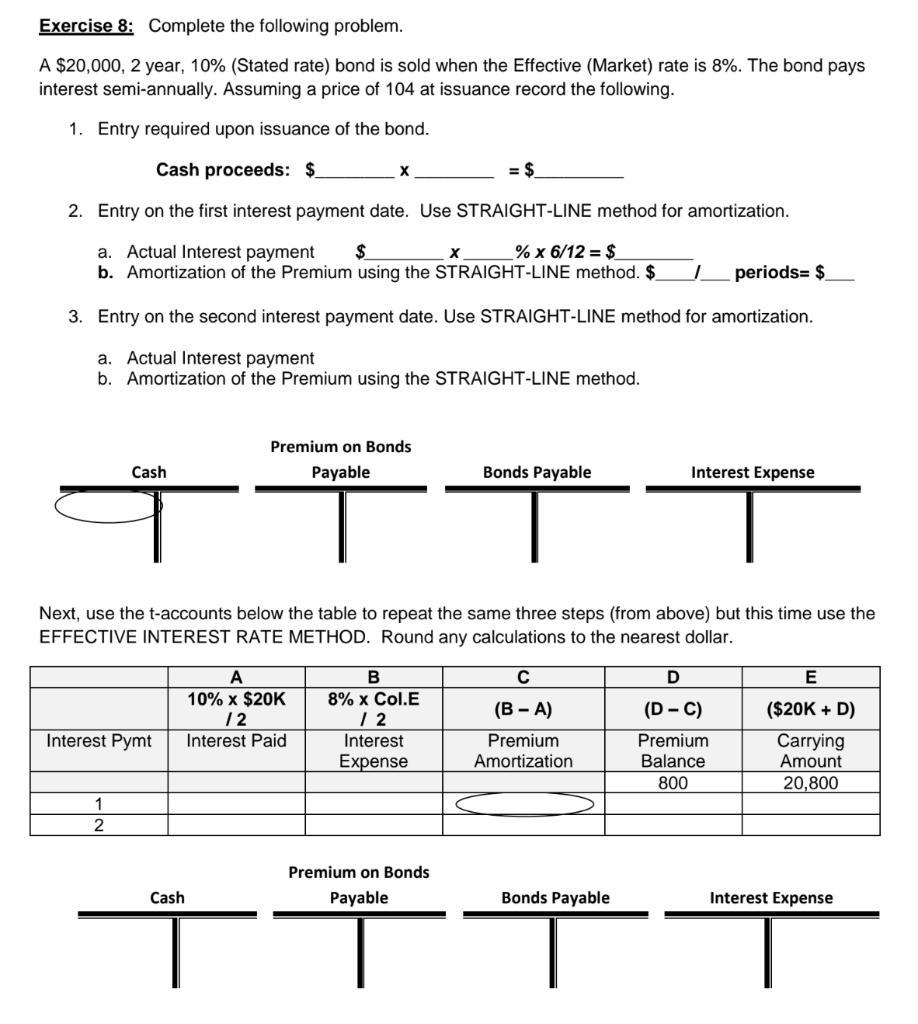

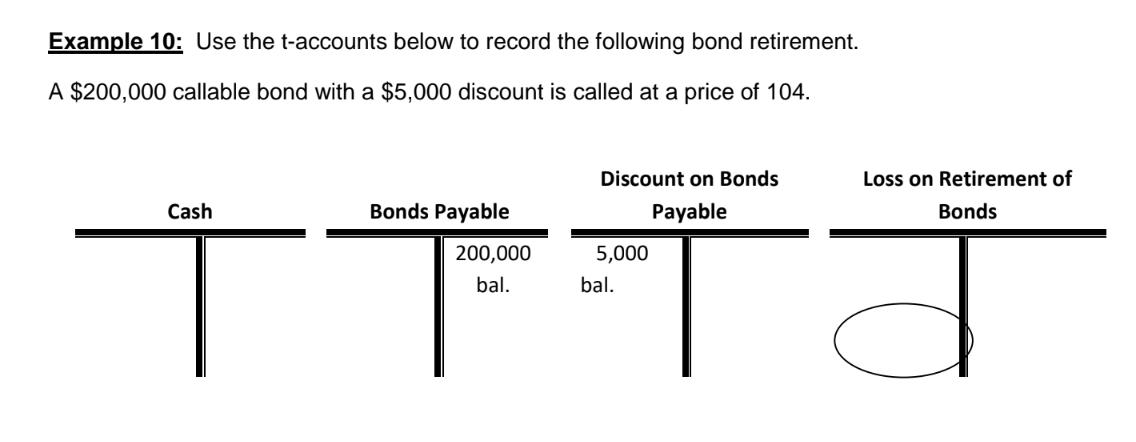

Exercise 6: Complete the following example for a bond issued at a price of 106. T-accts below. The same bond from Exercise 4 is issued at a price of 106. This price indicates that the Effective rate of interest is less than the Stated rate of interest. As a result, the bond issues at a Premium. 1. Entry required upon issuance of the bond. Cash proceeds: $ = $ Note: Even though a Premium is recorded, the company must still repay just $50,000 at the end of the bond term. X 2. Entry on first interest payment date: a. Actual Interest payment b. Amortization of the Premium $ X 1 NOTE: Much like amortizing a discount, use the total number of interest periods to amortize the premium using the straight-line method. Cash % x 6/12 = $ Interest periods = $_ In this case the premium amortization effectively decreases Interest Expense. Why? Once again, since the bond was issued at a premium the company received cash proceeds greater than the principal amount ($50,000). However, the company only has to pay back the principal at the end of the bond term. So, the premium received up front effectively reduces the overall interest expense to the company over the life of the bond. Another way to think about it is that the interest paid combined with the premium amortization lowers the Interest Expense recognized to the full Effective rate of interest (remember in this case the Effective rate was less than the Stated rate). In the end, the company will really pay the Effective (market) rate of interest over the life of the bond. Premium on Bonds Payable Bonds Payable Interest Expense Exercise 8: Complete the following problem. A $20,000, 2 year, 10% (Stated rate) bond is sold when the Effective (Market) rate is 8%. The bond pays interest semi-annually. Assuming a price of 104 at issuance record the following. 1. Entry required upon issuance of the bond. Cash proceeds: $ $ 2. Entry on the first interest payment date. Use STRAIGHT-LINE method for amortization. a. Actual Interest payment $ % x 6/12 = $ b. Amortization of the Premium using the STRAIGHT-LINE method. $ 1 periods= $_ 3. Entry on the second interest payment date. Use STRAIGHT-LINE method for amortization. a. Actual Interest payment b. Amortization of the Premium using the STRAIGHT-LINE method. Cash Interest Pymt 1 2 X Premium on Bonds Payable A 10% x $20K 12 Interest Paid X Next, use the t-accounts below the table to repeat the same three steps (from above) but this time use the EFFECTIVE INTEREST RATE METHOD. Round any calculations to the nearest dollar. B 8% x Col.E 12 Interest Expense Bonds Payable C (B-A) Premium Amortization Interest Expense D (D-C) Premium Balance 800 Premium on Bonds Cash Payable Bonds Payable E ($20K + D) Carrying Amount 20,800 Interest Expense Example 10: Use the t-accounts below to record the following bond retirement. A $200,000 callable bond with a $5,000 discount is called at a price of 104. Loss on Retirement of Cash Discount on Bonds Bonds Payable Payable 200,000 5,000 TTTT bal. bal. Bonds

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to be cut off and its not entirely clear what specific information or calculations youre asking for However from the provided image...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started