Exercise 6-01

Exercise 6-05

Exercise 6-05

Exercise 6-01A

Exercise 6-01A

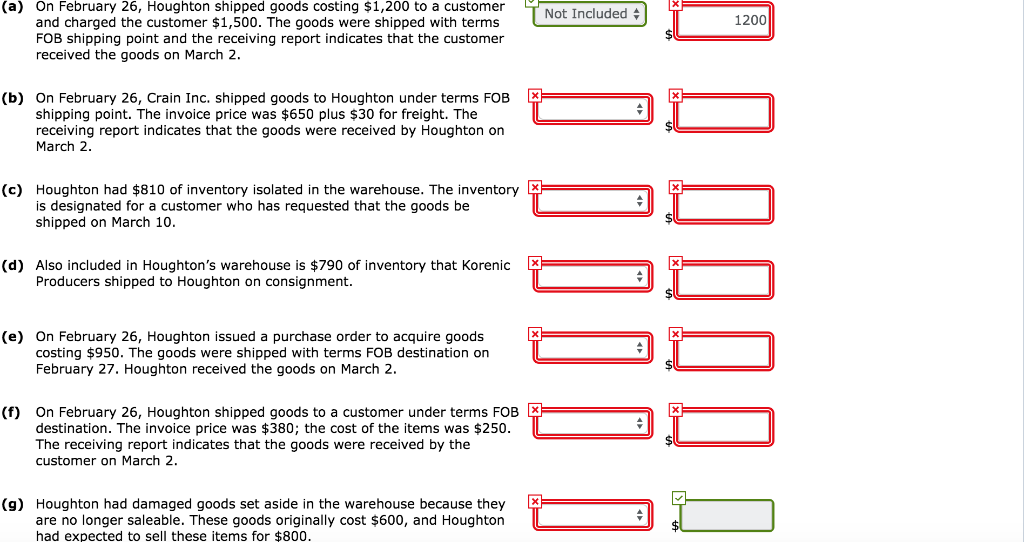

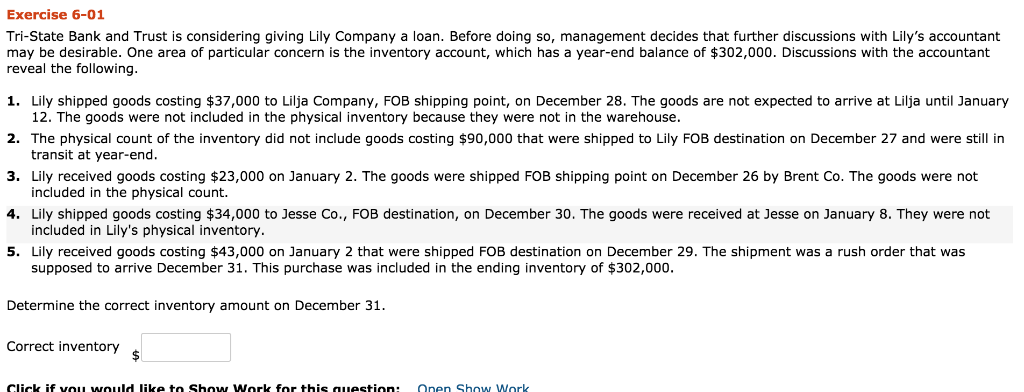

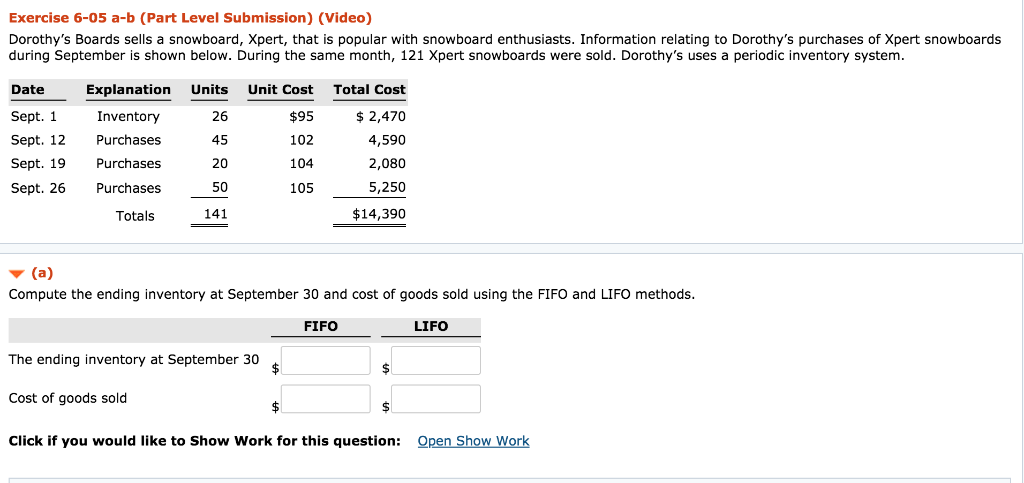

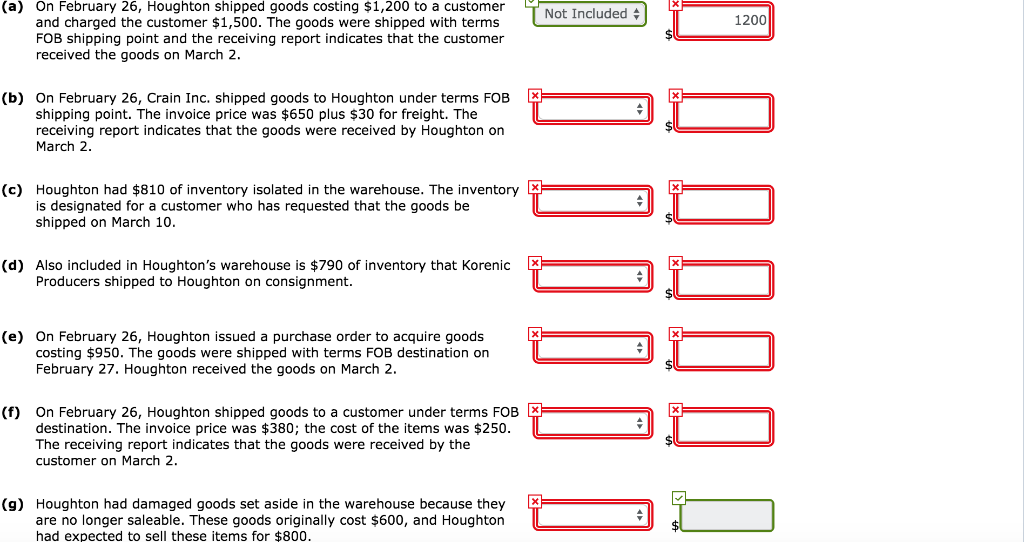

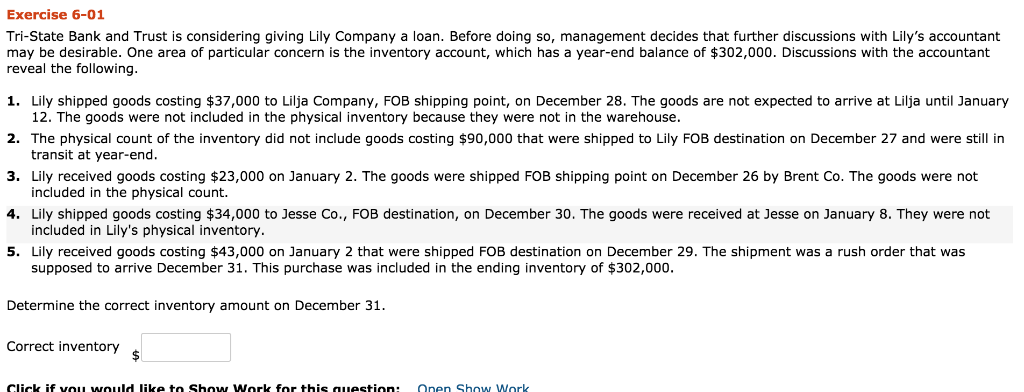

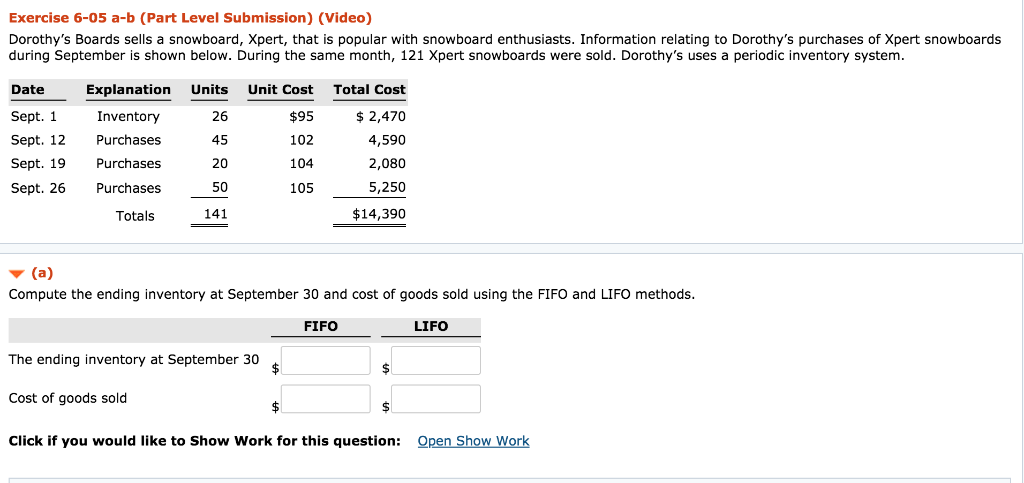

Exercise 6-01 Tri-State Bank and Trust is considering giving Lily Company a loan. Before doing so, management decides that further discussions with Lily's accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of $302,000. Discussions with the accountant reveal the following. 1. Lily shipped goods costing $37,000 to Lilja Company, FOB shipping point, on December 28. The goods are not expected to arrive at Lilja until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $90,000 that were shipped to Lily FOB destination on December 27 and were still in transit at year-end. 3. Lily received goods costing $23,000 on January 2. The goods were shipped FOB shipping point on December 26 by Brent Co. The goods were not included in the physical count. 4. Lily shipped goods costing $34,000 to Jesse Co., FOB destination, on December 30. The goods were received at Jesse on January 8. They were not included in Lily's physical inventory. 5. Lily received goods costing $43,000 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of $302,000 Determine the correct inventory amount on December 31. Correct inventory Click if vou wOuld likke to Show Work for this auestion: Onen Show Work Exercise 6-05 a-b (Part Level Submission) (Video) Dorothy's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Dorothy's purchases of Xpert snowboards during September is shown below. During the same month, 121 Xpert snowboards were sold. Dorothy's uses a periodic inventory system Date Sept. 1 Sept. 12 Purchases Sept. 19 Purchases Sept. 26Purchases Explanation Units Unit Cost Total Cost $ 2,470 4,590 2,080 5,250 $14,390 $95 102 104 105 Inventory 26 45 20 50 141 Totals Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods FIFO LIFO The ending inventory at September 30 Cost of goods sold Click if you would like to Show Work for this question: Open Show Work (a) On February 26, Houghton shipped goods costing $1,200 to a customer Not Included 1200 and charged the customer $1,500. The goods were shipped with terms FOB shipping point and the receiving report indicates that the customer received the goods on March 2 (b) On February 26, Crain Inc. shipped goods to Houghton under terms FOB shipping point. The invoice price was $650 pluS $30 for freight. The receiving report indicates that the goods were received by Houghton on March 2 (c) Houghton had $810 of inventory isolated in the warehouse. The inventory is designated for a customer who has requested that the goods be shipped on March 10 (d) Also included in Houghton's warehouse is $790 of inventory that Korenic X Producers shipped to Houghton on consignment. (e) On February 26, Houghton issued a purchase order to acquire goods costing $950. The goods were shipped with terms FOB destination on February 27. Houghton received the goods on March 2 (f) On February 26, Houghton shipped goods to a customer under terms FOB destination. The invoice price was $380; the cost of the items was $250 The receiving report indicates that the goods were received by the customer on March 2 (g) Houghton had damaged goods set aside in the warehouse because they are no longer saleable. These goods originally cost $600, and Houghton had expected to sell these items for $800

Exercise 6-05

Exercise 6-05 Exercise 6-01A

Exercise 6-01A