Answered step by step

Verified Expert Solution

Question

1 Approved Answer

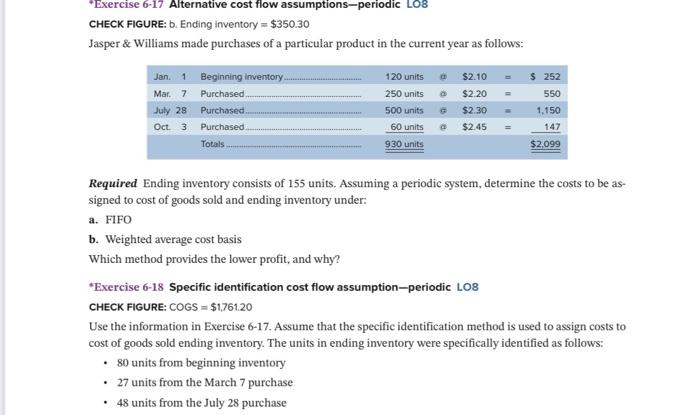

*Exercise 6-17 Alternative cost flow assumptions-periodic L08 CHECK FIGURE: b. Ending inventory = $350.30 Jasper & Williams made purchases of a particular product in the

*Exercise 6-17 Alternative cost flow assumptions-periodic L08 CHECK FIGURE: b. Ending inventory = $350.30 Jasper & Williams made purchases of a particular product in the current year as follows: Jan. 1 Mar. 7 July 28 Oct. 3 Beginning inventory. Purchased. Purchased Purchased. . Totals. a. FIFO b. Weighted average cost basis Which method provides the lower profit, and why? . 120 units @ $2.10 = 250 units 500 units $2.20 = $2.30 = 60 units @ $2.45 = 930 units @ Required Ending inventory consists of 155 units. Assuming a periodic system, determine the costs to be as- signed to cost of goods sold and ending inventory under: @ $ 252 550 1,150 147 $2,099 *Exercise 6-18 Specific identification cost flow assumption-periodic L08 CHECK FIGURE: COGS = $1,761.20 Use the information in Exercise 6-17. Assume that the specific identification method is used to assign costs to cost of goods sold ending inventory. The units in ending inventory were specifically identified as follows: 80 units from beginning inventory 27 units from the March 7 purchase 48 units from the July 28 purchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started