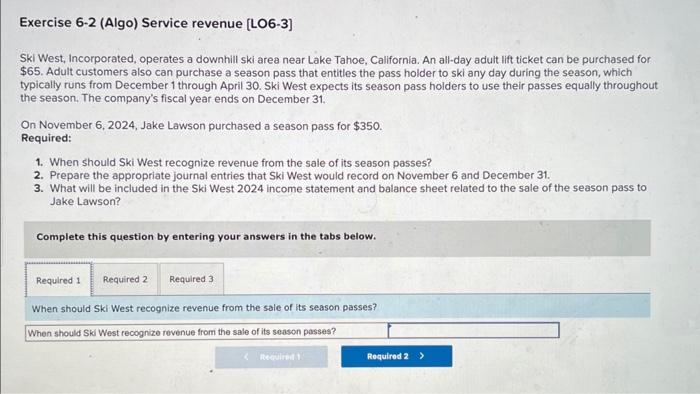

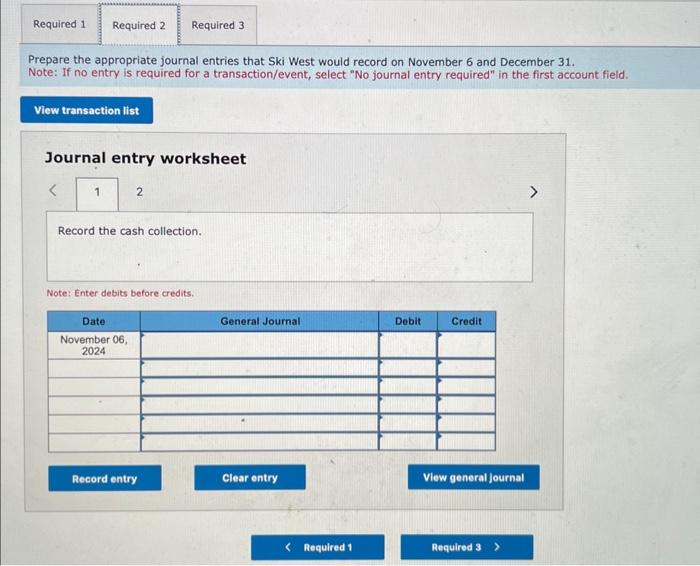

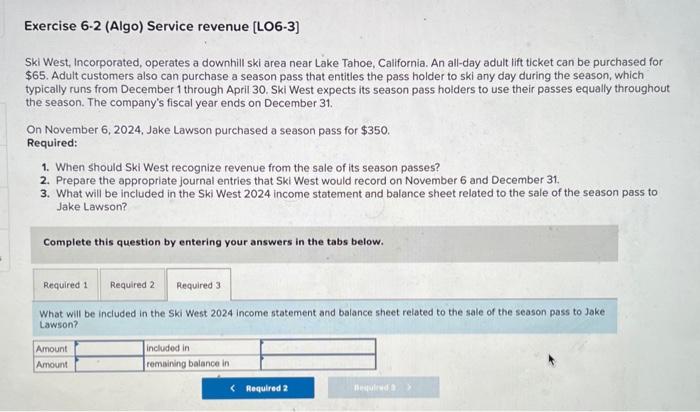

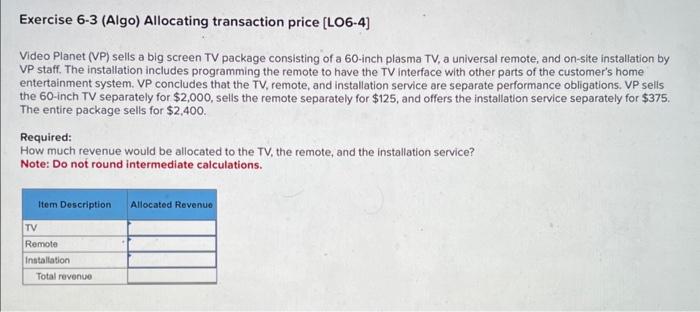

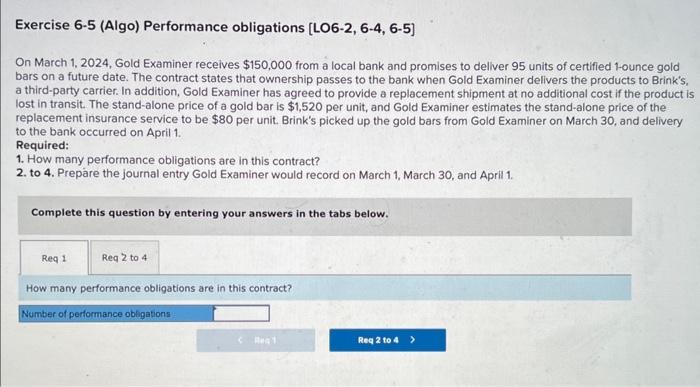

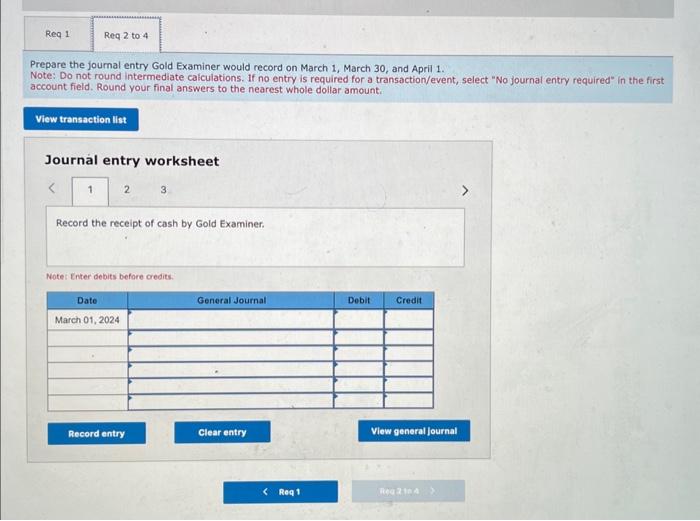

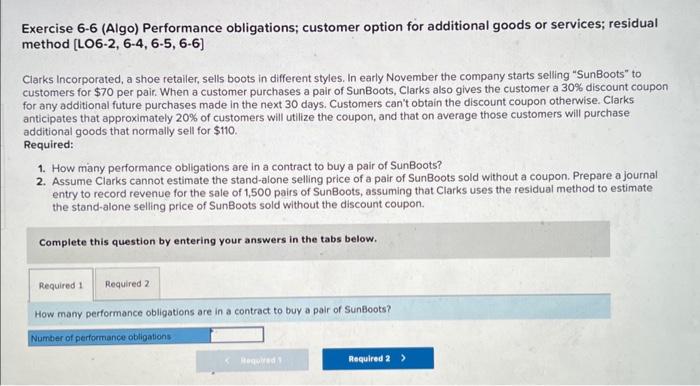

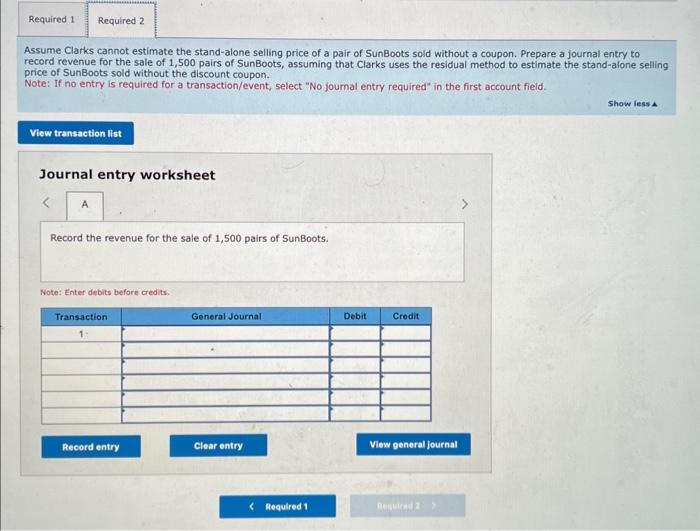

Exercise 6-2 (Algo) Service revenue [LO6-3] Ski West, Incorporated, operates a downhill ski area near Lake Tahoe, California. An all-day adult lift ticket can be purchased for $65. Adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typically runs from December 1 through April 30. Ski West expects its season pass holders to use their passes equally throughout the season. The company's fiscal year ends on December 31 . On November 6,2024 , Jake Lawson purchased a season pass for $350. Required: 1. When should Ski West recognize revenue from the sale of its season passes? 2. Prepare the appropriate journal entries that Ski West would record on November 6 and December 31. 3. What will be included in the Ski West 2024 income statement and balance sheet related to the sale of the season pass to Jake Lawson? Complete this question by entering your answers in the tabs below. When should Ski West recognize revenue from the sale of its season passes? When should Ski West recognize revenue from the sale of its season passes? Prepare the appropriate journal entries that Ski West would record on November 6 and December 31. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits, Ski West, Incorporated, operates a downhill ski area near Lake Tahoe, California. An all-day adult lift ticket can be purchased for $65. Adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typically runs from December 1 through April 30 . Ski West expects its season pass holders to use their passes equally throughout the season. The company's fiscal year ends on December 31. On November 6,2024 , Jake Lawson purchased a season pass for $350. Required: 1. When should Ski West recognize revenue from the sale of its season passes? 2. Prepare the appropriate journal entries that Ski West would record on November 6 and December 31 . 3. What will be included in the Ski West 2024 income statement and balance sheet related to the sale of the season pass to Jake Lawson? Complete this question by entering your answers in the tabs below. What will be included in the Ski West 2024 income statement and balance sheet related to the sale of the season pass to Jake Lawson? Exercise 6-3 (Algo) Allocating transaction price [LO6-4] Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment system. VP concludes that the TV, remote, and installation service are separate performance obligations. VP selis the 60-inch TV separately for $2,000, sells the remote separately for $125, and offers the installation service separately for $375. The entire package sells for $2,400. Required: How much revenue would be allocated to the TV, the remote, and the installation service? Note: Do not round intermediate calculations. On March 1, 2024, Gold Examiner receives $150,000 from a local bank and promises to dellver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Gold Examiner dellvers the products to Brink's, a third-party carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1,520 per unit, and Gold Examiner estimates the stand-alone price of the replacement insurance service to be $80 per unit. Brink's picked up the gold bars from Gold Examiner on March 30 , and delivery to the bank occurred on April 1. Required: 1. How many performance obligations are in this contract? 2. to 4. Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1. Complete this question by entering your answers in the tabs below. How many performance obligations are in this contract? Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount. Journal entry worksheet Record the receipt of cash by Gold Examiner. Notes Enter debits before oredits. Exercise 6-6 (Algo) Performance obligations; customer option for additional goods or services; residual method [LO6-2, 6-4, 6-5, 6-6] Clarks Incorporated, a shoe retailer, sells boots in different styles. In early November the company starts selling "SunBoots" to customers for $70 per pair. When a customer purchases a pair of SunBoots, Clarks also gives the customer a 30% discount coupon for any additional future purchases made in the next 30 days. Customers can't obtain the discount coupon otherwise. Clarks anticipates that approximately 20% of customers will utilize the coupon, and that on average those customers will purchase additional goods that normally sell for $110. Required: 1. How many performance obligations are in a contract to buy a pair of SunBoots? 2. Assume Clarks cannot estimate the stand-alone selling price of a pair of SunBoots sold without a coupon. Prepare a journal entry to record revenue for the sale of 1,500 pairs of SunBoots, assuming that Clarks uses the residual method to estimate the stand-alone selling price of SunBoots sold without the discount coupon. Complete this question by entering your answers in the tabs below. How many performance obligations are in a contract to buy a pair of SunBoots? Assume Clarks cannot estimate the stand-alone selling price of a pair of SunBoots sold without a coupon. Prepare a journal entry to record revenue for the sale of 1,500 pairs of SunBoots, assuming that Clarks uses the residual method to estimate the stand-alone selling price of SunBoots sold without the discount coupon. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet Record the revenue for the sale of 1,500 pairs of SunBoots. Note: Enter debits before credits