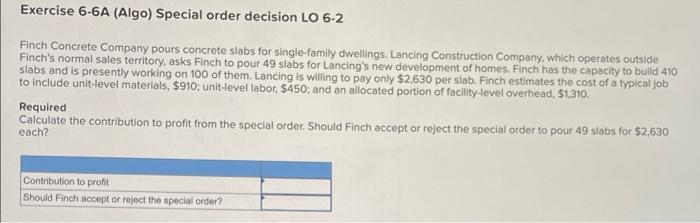

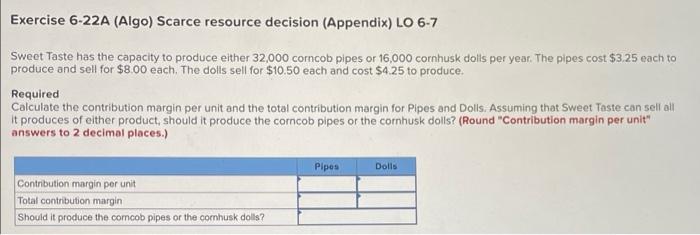

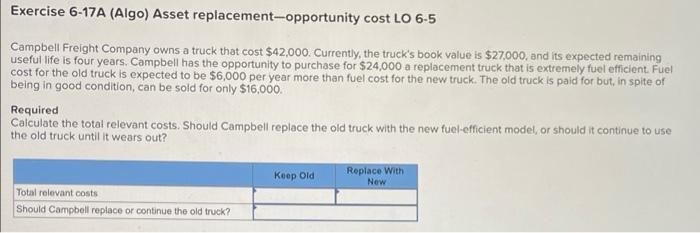

Exercise 6-6A (Algo) Special order decision LO 6-2 Finch Concrete Company pours concrete slabs for single-family dwellings. Lancing Construction Company, which operates outside Finch's normal sales territory, asks Finch to pour 49 slabs for Lancing's new development of homes. Finch has the capacity to build 410 slabs and is presently working on 100 of them. Lancing is willing to pay only $2,630 per slab. Finch estimates the cost of a typical job to include unit-level materials, $910, unit-level labor, 5450, and an allocated portion of facility-level overhead. $1.310. Required Calculate the contribution to profit from the special order. Should Finch accept or reject the special order to pour 49 slabs for $2,630 each? Contribution to profit Should Finch accept or reject the special order? Exercise 6-22A (Algo) Scarce resource decision (Appendix) LO 6-7 Sweet Taste has the capacity to produce either 32,000 corncob pipes or 16,000 cornhusk dolls per year. The pipes cost $3.25 each to produce and sell for $8.00 each. The dolls sell for $10.50 each and cost $4.25 to produce. Required Calculate the contribution margin per unit and the total contribution margin for Pipes and Dolls. Assuming that Sweet Taste con sell all it produces of either product, should it produce the corncob pipes or the cornhusk dolls? (Round "Contribution margin per unit" answers to 2 decimal places.) Pipes Dolls Contribution margin por unit Total contribution margin Should it produce the comcob pipes or the comhusk dolls? Exercise 6-17A (Algo) Asset replacement-opportunity cost LO 6-5 Campbell Freight Company owns a truck that cost $42,000. Currently, the truck's book value is $27,000, and its expected remaining useful life is four years. Campbell has the opportunity to purchase for $24,000 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $6,000 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $16,000. Required Calculate the total relevant costs. Should Campbell replace the old truck with the new fuel-efficient model or should it continue to use the old truck until it wears out? Keep Old Replace With New Total relevant costs Should Campbell replace or continue the old truck