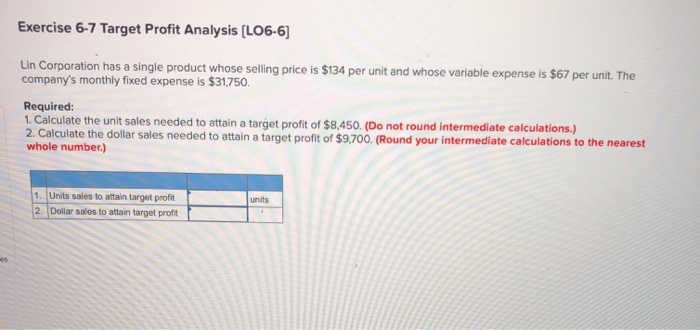

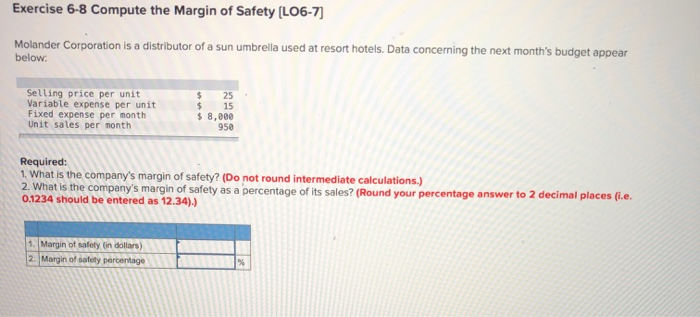

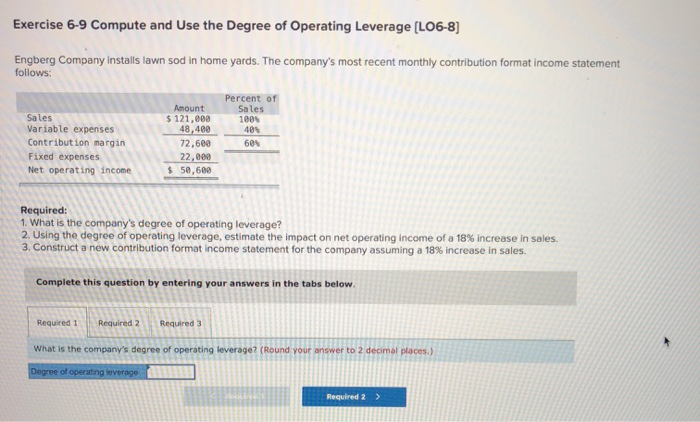

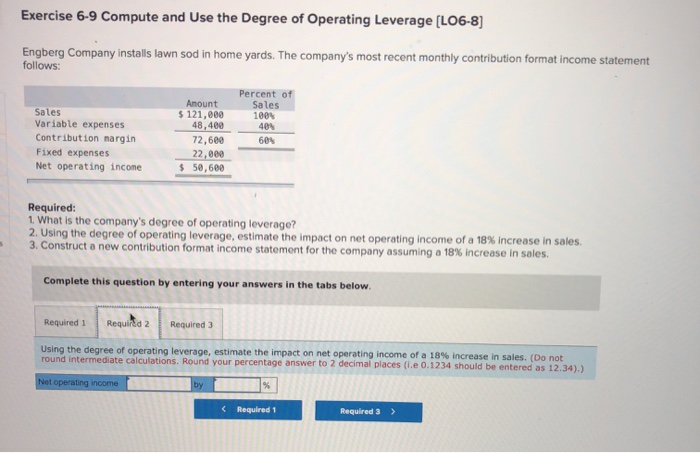

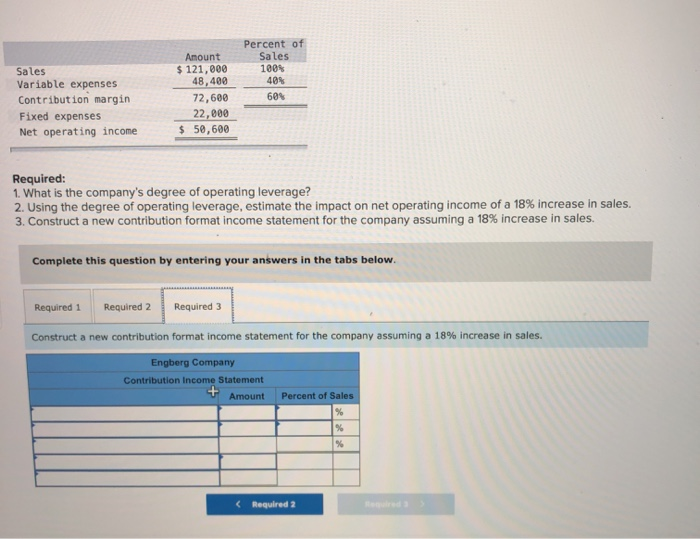

Exercise 6-7 Target Profit Analysis (L06-6) Lin Corporation has a single product whose selling price is $134 per unit and whose variable expense is $67 per unit. The company's monthly fixed expense is $31,750. Required: 1. Calculate the unit sales needed to attain a target profit of $8,450. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $9,700. (Round your intermediate calculations to the nearest whole number.) 1. Units sales to attain target profit 2. Dollar sales to attain target profit units Exercise 6-8 Compute the Margin of Safety (LO6-7) Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 25 $ 15 $ 8,000 950 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) 1. Margin of safety in dollars) 2. Margin of safety percentage Exercise 6-9 Compute and Use the Degree of Operating Leverage (L06-8) Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 121,000 48,400 72,600 22,000 $ 50,600 Percent of Sales 100 40 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 18% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 18% increase in sales. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating average Required 2 > Exercise 6-9 Compute and Use the Degree of Operating Leverage (L06-8] Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Anount $ 121,000 48,400 72,600 22,800 $ 50,600 Percent of Sales 1009 40% 604 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 18% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 18% increase in sales. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 18% increase in sales. (Do not round intermediate calculations. Round your percentage answer to 2 decimal places (ie 0.1234 should be entered as 12.34).) Net operating income by Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 121,000 48,400 72,600 22,000 $ 50,600 Percent of Sales 100 40% 604 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 18% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 18% increase in sales. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Construct a new contribution format income statement for the company assuming a 18% increase in sales. Engberg Company Contribution Income Statement Amount Percent of Sales % % %