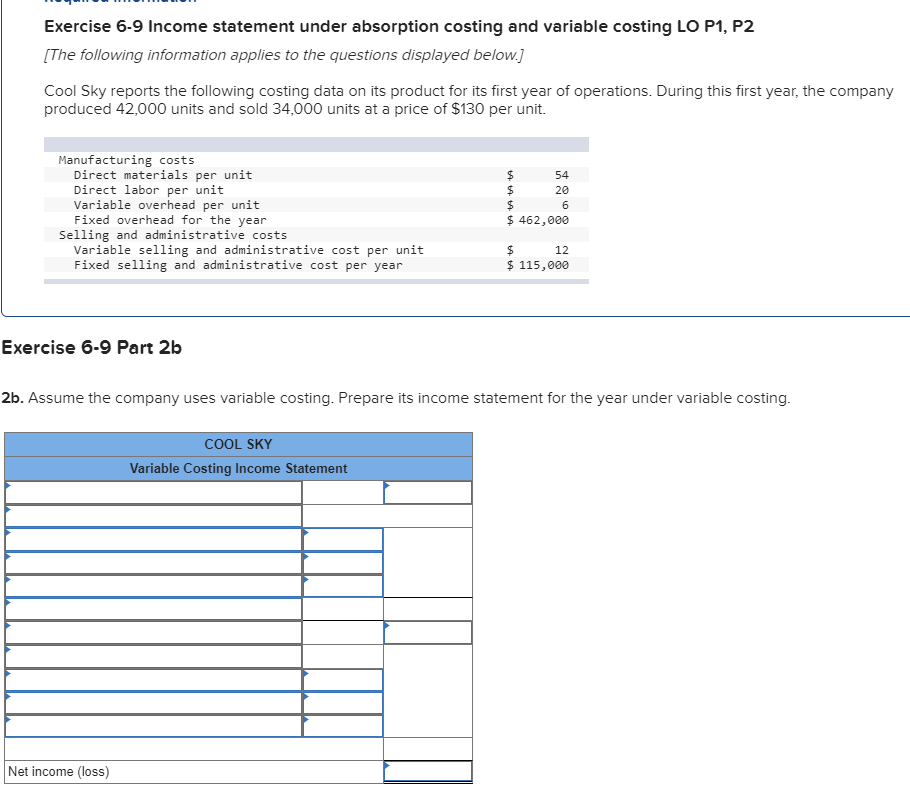

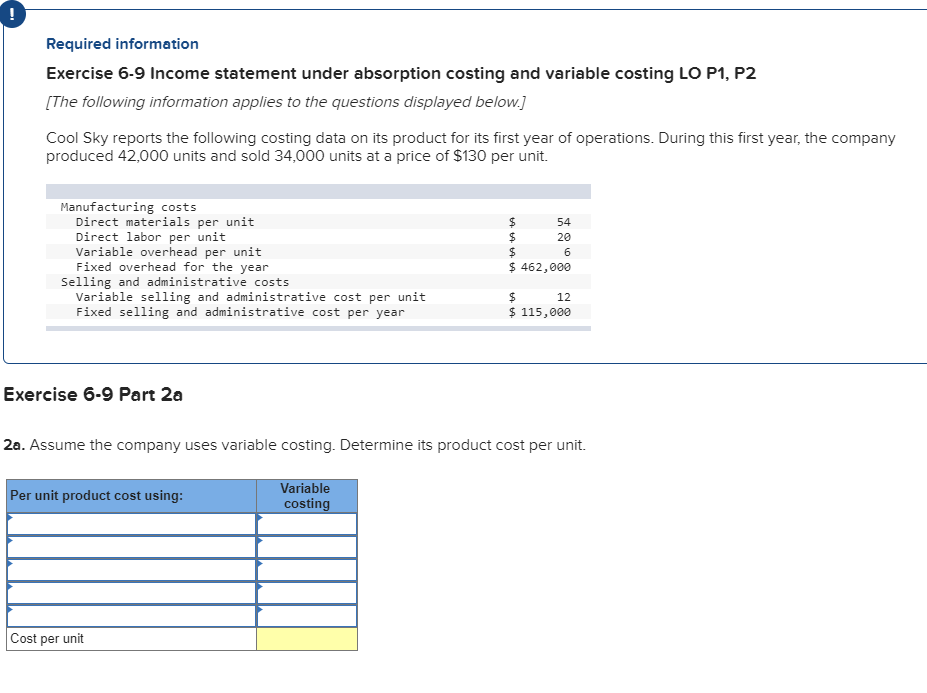

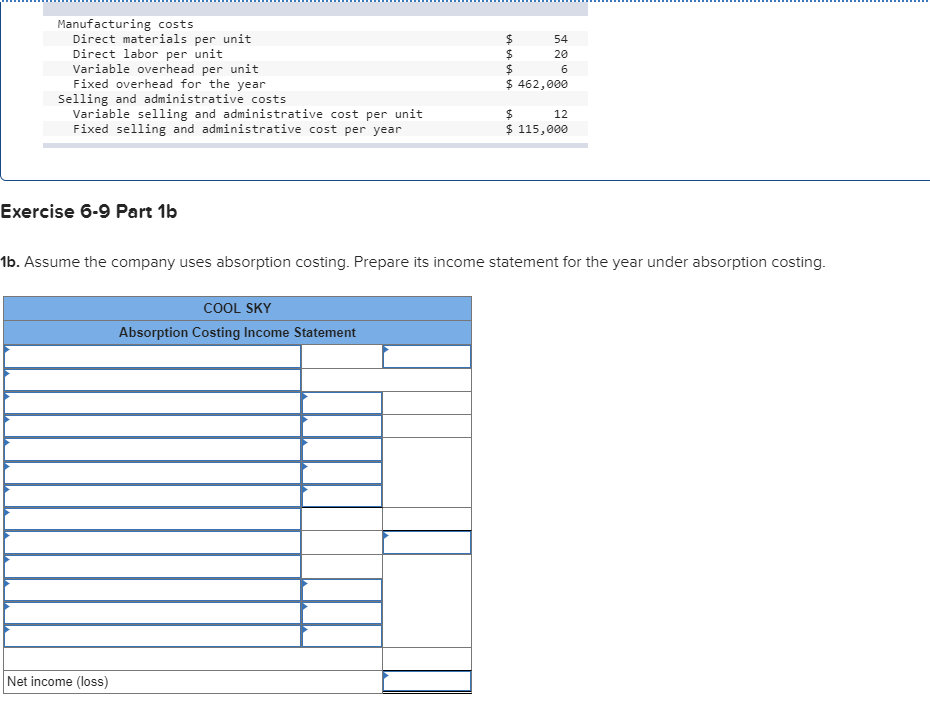

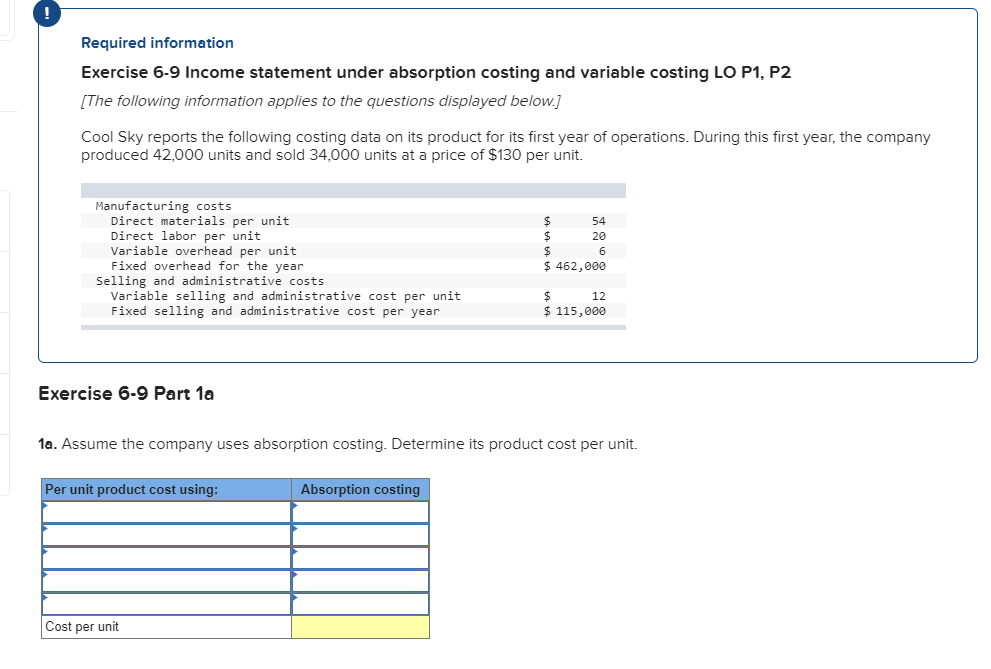

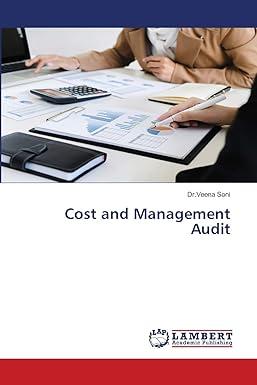

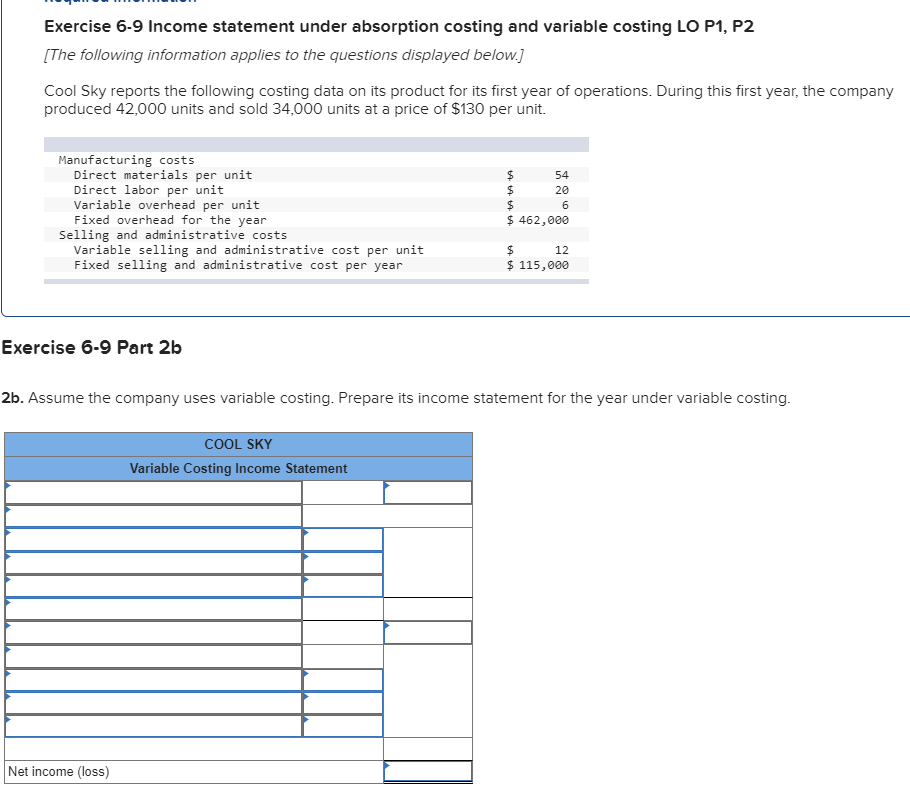

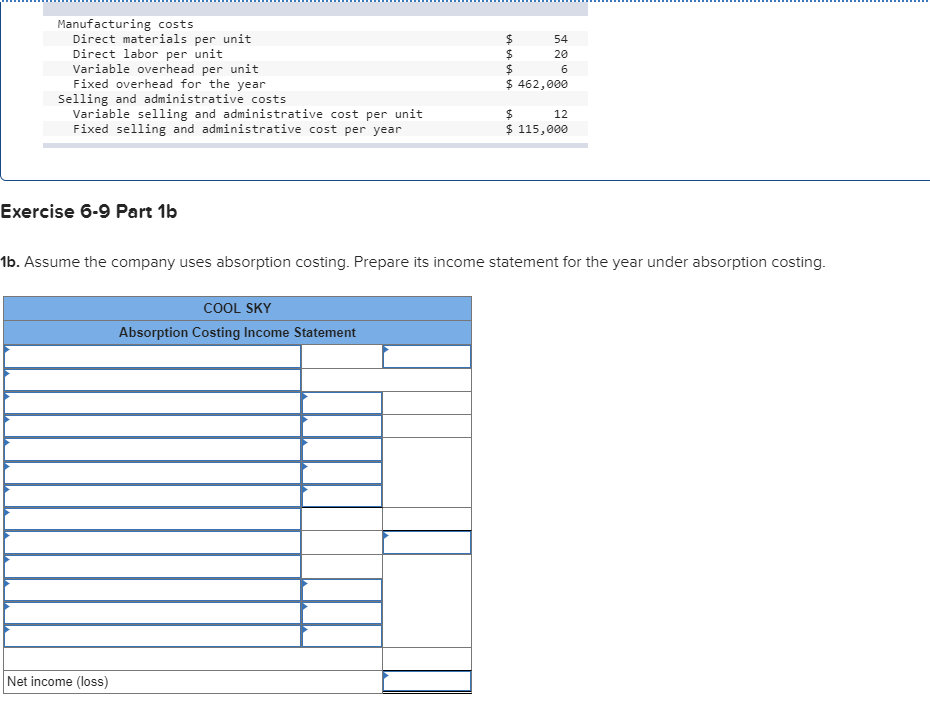

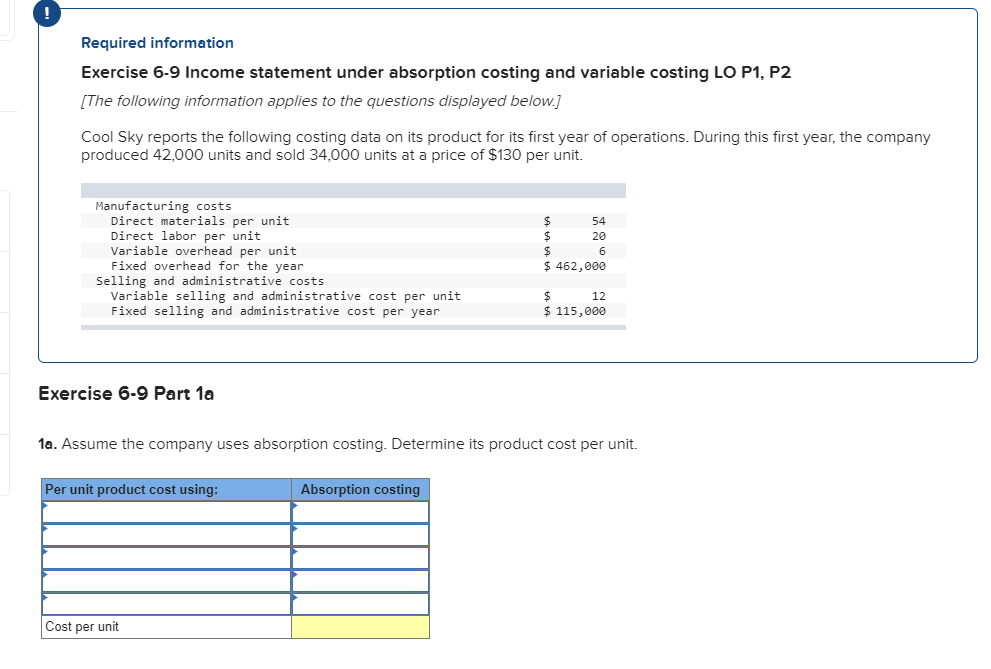

Exercise 6-9 Income statement under absorption costing and variable costing LO P1, P2 The following information applies to the questions displayed below.] Cool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 42,000 units and sold 34,000 units at a price of $130 per unit. Manufacturing costs Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead for the year Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 54 20 462,000 12 $ 115,000 Exercise 6-9 Part 2b 2b. Assume the company uses variable costing. Prepare its income statement for the year under variable costing. COOL SKY Variable Costing Income Statement Net income (loss) Required information Exercise 6-9 Income statement under absorption costing and variable costing LO P1, P2 [The following information applies to the questions displayed below.] Cool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 42,000 units and sold 34,000 units at a price of $130 per unit. Manufacturing costs Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead for the year 54 20 462,000 Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 12. $ 115,000 Exercise 6-9 Part 2a 2a. Assume the company uses variable costing. Determine its product cost per unit. Variable Per unit product cost using: costing Cost per unit Manufacturing costs Direct materials per unit 54 Direct labor per unit Variable overhead per unit Fixed overhead for the year 20 462,000 Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 12 115,000 Exercise 6-9 Part 1b 1b. Assume the company uses absorption costing. Prepare its income statement for the year under absorption costing. COOL SKY Absorption Costing Income Statement Net income (loss) Required information Exercise 6-9 Income statement under absorption costing and variable costing LO P1, P2 [The following information applies to the questions displayed below.] Cool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 42,000 units and sold 34,000 units at a price of $130 per unit. Manufacturing costs Direct materials per unit Direct labor per unit Variable overhead per unit 54 26 Fixed overhead for the year 462,000 Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 12 115,000 Exercise 6-9 Part 1a 1a. Assume the company uses absorption costing. Determine its product cost per unit. Per unit product cost using: Absorption costing Cost per unit