Answered step by step

Verified Expert Solution

Question

1 Approved Answer

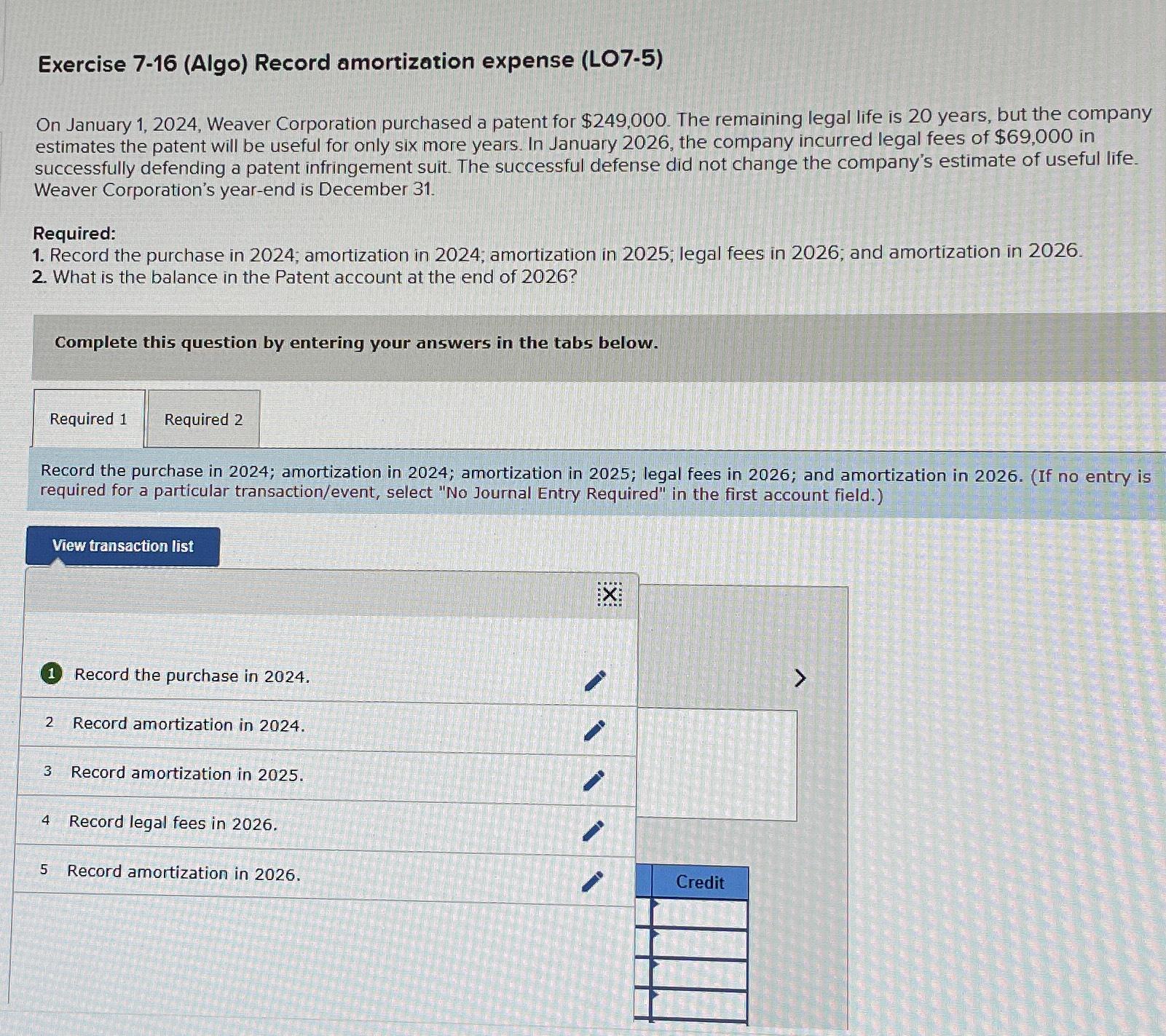

Exercise 7 - 1 6 ( Algo ) Record amortization expense ( LO 7 - 5 ) On January 1 , 2 0 2 4

Exercise Algo Record amortization expense LO

On January Weaver Corporation purchased a patent for $ The remaining legal life is years, but the company estimates the patent will be useful for only six more years. In January the company incurred legal fees of $ in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Weaver Corporation's yearend is December

Required:

Record the purchase in ; amortization in ; amortization in ; legal fees in ; and amortization in

What is the balance in the Patent account at the end of

Complete this question by entering your answers in the tabs below.

Required

Record the purchase in ; amortization in ; amortization in ; legal fees in ; and amortization in If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record the purchase in

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditJanuary

Exercise Algo Record amortization expense LO

On January Weaver Corporation purchased a patent for $ The remaining legal life is years, but the company estimates the patent will be useful for only six more years. In January the company incurred legal fees of $ in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Weaver Corporation's yearend is December

Required:

Record the purchase in ; amortization in ; amortization in ; legal fees in ; and amortization in

What is the balance in the Patent account at the end of

Complete this question by entering your answers in the tabs below.

Record the purchase in ; amortization in ; amortization in ; legal fees in ; and amortization in If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Record the purchase in

Record amortization in

Record amortization in

Record legal fees in

Record amortization in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started