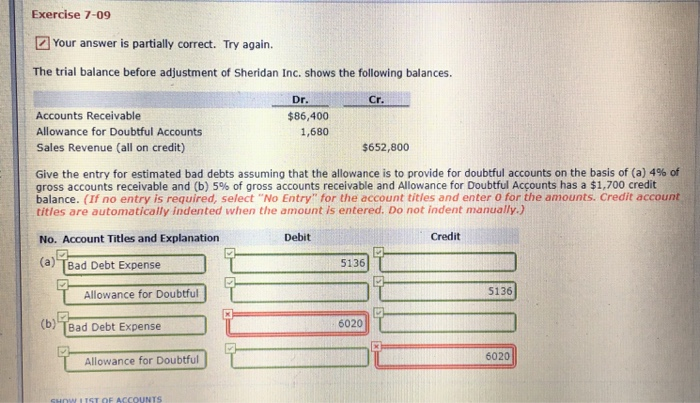

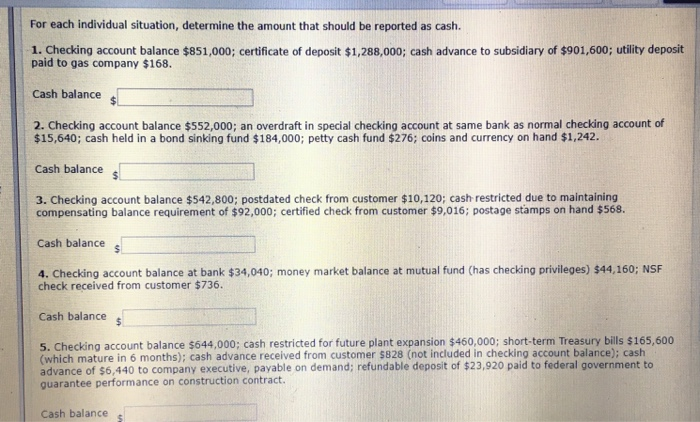

Exercise 7-09 Your answer is partially correct. Try again. The trial balance before adjustment of Sheridan Inc. shows the following balances. Dr. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) $86,400 1,680 $652,800 Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b) 5% of gross accounts receivable and Allowance for Doubtful Accounts has a $1,700 credit balance. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) Tead Debt Expense Allowance for Doubtful (b) Bad Debt Expense 6020 Allowance for Doubtful 6020 CURRICT OF ACCOUNTS For each individual situation, determine the amount that should be reported as cash. 1. Checking account balance $851,000; certificate of deposit $1,288,000; cash advance to subsidiary of $901,600; utility deposit paid to gas company $168. Cash balance 2. Checking account balance $552,000; an overdraft in special checking account at same bank as normal checking account of $15,640; cash held in a bond sinking fund $184,000; petty cash fund $276; coins and currency on hand $1,242. Cash balance 3. Checking account balance $542.800: postdated check from customer $10,120; cash restricted due to maintaining compensating balance requirement of $92,000; certified check from customer $9,016; postage stamps on hand $568. Cash balances 4. Checking account balance at bank $34,040; money market balance at mutual fund (has checking privileges) $44,160; NSF check received from customer $736. Cash balances 5. Checking account balance $644,000; cash restricted for future plant expansion $460,000; short-term Treasury bills $165,600 (which mature in 6 months); cash advance received from customer $828 (not included in checking account balance); cash advance of $6,440 to company executive, payable on demand; refundable deposit of $23,920 paid to federal government to guarantee performance on construction contract. Cash balances