Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 7-10 (Video) Stahl Inc. produces three separate products from a common process costing $100,800. Each of the products can be sold at the split-off

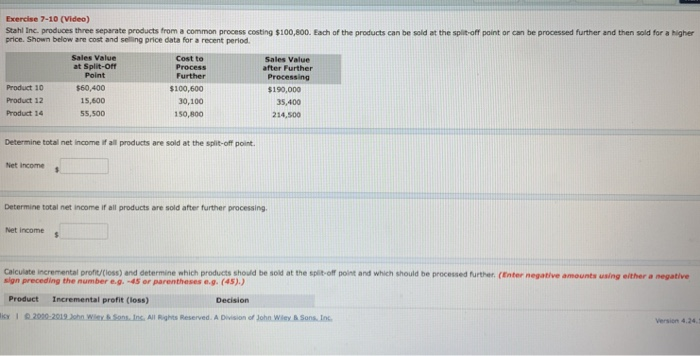

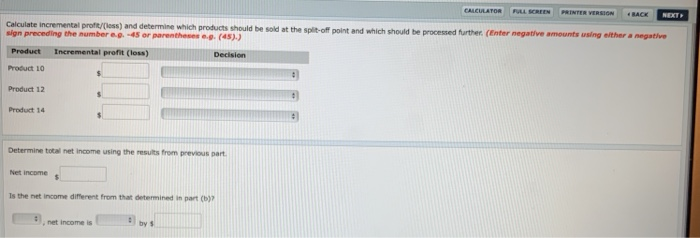

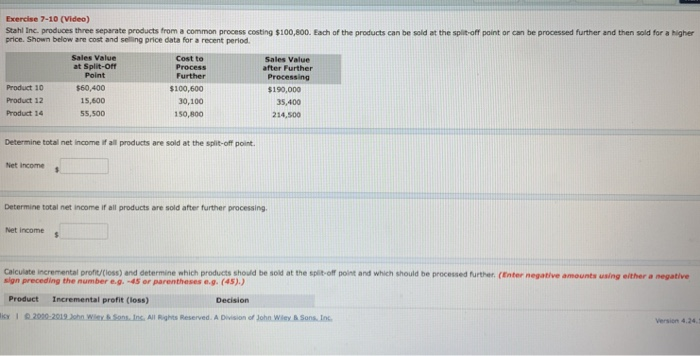

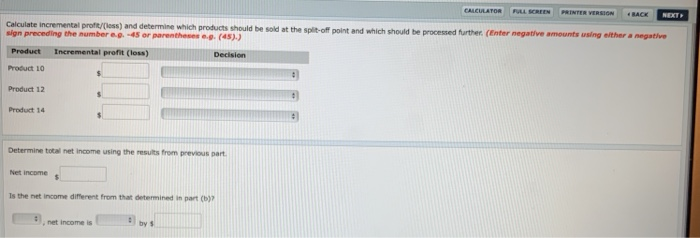

Exercise 7-10 (Video) Stahl Inc. produces three separate products from a common process costing $100,800. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period Sales Value at Split-off Point Cost to Process Further Sales Value after Further Product 10 Product 12 Product 14 $60,400 15,600 55,500 $100,600 30,100 $190,000 35,400 214,500 50,800 Determine total net income if all products are sold at the split-off point. Net incomes Determine total net income if all products are sold after further processing Net income s Calculate incremental prontu/ioss) and determine which products should be sold at the splt-off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Product Incremental profit (loss) Decision les i 2000-2011am ytrkfon.In& All Rights Reserved. A Division o, John wsey & Sons,unc. Version 4.24.1 ) and determine which products should be sold at t the split-off point and which should be processed further. (Enter negative amounts using either a negative Calculate sign preceding the number e.g. 45 or parentheses o.g. (45).) Product Incremental profit (loss) Product 10 Product 12 Product 14 Decisior Determine total net Income using the results from previous pant Is the net income different from thalt determined in part (b)7 net income is by $

Exercise 7-10 (Video) Stahl Inc. produces three separate products from a common process costing $100,800. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period Sales Value at Split-off Point Cost to Process Further Sales Value after Further Product 10 Product 12 Product 14 $60,400 15,600 55,500 $100,600 30,100 $190,000 35,400 214,500 50,800 Determine total net income if all products are sold at the split-off point. Net incomes Determine total net income if all products are sold after further processing Net income s Calculate incremental prontu/ioss) and determine which products should be sold at the splt-off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Product Incremental profit (loss) Decision les i 2000-2011am ytrkfon.In& All Rights Reserved. A Division o, John wsey & Sons,unc. Version 4.24.1 ) and determine which products should be sold at t the split-off point and which should be processed further. (Enter negative amounts using either a negative Calculate sign preceding the number e.g. 45 or parentheses o.g. (45).) Product Incremental profit (loss) Product 10 Product 12 Product 14 Decisior Determine total net Income using the results from previous pant Is the net income different from thalt determined in part (b)7 net income is by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started