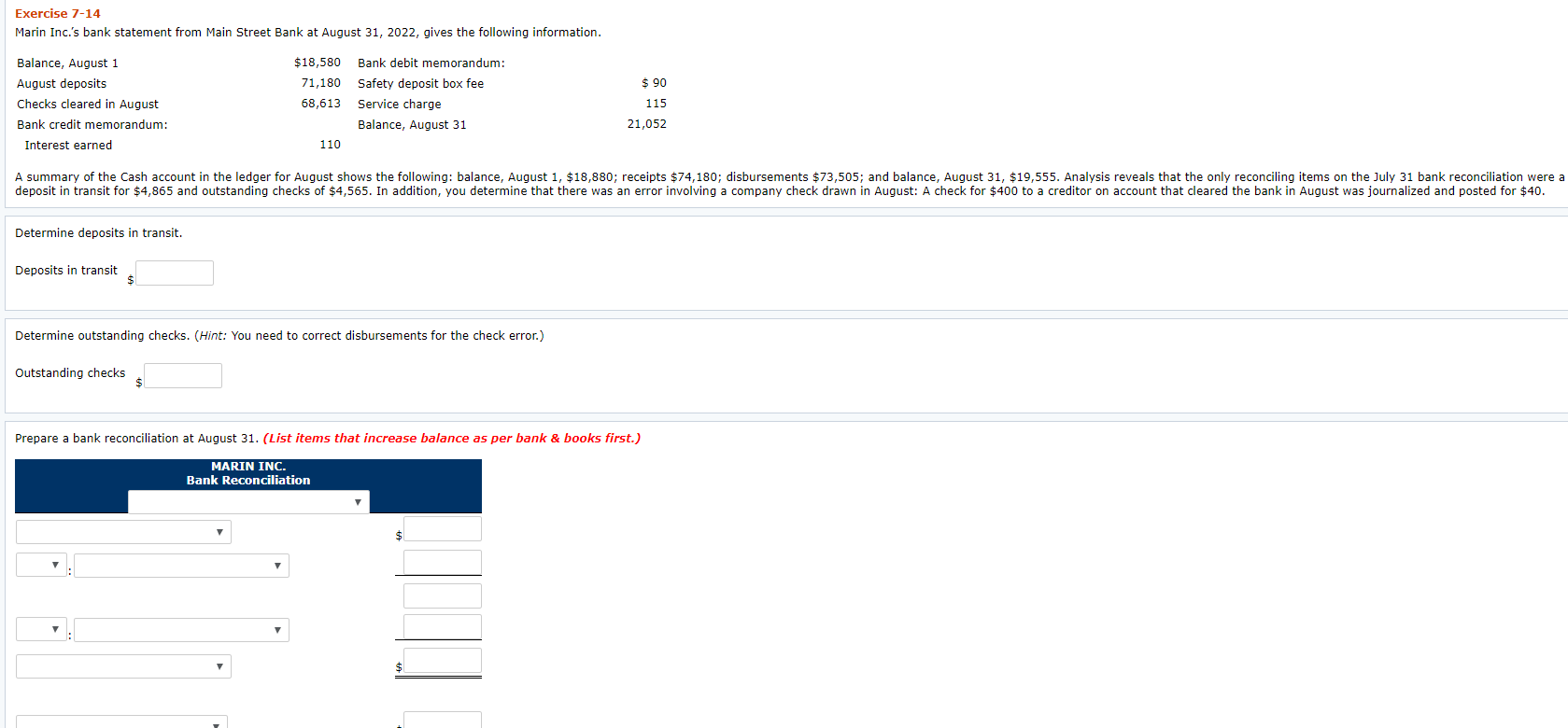

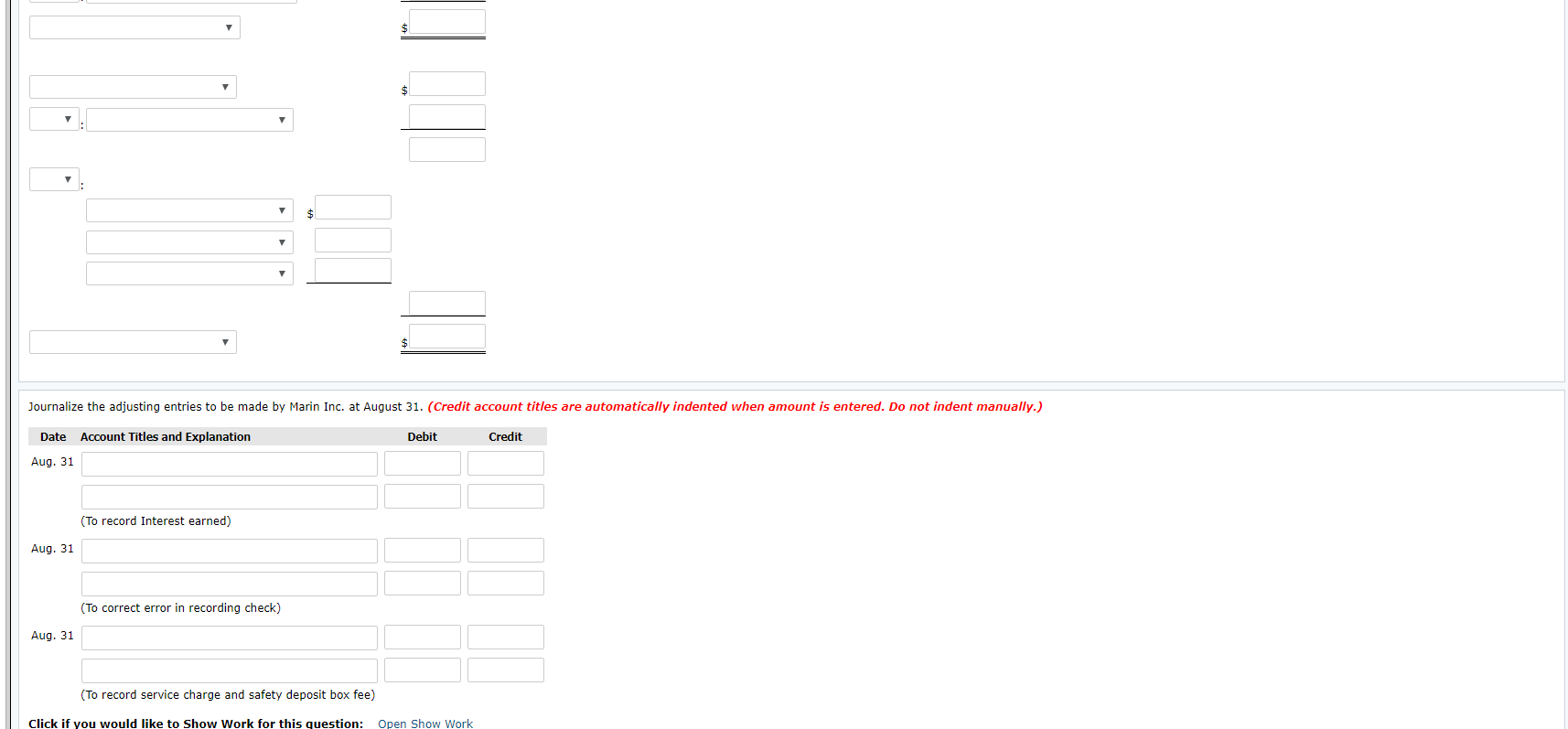

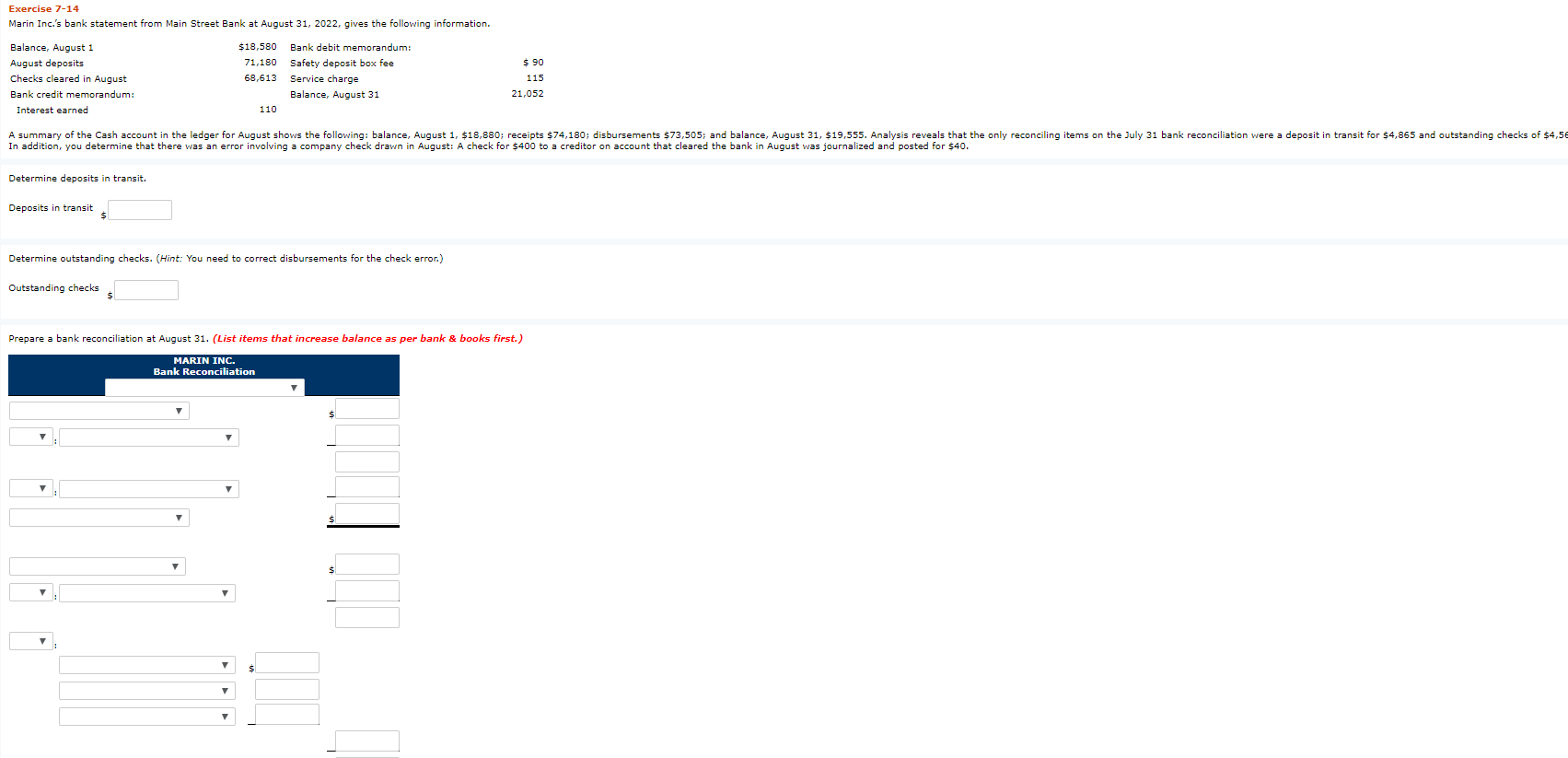

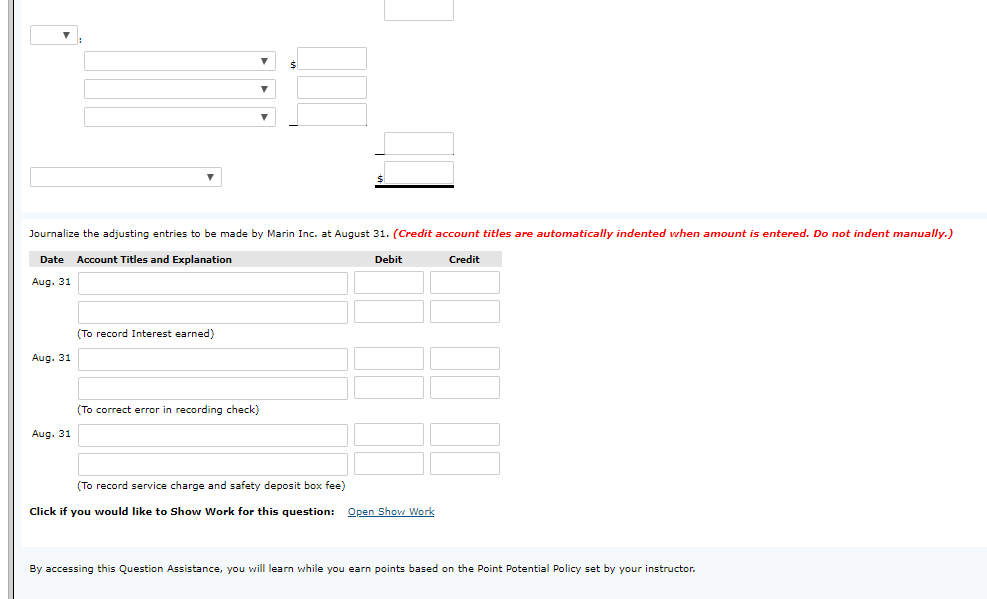

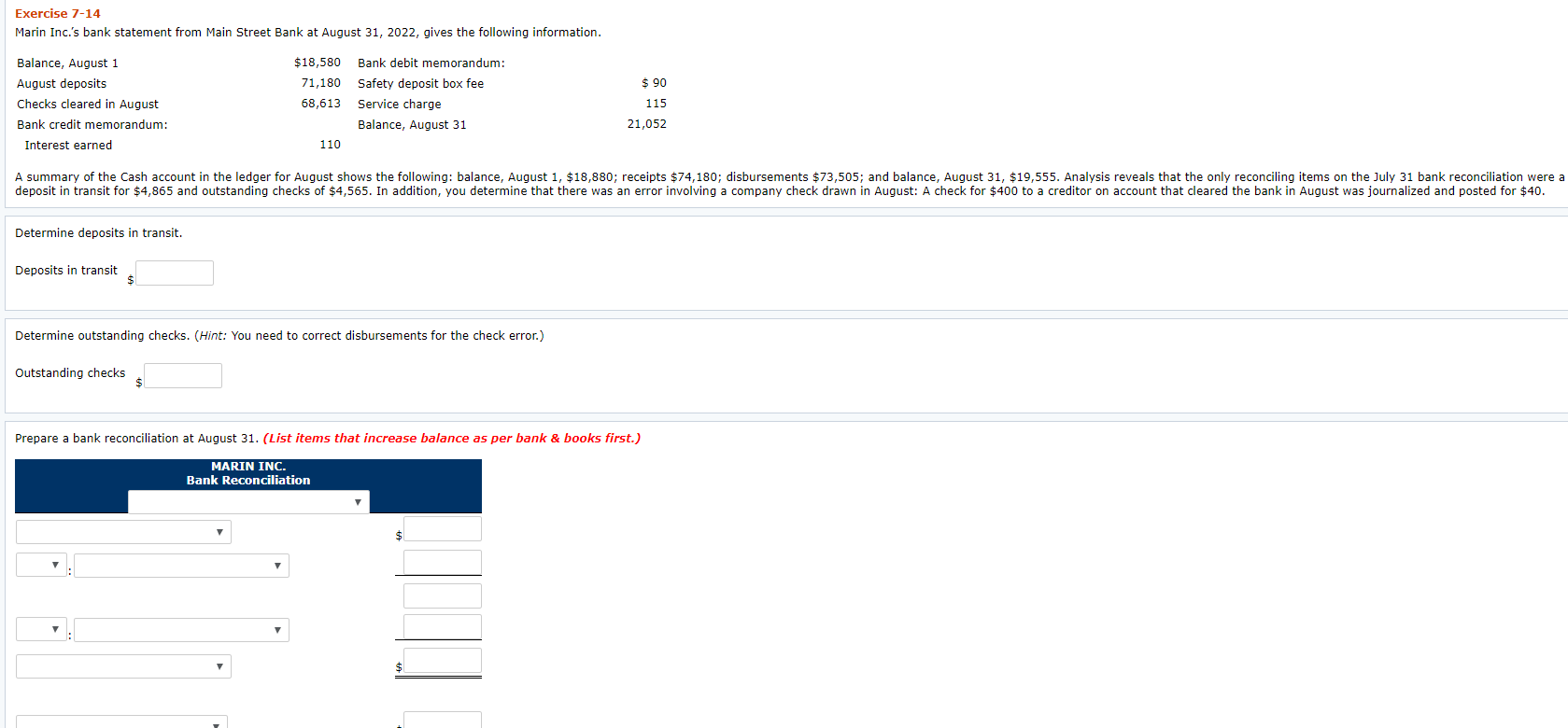

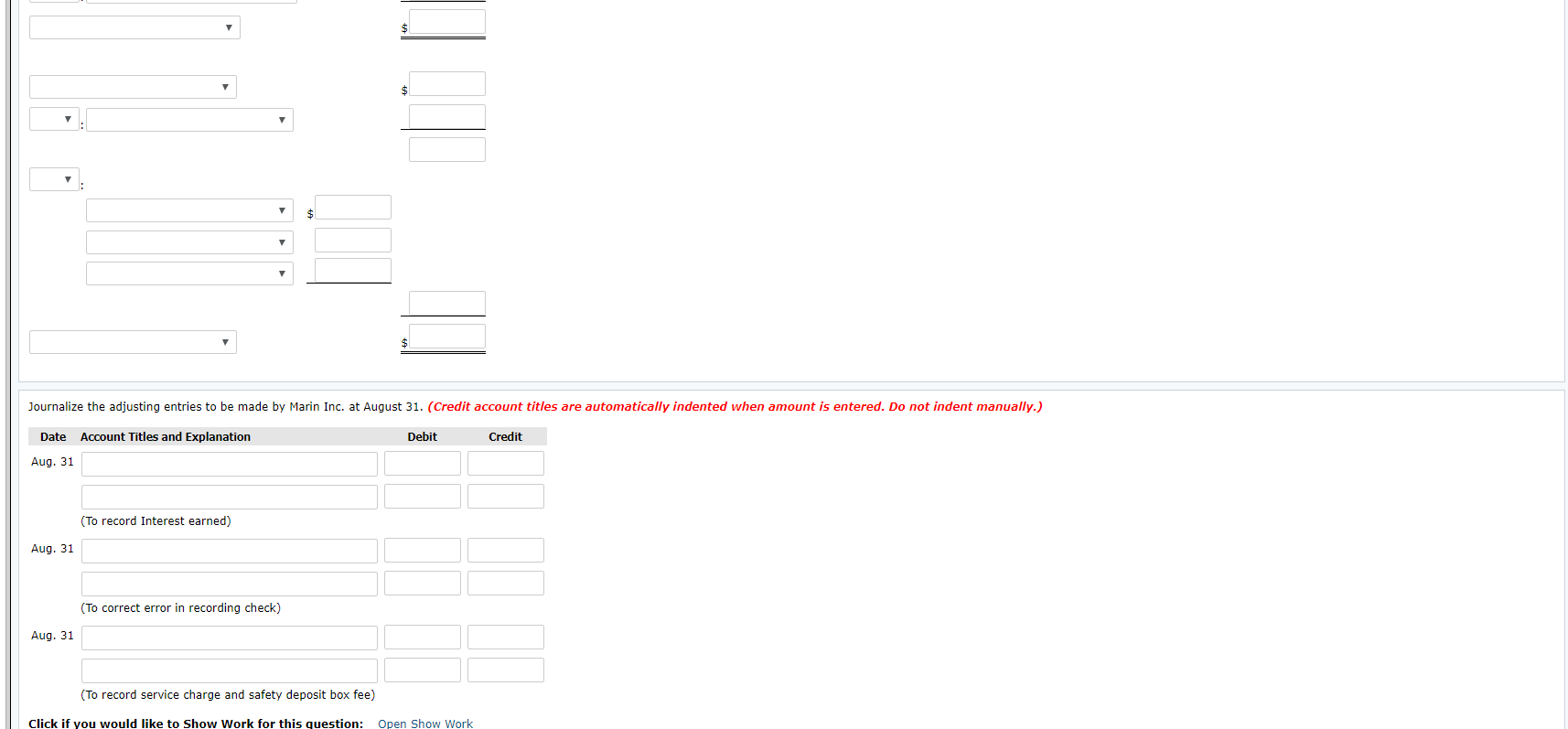

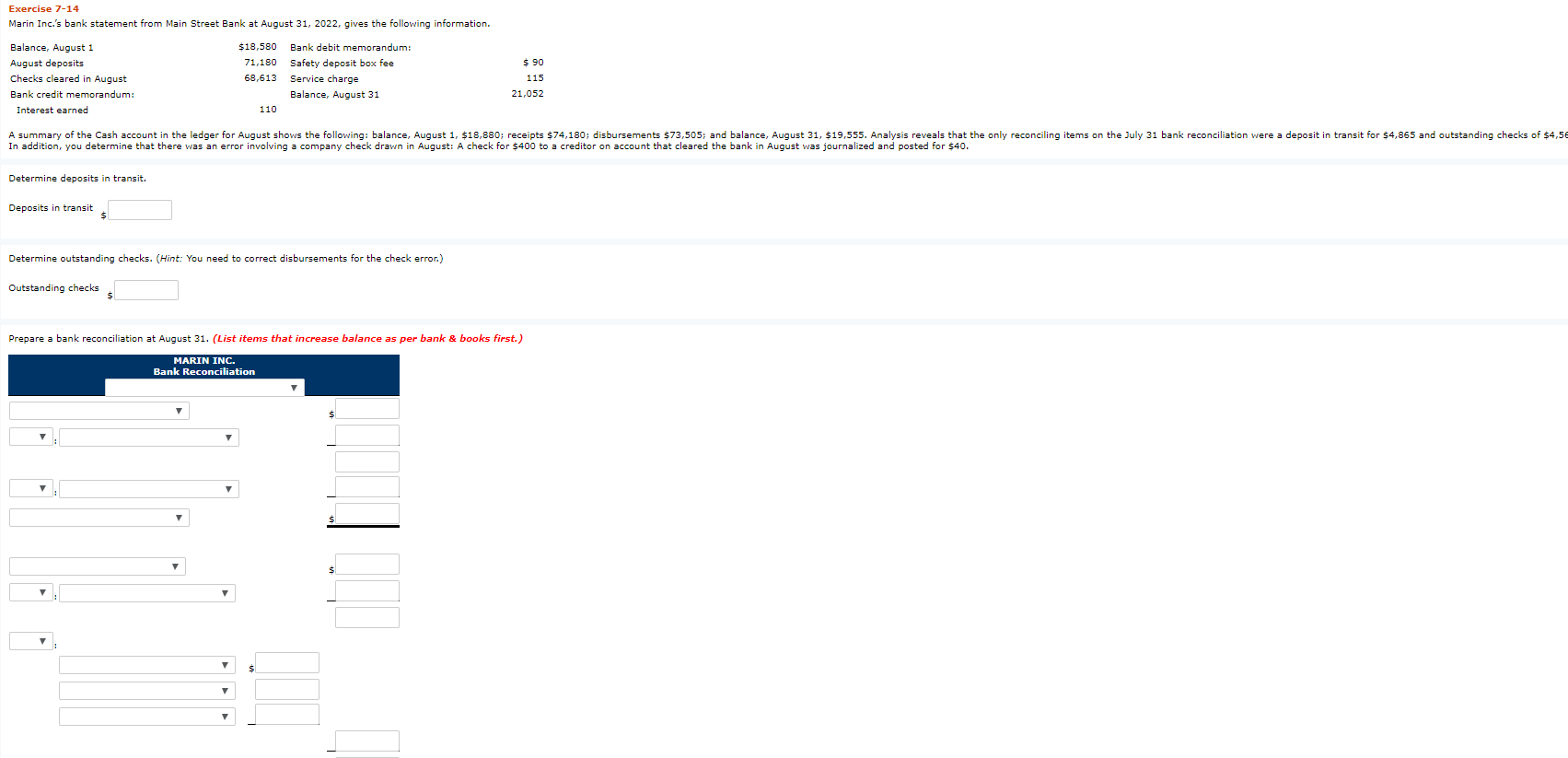

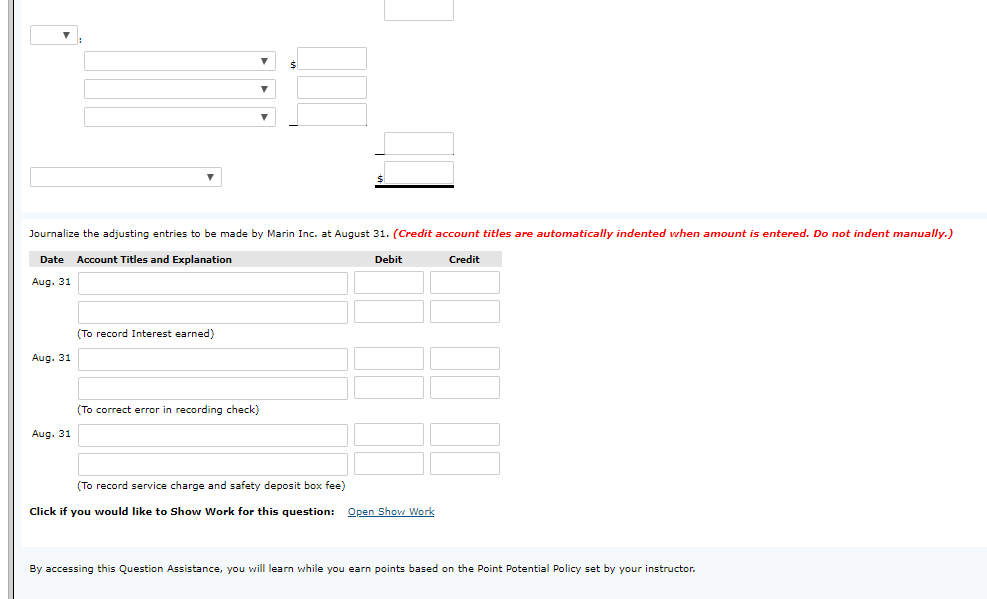

Exercise 7-14 Marin Inc.'s bank statement from Main Street Bank at August 31, 2022, gives the following information. Balance, August 1 August deposits Checks cleared in August Bank credit memorandum: Interest earned $18,580 Bank debit memorandum: 71,180 Safety deposit box fee 68,613 Service charge Balance, August 31 110 $ 90 115 21,052 A summary of the Cash account in the ledger for August shows the following: balance, August 1, $18,880; receipts $74,180; disbursements $73,505; and balance, August 31, $19,555. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $4,865 and outstanding checks of $4,565. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40. Determine deposits in transit. Deposits in transit Determine outstanding checks. (Hint: You need to correct disbursements for the check error.) Outstanding checks Prepare a bank reconciliation at August 31. (List items that increase balance as per bank & books first.) MARIN INC. Bank Reconciliation Journalize the adjusting entries to be made by Marin Inc. at August 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Aug. 31 (To record Interest earned) Aug. 31 (To correct error in recording check) Aug. 31 (To record service charge and safety deposit box fee) Click if you would like to Show Work for this question: Open Show Work Exercise 7-14 Marin Inc.'s bank statement from Main Street Bank at August 31, 2022, gives the following information. Balance, August 1 August deposits Checks cleared in August Bank credit memorandum: Interest earned $18,580 71,180 68,613 Bank debit memorandum: Safety deposit box fee Service charge Balance, August 31 $ 90 115 21,052 A summary of the Cash account in the ledger for August shows the following: balance, August 1, $18,880; receipts $74,180; disbursements 573,505; and balance, August 31, $19,555. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $4,865 and outstanding checks of $4,5 In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40. Determine deposits in transit. Deposits in transit Determine outstanding checks. (Hint: You need to correct disbursements for the check error.) Outstanding checks Prepare a bank reconciliation at August 31. (List items that increase balance as per bank & books first.) MARIN INC. Bank Reconciliation Journalize the adjusting entries to be made by Marin Inc. at August 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Aug. 31 (To record Interest earned) Aug. 31 (To correct error in recording check) Aug. 31 (To record service charge and safety deposit box fee) Click if you would like to Show Work for this question: Qren Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor