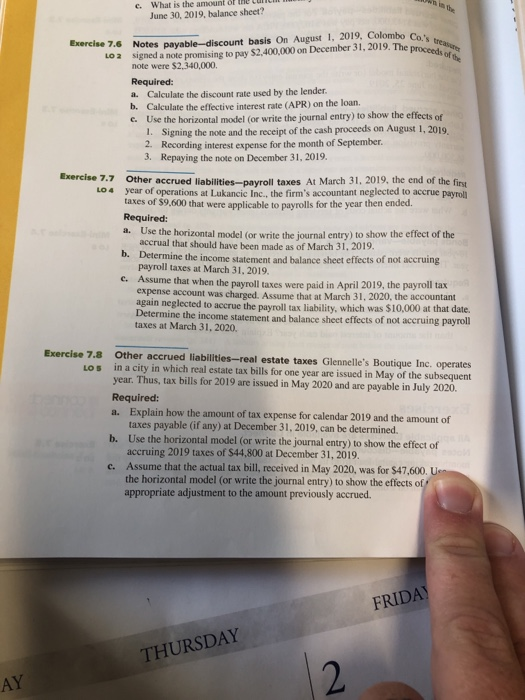

Exercise 7.6 Notes payable-discount basis On August 1, 2019, Colombo Co.'s true LO2 signed a note promising to pay $2,400,000 on December 31, 2019. The proceeds of the c. What is the amount of June 30, 2019, balance sheet? LO4 note were $2.340,000 Required: a. Calculate the discount rate used by the lender. b. Calculate the effective interest rate (APR) on the loan c. Use the horizontal model (or write the journal entry) to show the effects of 1. Signing the note and the receipt of the cash proceeds on August 1, 2019, 2. Recording interest expense for the month of September 3. Repaying the note on December 31, 2019. Exercise 7.7 Other accrued liabilities-payroll taxes At March 31, 2019, the end of the first year of operations at Lukancic Inc., the firm's accountant neglected to accrue payroll taxes of $9,600 that were applicable to payrolls for the year then ended. Required: a. Use the horizontal model (or write the journal entry) to show the effect of the accrual that should have been made as of March 31, 2019. b. Determine the income statement and balance sheet effects of not accruing payroll taxes at March 31, 2019 c. Assume that when the payroll taxes were paid in April 2019, the payroll tax expense account was charged. Assume that at March 31, 2020, the accountant again neglected to accrue the payroll tax liability, which was $10,000 at that date. Determine the income statement and balance sheet effects of not aceruing payroll taxes at March 31, 2020. Exercise 7.8 LOS Other accrued liabilities-real estate taxes Glennelle's Boutique Inc. operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2019 are issued in May 2020 and are payable in July 2020. Required: a. Explain how the amount of tax expense for calendar 2019 and the amount of taxes payable (if any) at December 31, 2019, can be determined. b. Use the horizontal model (or write the journal entry) to show the effect of accruing 2019 taxes of $44.800 at December 31, 2019. Assume that the actual tax bill, received in May 2020, was for $47,600. Uen the horizontal model (or write the journal entry) to show the effects of appropriate adjustment to the amount previously accrued. c. FRIDAY THURSDAY AY 2