Question

Exercise 7-7A Effect of recognizing uncollectible accounts on the financial statements: percent of receivables allowance method LO 7-2 Skip to question [The following information applies

Exercise 7-7A Effect of recognizing uncollectible accounts on the financial statements: percent of receivables allowance method LO 7-2

Skip to question

[The following information applies to the questions displayed below.] Leach Inc. experienced the following events for the first two years of its operations: Year 1:

- Issued $12,000 of common stock for cash.

- Provided $80,200 of services on account.

- Provided $38,000 of services and received cash.

- Collected $71,000 cash from accounts receivable.

- Paid $40,000 of salaries expense for the year.

- Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

- Closed the revenue account.

- Closed the expense account.

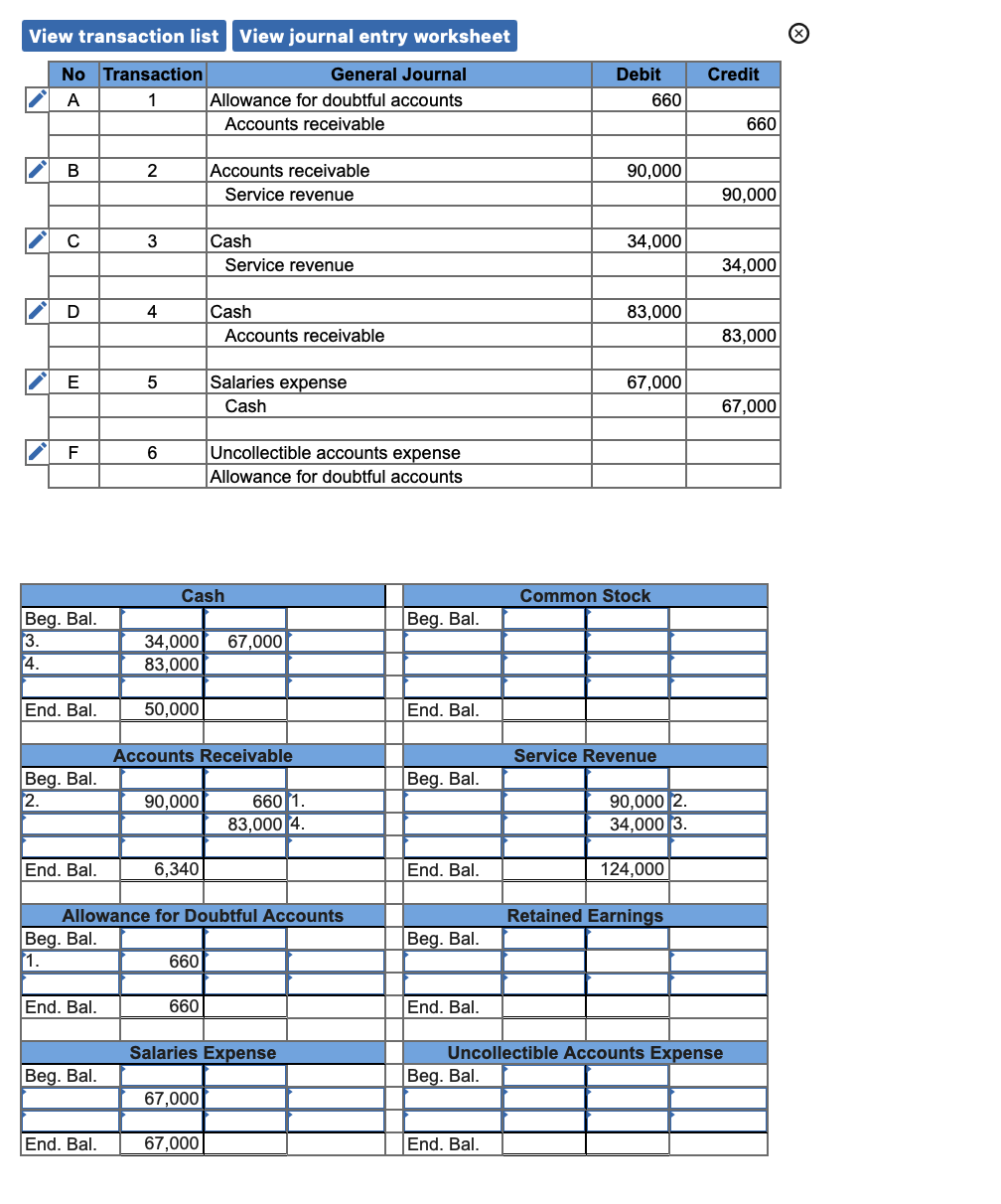

Year 2:

- Wrote off an uncollectible account for $660.

- Provided $90,000 of services on account.

- Provided $34,000 of services and collected cash.

- Collected $83,000 cash from accounts receivable.

- Paid $67,000 of salaries expense for the year.

- Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

Exercise 7-7A Part d

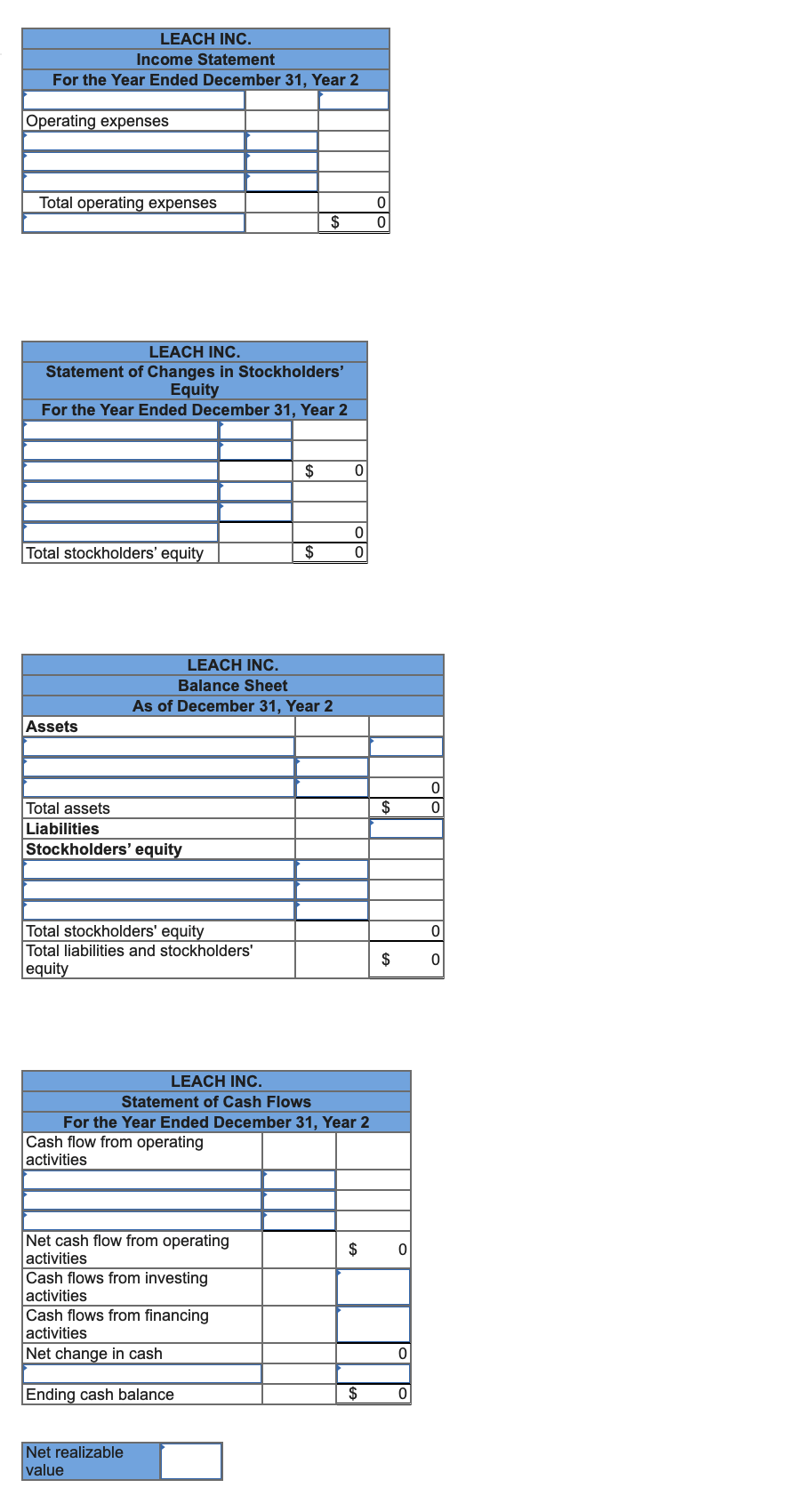

d. Repeat parts a, b, and c for Year 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Statement of Cash Flows and Balance Sheet only: Items to be deducted must be indicated with a minus sign. Round your answers to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started