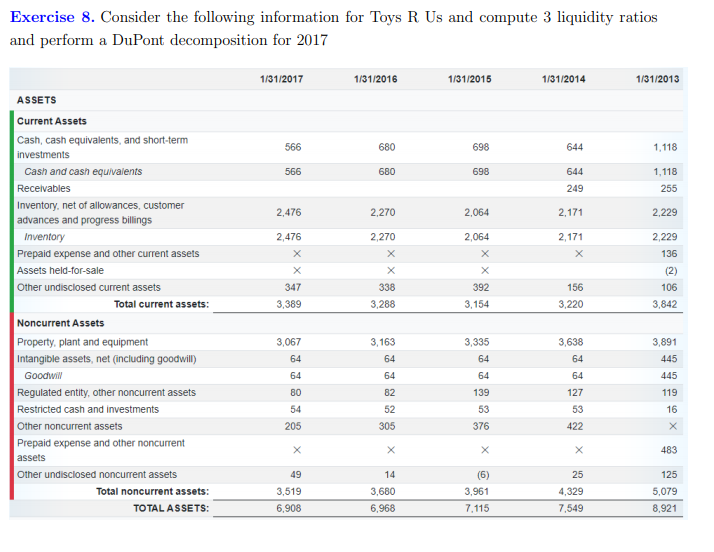

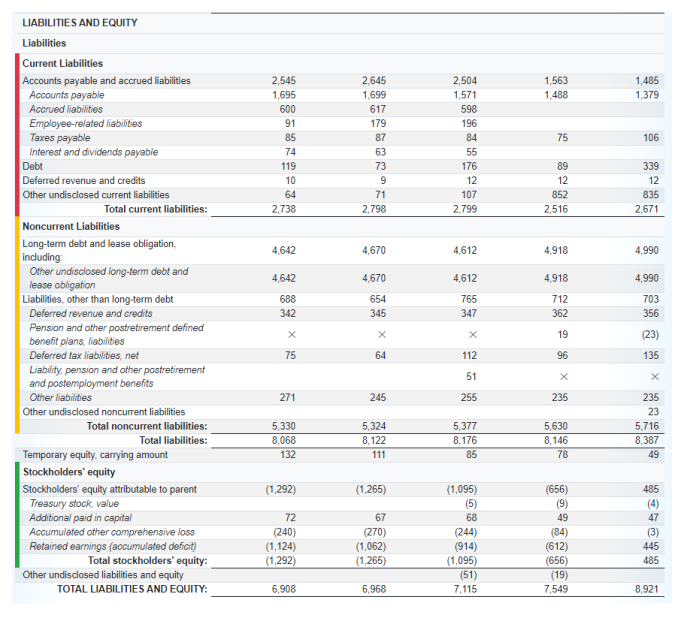

Exercise 8. Consider the following information for Toys R Us and compute 3 liquidity ratios and perform a DuPont decomposition for 2017 1/31/2017 1/31/2016 1/31/2015 1/31/2014 1/31/2013 566 680 698 644 1,118 566 680 698 644 1.118 255 249 2,476 2.270 2,064 2,171 2,229 2,476 2,270 2,064 2,171 2,229 136 (2) 106 338 156 ASSETS Current Assets Cash, cash equivalents, and short-term investments Cash and cash equivalents Receivables Inventory, net of allowances, customer advances and progress billings Inventory Prepaid expense and other current assets Assets heid-for-sale Other undisclosed current assets Total current assets: Noncurrent Assets Property, plant and equipment Intangible assets, net (including goodwill) Goodwill Regulated entity, other noncurrent assets Restricted cash and investments Other noncurrent assets Prepaid expense and other noncurrent assets Other undisclosed noncurrent assets Total noncurrent assets: TOTAL ASSETS: 347 3,389 392 3,154 3,288 3,220 3,842 3,067 64 3,163 64 3,638 64 3,891 445 3,335 64 64 139 64 64 64 445 82 119 80 54 205 127 53 52 16 53 376 305 422 X x 483 14 25 125 49 3,519 6.908 3,680 6.968 (6) 3,961 7.115 4,329 7,549 5,079 8,921 LIABILITIES AND EQUITY 1,563 1,488 1,485 1,379 75 106 2,545 1,695 600 91 85 74 119 10 64 2.738 2,645 1,699 617 179 87 63 73 9 71 2,798 2,504 1,571 598 196 84 55 176 12 107 2,799 89 12 852 2,516 339 12 835 2,671 4,642 4.670 4,612 4,918 4,990 4,642 4,670 4,612 4,918 4.990 Liabilities Current Liabilities Accounts payable and accrued liabilities Accounts payable Accrued liabilities Employee-related liabilities Taxes payable Interest and dividends payable Debt Deferred revenue and credits Other undisclosed current liabilities Total current liabilities: Noncurrent Liabilities Long-term debt and lease obligation, including: Other undisclosed long-term debt and lease obligation Liabilities, other than long-term debt Deferred revenue and credits Pension and other postretirement defined benefit plans, liabilities Deferred tax liabilities, net Liability, pension and other postretirement and postemployment benefits Other liabilities Other undisclosed noncurrent liabilities Total noncurrent liabilities: Total liabilities: Temporary equity, carrying amount Stockholders' equity Stockholders' equity attributable to parent Treasury stock value Additional paid in capital Accumulated other comprehensive loss Retained earnings (accumulated deficit) Total stockholders' equity: Other undisclosed liabilities and equity TOTAL LIABILITIES AND EQUITY: 688 342 654 345 765 347 712 362 703 356 19 (23) 75 64 112 96 135 51 X 271 245 255 235 5,330 8,068 132 5,324 8. 122 111 5,377 8,176 85 5,630 8,146 78 235 23 5,716 8,387 49 (1.292) (1,265) 72 (240) (1,124) (1,292) 67 (270) (1,062) (1,265) (1,095) (5) 68 (244) (914) (1,095) (51) 7,115 (656) (9) 49 (84) (612) 485 (4) 47 (3) 445 485 (656 (19) 7,549 6,908 6,968 8,921 Exercise 8. Consider the following information for Toys R Us and compute 3 liquidity ratios and perform a DuPont decomposition for 2017 1/31/2017 1/31/2016 1/31/2015 1/31/2014 1/31/2013 566 680 698 644 1,118 566 680 698 644 1.118 255 249 2,476 2.270 2,064 2,171 2,229 2,476 2,270 2,064 2,171 2,229 136 (2) 106 338 156 ASSETS Current Assets Cash, cash equivalents, and short-term investments Cash and cash equivalents Receivables Inventory, net of allowances, customer advances and progress billings Inventory Prepaid expense and other current assets Assets heid-for-sale Other undisclosed current assets Total current assets: Noncurrent Assets Property, plant and equipment Intangible assets, net (including goodwill) Goodwill Regulated entity, other noncurrent assets Restricted cash and investments Other noncurrent assets Prepaid expense and other noncurrent assets Other undisclosed noncurrent assets Total noncurrent assets: TOTAL ASSETS: 347 3,389 392 3,154 3,288 3,220 3,842 3,067 64 3,163 64 3,638 64 3,891 445 3,335 64 64 139 64 64 64 445 82 119 80 54 205 127 53 52 16 53 376 305 422 X x 483 14 25 125 49 3,519 6.908 3,680 6.968 (6) 3,961 7.115 4,329 7,549 5,079 8,921 LIABILITIES AND EQUITY 1,563 1,488 1,485 1,379 75 106 2,545 1,695 600 91 85 74 119 10 64 2.738 2,645 1,699 617 179 87 63 73 9 71 2,798 2,504 1,571 598 196 84 55 176 12 107 2,799 89 12 852 2,516 339 12 835 2,671 4,642 4.670 4,612 4,918 4,990 4,642 4,670 4,612 4,918 4.990 Liabilities Current Liabilities Accounts payable and accrued liabilities Accounts payable Accrued liabilities Employee-related liabilities Taxes payable Interest and dividends payable Debt Deferred revenue and credits Other undisclosed current liabilities Total current liabilities: Noncurrent Liabilities Long-term debt and lease obligation, including: Other undisclosed long-term debt and lease obligation Liabilities, other than long-term debt Deferred revenue and credits Pension and other postretirement defined benefit plans, liabilities Deferred tax liabilities, net Liability, pension and other postretirement and postemployment benefits Other liabilities Other undisclosed noncurrent liabilities Total noncurrent liabilities: Total liabilities: Temporary equity, carrying amount Stockholders' equity Stockholders' equity attributable to parent Treasury stock value Additional paid in capital Accumulated other comprehensive loss Retained earnings (accumulated deficit) Total stockholders' equity: Other undisclosed liabilities and equity TOTAL LIABILITIES AND EQUITY: 688 342 654 345 765 347 712 362 703 356 19 (23) 75 64 112 96 135 51 X 271 245 255 235 5,330 8,068 132 5,324 8. 122 111 5,377 8,176 85 5,630 8,146 78 235 23 5,716 8,387 49 (1.292) (1,265) 72 (240) (1,124) (1,292) 67 (270) (1,062) (1,265) (1,095) (5) 68 (244) (914) (1,095) (51) 7,115 (656) (9) 49 (84) (612) 485 (4) 47 (3) 445 485 (656 (19) 7,549 6,908 6,968 8,921