Answered step by step

Verified Expert Solution

Question

1 Approved Answer

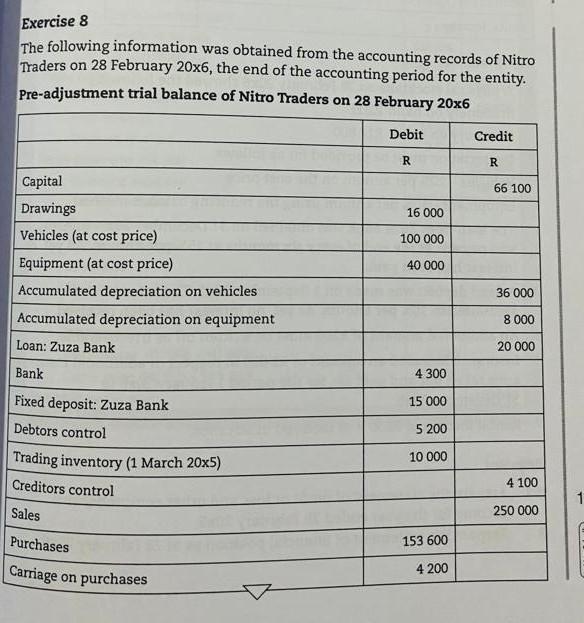

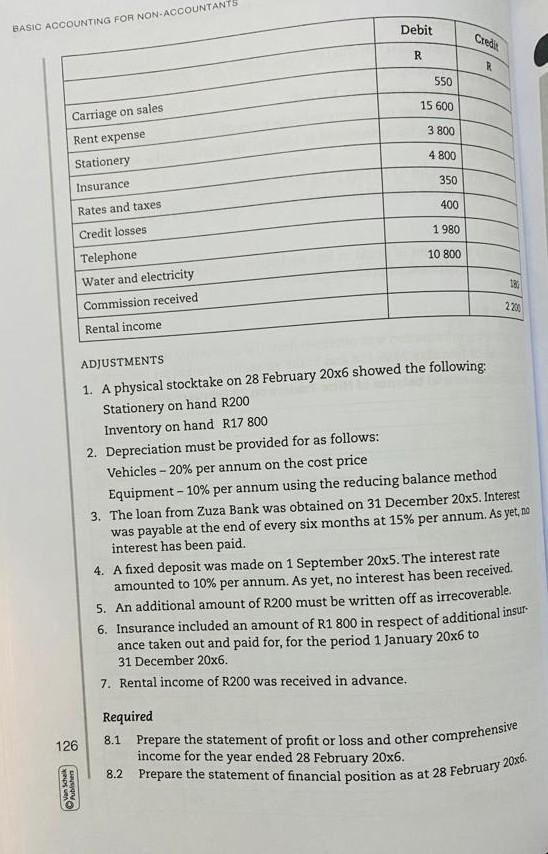

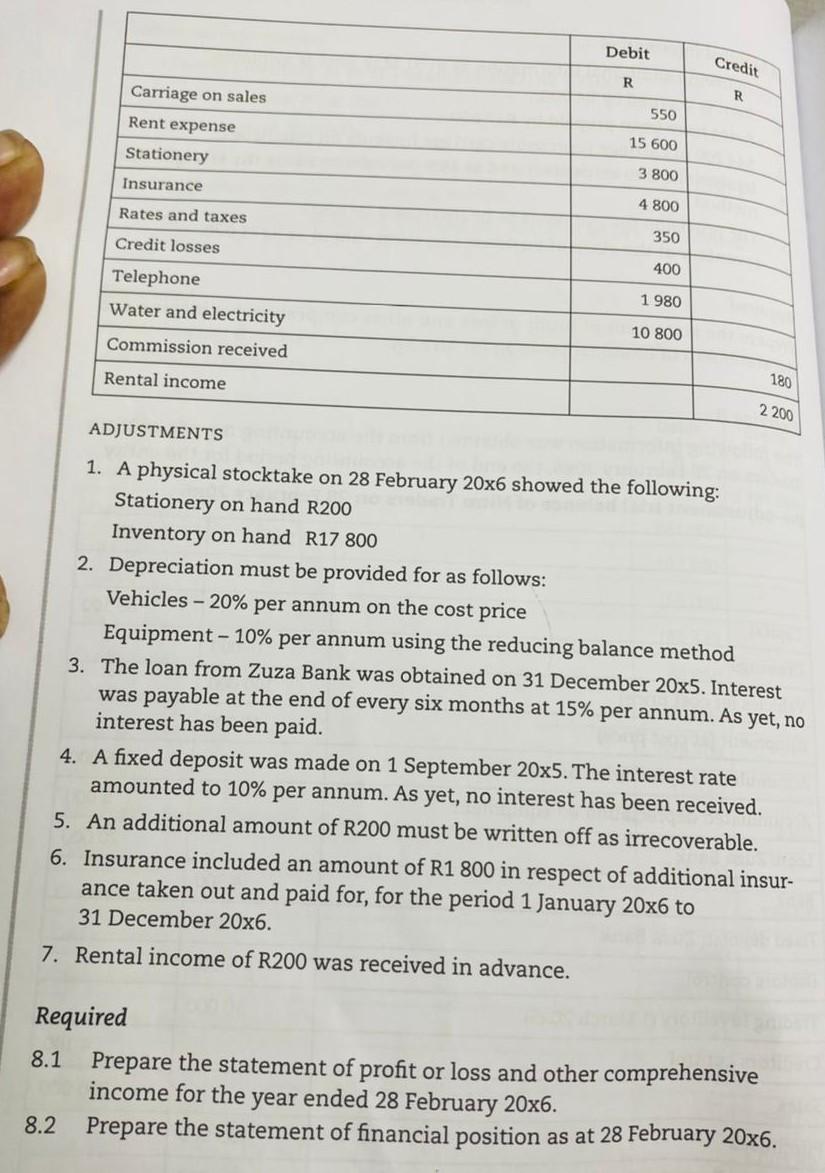

Exercise 8 The following information was obtained from the accounting records of Nitro Traders on 28 February 206, the end of the accounting period for

Exercise 8 The following information was obtained from the accounting records of Nitro Traders on 28 February 206, the end of the accounting period for the entity. Pre-adjustment trial balance of Nitrn ADJUSTMENTS 1. A physical stocktake on 28 February 206 showed the following: Stationery on hand R 200 Inventory on hand R17 800 2. Depreciation must be provided for as follows: Vehicles 20% per annum on the cost price Equipment 10% per annum using the reducing balance method 3. The loan from Zuza Bank was obtained on 31 December 205. Interest was payable at the end of every six months at 15% per annum. As yet, 10 interest has been paid. 4. A fixed deposit was made on 1 September 205. The interest rate amounted to 10% per annum. As yet, no interest has been received. 5. An additional amount of R 200 must be written off as irrecoverable. 6. Insurance included an amount of R1 800 in respect of additional insur. ance taken out and paid for, for the period 1 January 206 to 31 December 206. 7. Rental income of R200 was received in advance. Required 8.1 Prepare the statement of profit or loss and other comprehensive income for the year ended 28 February 206. 8.2 Prepare the statement of financial position as at 28 February 2086. 1. A physical stocktake on 28 February 206 showed the following: Stationery on hand R200 Inventory on hand R 17800 2. Depreciation must be provided for as follows: Vehicles - 20% per annum on the cost price Equipment - 10% per annum using the reducing balance method 3. The loan from Zuza Bank was obtained on 31 December 205. Interest was payable at the end of every six months at 15% per annum. As yet, no interest has been paid. 4. A fixed deposit was made on 1 September 205. The interest rate amounted to 10% per annum. As yet, no interest has been received. 5. An additional amount of R200 must be written off as irrecoverable. 6. Insurance included an amount of R1800 in respect of additional insurance taken out and paid for, for the period 1 January 206 to 31 December 206. 7. Rental income of R200 was received in advance. Required 8.1 Prepare the statement of profit or loss and other comprehensive income for the year ended 28 February 206. 8.2 Prepare the statement of financial position as at 28 February 206

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started