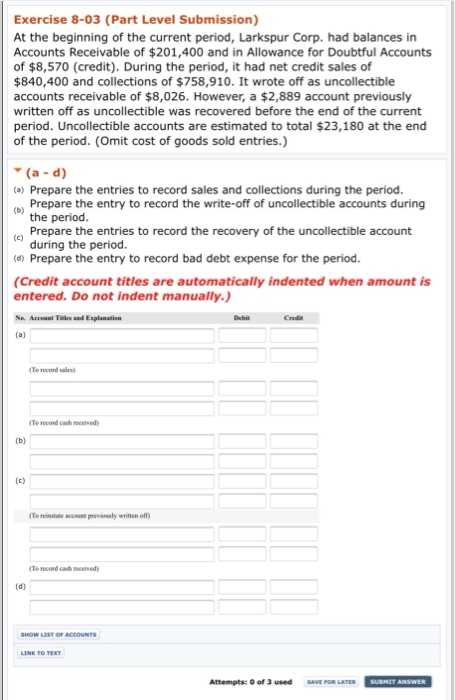

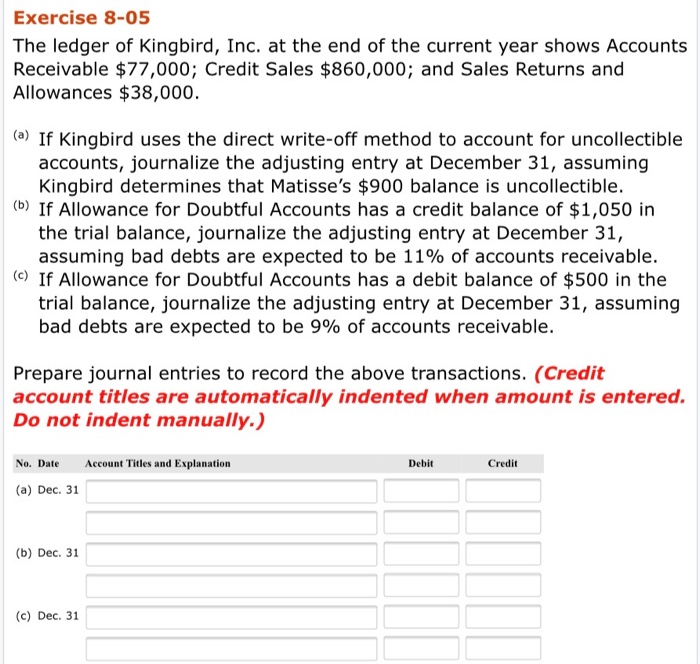

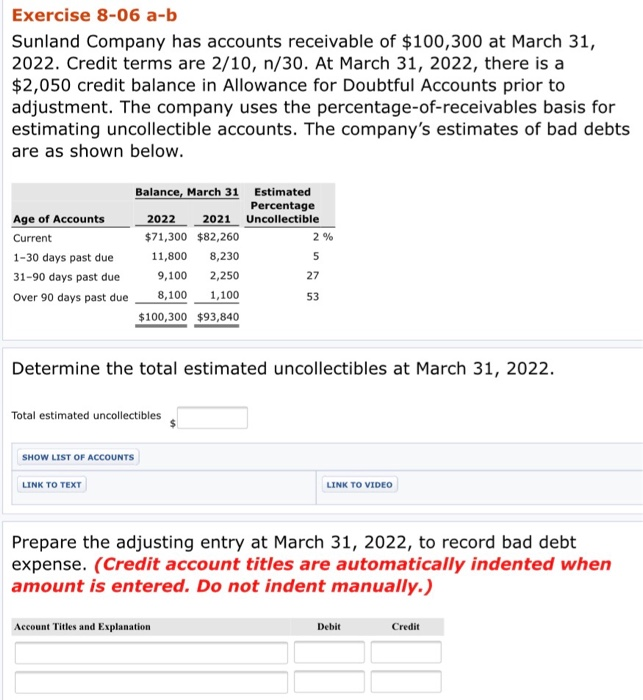

Exercise 8-03 (Part Level Submission) At the beginning of the current period, Larkspur Corp. had balances in Accounts Receivable of $201,400 and in Allowance for Doubtful Accounts of $8,570 (credit). During the period, it had net credit sales of $840,400 and collections of $758,910. It wrote off as uncollectible accounts receivable of $8,026. However, a $2,889 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $23,180 at the end of the period. (Omit cost of goods sold entries.) (a-d) (a) Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. (d) Prepare the entry to record bad debt expense for the period. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) A Ne. d Explanati Dublu (a) (Te records Tech Tow n of Attempts of used SAVERTER SUBMIT ANSWER Exercise 8-05 The ledger of Kingbird, Inc. at the end of the current year shows Accounts Receivable $77,000; Credit Sales $860,000; and Sales Returns and Allowances $38,000. (a) If Kingbird uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Kingbird determines that Matisse's $900 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $1,050 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. () If Allowance for Doubtful Accounts has a debit balance of $500 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit No. Date (a) Dec. 31 (b) Dec. 31 (c) Dec. 31 Exercise 8-06 a-b Sunland Company has accounts receivable of $100,300 at March 31, 2022. Credit terms are 2/10, n/30. At March 31, 2022, there is a $2,050 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Balance, March 31 Estimated Percentage Age of Accounts 2022 2021 Uncollectible Current $71,300 $82,260 2 % 1-30 days past due 11,800 8,230 31-90 days past due 9,100 2,250 Over 90 days past due 8,100 1,100 $100,300 $93,840 Determine the total estimated uncollectibles at March 31, 2022. Total estimated uncollectibles SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Prepare the adjusting entry at March 31, 2022, to record bad debt expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit