Answered step by step

Verified Expert Solution

Question

1 Approved Answer

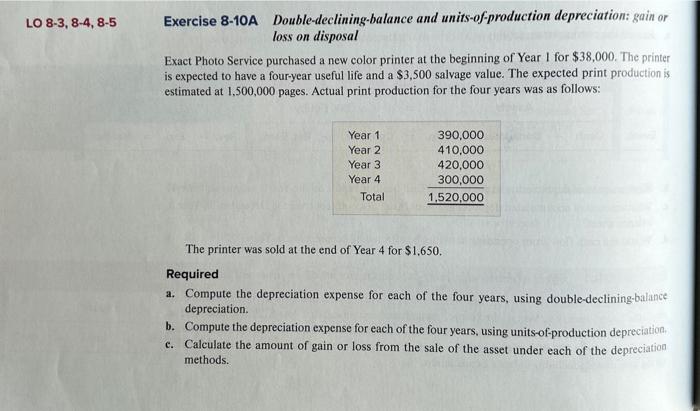

EXERCISE 8-10A Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of

EXERCISE 8-10A

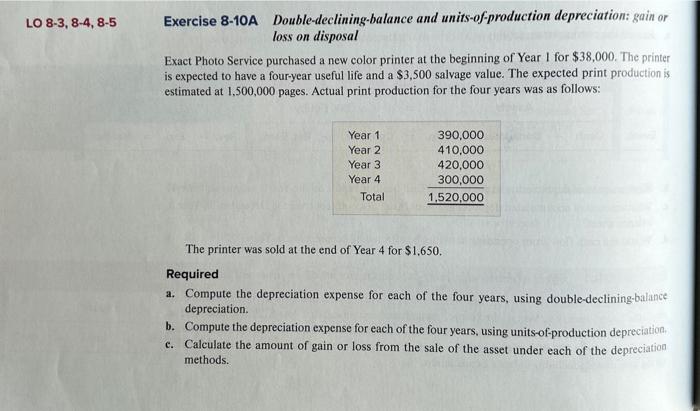

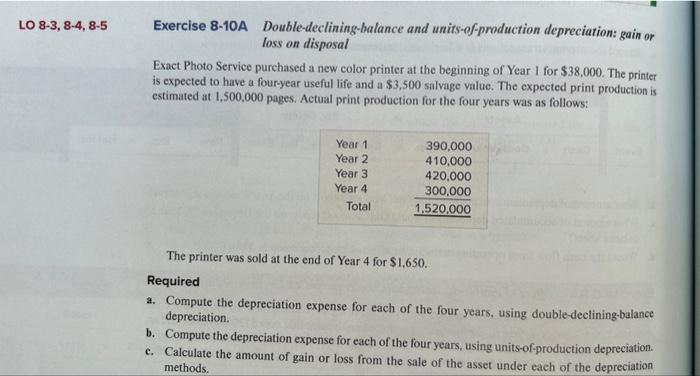

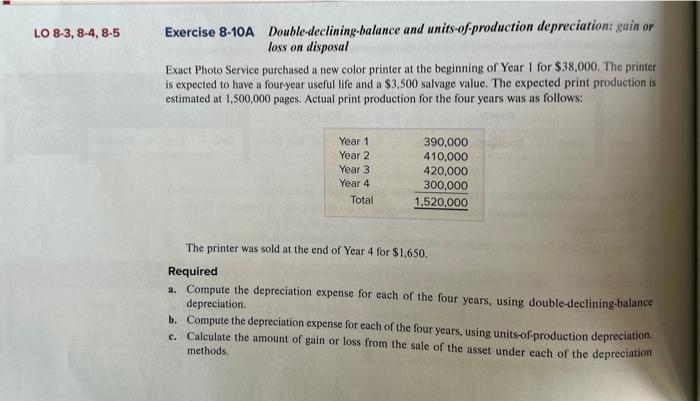

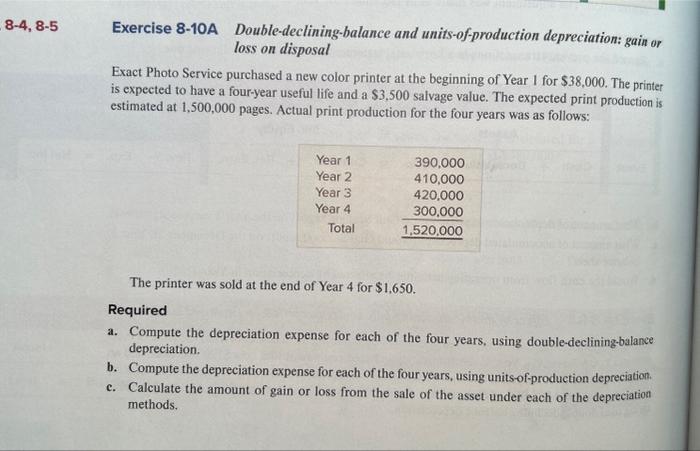

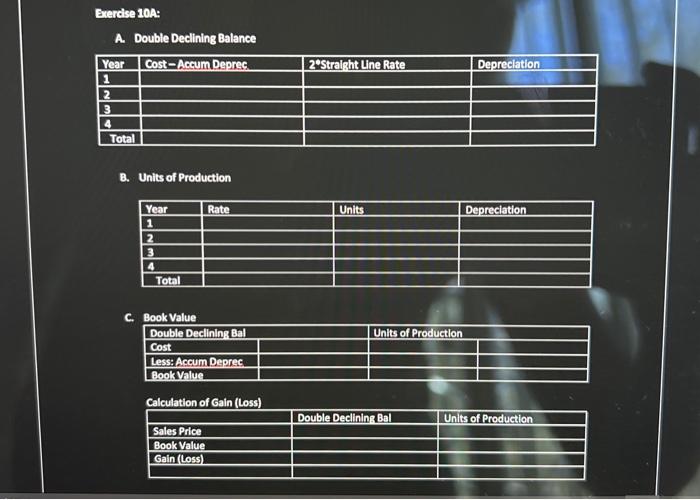

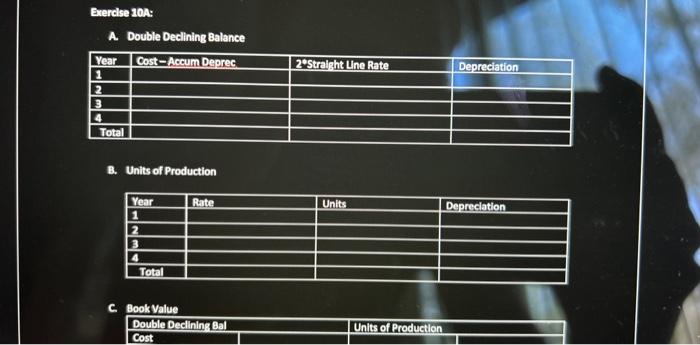

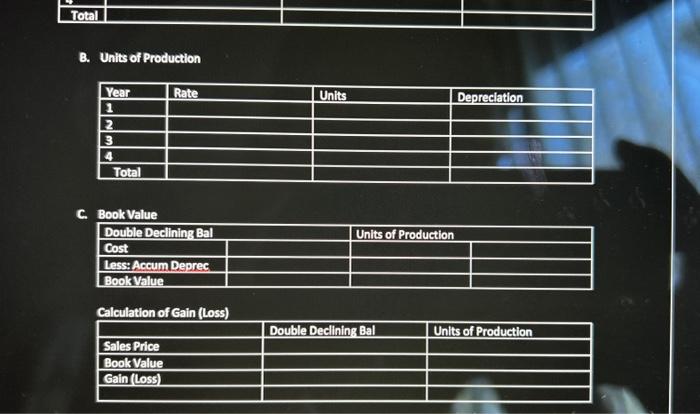

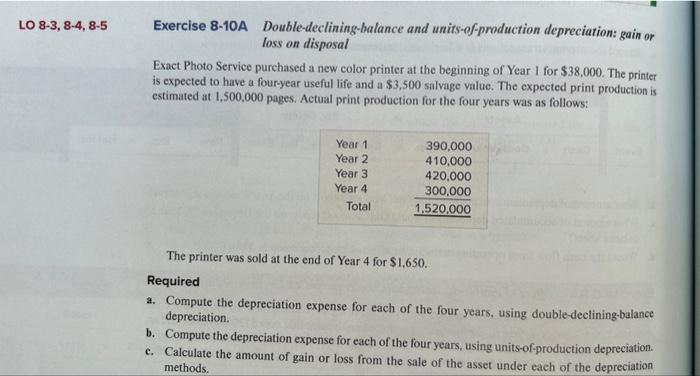

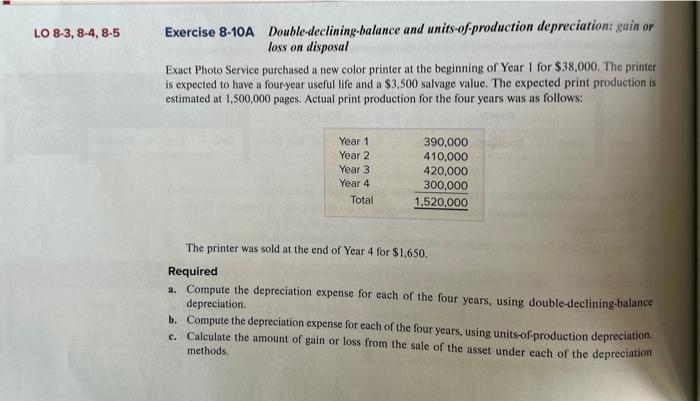

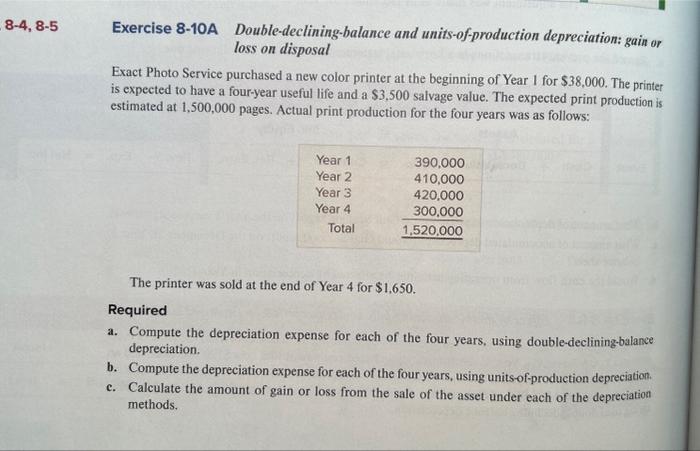

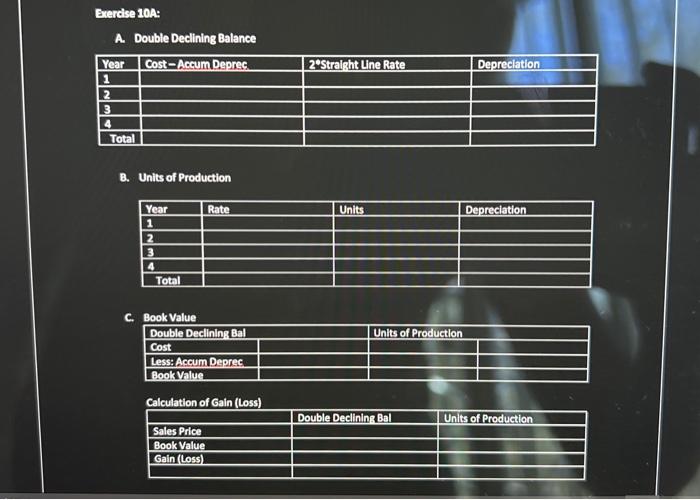

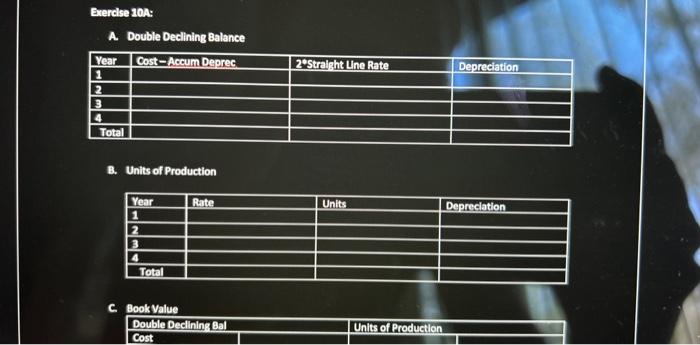

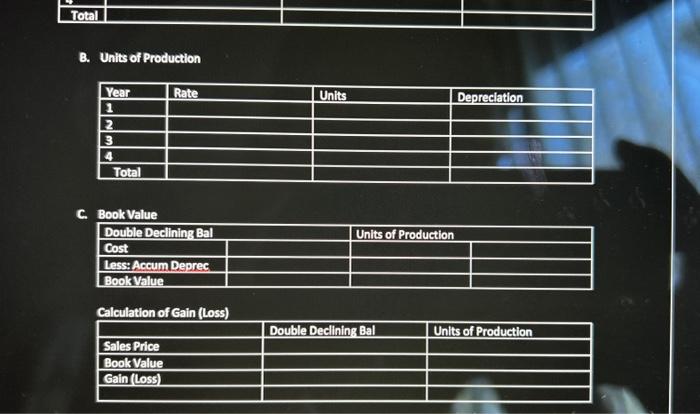

Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation, c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year I for $38,000. The printer is expected to have a fouryear useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650, Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Exercise 10A: A. Double Decilining Balance \begin{tabular}{|l|l|l|l|} \hline Year & Cost-Aceum Deprec. & 2estralaht Une Rate & Depreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline Total & & & \\ \hline \end{tabular} B. Units of Production \begin{tabular}{|l|l|l|l|} \hline Year & Rate & Units & Depreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline Total & & & \\ \hline \end{tabular} c. Book Value \begin{tabular}{|l|l|l|l|} \hline Double Decllning Bal & & Units of Production \\ \hline Cost & & & \\ \hline Less:Accum Deprec & & & \\ \hline BookValue & & & \\ \hline \end{tabular} Calculation of Gain (Loss) \begin{tabular}{|l|l|l|} \hline & Double Declining Bal & Units of Production \\ \hline Sales Price & & \\ \hline Book Value & & \\ \hline Gain(Loss) & & \\ \hline & & \\ \hline \end{tabular} Exerclse 10A: A. Double Declining Balance \begin{tabular}{|l|l|l|l|} \hline Year & Cost-Accum Deprec & 2e+5 Stralsht Une Rate & Depreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline Total & & & \\ \hline \end{tabular} B. Units of Production \begin{tabular}{|l|l|l|l|} \hline Year & Rate & Units & \\ \hline 1 & & & Depreclation \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline Total & & & \\ \hline \end{tabular} C. Book Value \begin{tabular}{|l|l|l|} \hline Double Decining Bal & Units of Production \\ \hline Cost & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started