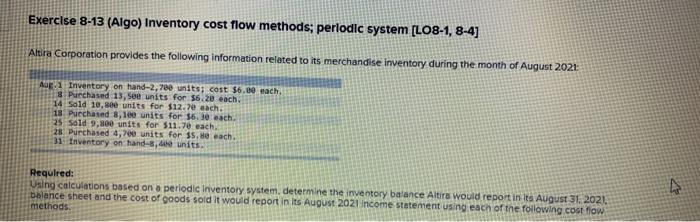

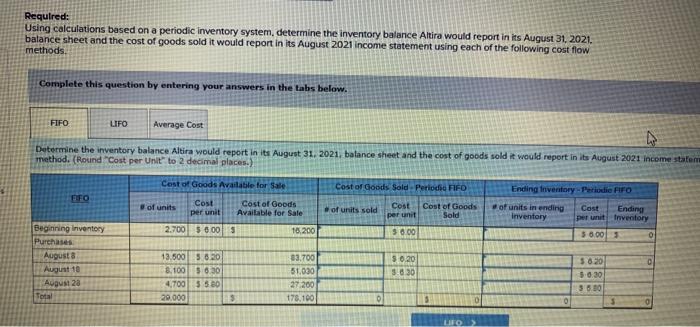

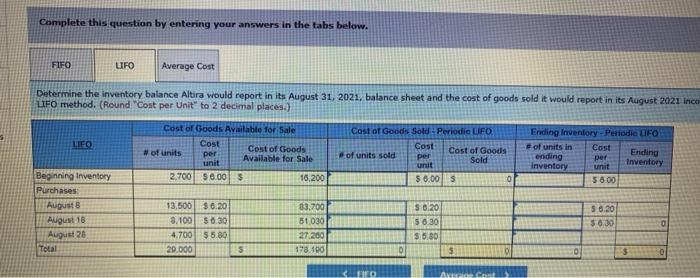

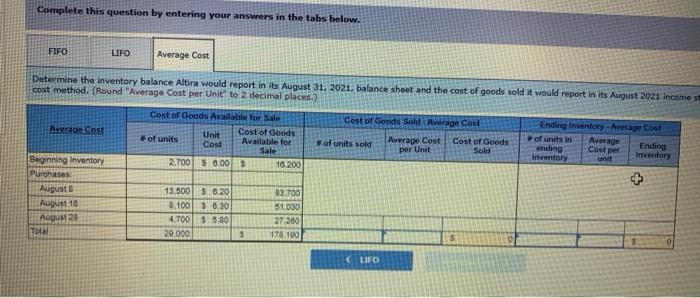

Exercise 8-13 (Algo) Inventory cost flow methods; periodic system [LO8-1, 8-4] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021 Aug. 1 Inventory on hand-2,780 units; cost $6.00 each 8 Purchased 13, See units for $6.20 each 14 Sold 10,00 units for $12.70 each. 18 Purchased 8,100 units for $6.30 sach. 25 Sold 9,800 units for $11.70 each 28 Purchased 4,700 units for 35. He wach. 31 Inventory on hand-8,60 units. Required: Using calculations based on a periodic Inventory system, determine the inventory balance Altra would report in its August 31, 2021. balance sheet and the cost of goods sold it would report in its August 2021 Income statement using each of the following cost flow methods. Required: Using calculations based on a periodic inventory system, determine the inventory balance Altira would report in its August 31, 2021. balance sheet and the cost of goods sold it would report in its August 2021 income statement using each of the following cost flow methods. Complete this question by entering your answers in the tabs below. FIFO LIFO Average Cost Determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statem method. (Round Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Cost of Goods Sold Periode FIFO Ending Inventory Periode FIFO DFO of units Cost per unit Cost of Goods Available for Sale of units sold Cost per unit Cost of Goods Sold of units in ending Inventory Cost Ending per unit triventory 5 6.00 3 0 2.700 5 600 5 18,200 38.00 Beginning inventory Purchases August August 18 August 28 Total $ 0.20 5.630 13.500 3.820 8.100 8.30 4.700 3 500 20.000 23.700 51.030 27 200 178.100 3620 5-6.30 3 5.30 LILO Complete this question by entering your answers in the tabs below. FIFO URO Average Cost Determine the inventory balance Altira would report in its August 31, 2021. balance sheet and the cost of goods sold it would report in its August 2021 Inco LIFO method. (Round "Cost per Unit" to 2 decimal places) LEO Cost of Goods Available for sale Cost # of units Cost of Goods per unit Available for Sale 2.700 $0.00 $ 16,200 Cost of Goods Sold - Periodic UFO. Cost of units sold per Cost of Goods unit Sold $ 0.00 0 Ending Inventory - Periodie UFO of units in Cost ending Ending per Inventory Inventory unit 58.00 Beginning inventory Purchases August August 18 August 26 Total 13,500 $ 0.20 3.100 50.30 4.700 55.80 20.000 5 0.20 $8.30 83.700 51030 27 200 193.100 $ 0.20 50.30 5.6.30 5 3 0 D 5 ol BED Avec Complete this question by entering your answers in the tabs below. FIFO LIFO Average Cost Determine the inventory balance Altira would report in its August 31, 2021. balance sheet and the cost of goods sold it would report in its August 2021 incomes cost method. (Round "Average Cost per Unit" to 2 decimal places.) Averatrost Cost of Goods Available for sale Unit of units Cost of Goods Cost Available for Sale 2.700 50.00 5 10.200 Cost of Goods Sold Average Cont Wof units sold Average Cost Cost of Goods per Unit Sold Ending Inventory-Avtage Cost d of units in ending Cost per Ending Inventory unit Inventory Average Beginning Inventory Purchases August August 18 Augu TOIM 13.500 3.6.20 8.100 5 0,30 4.700 95.00 20,000 83.700 51.030 27.260 178.100 3 (LFO