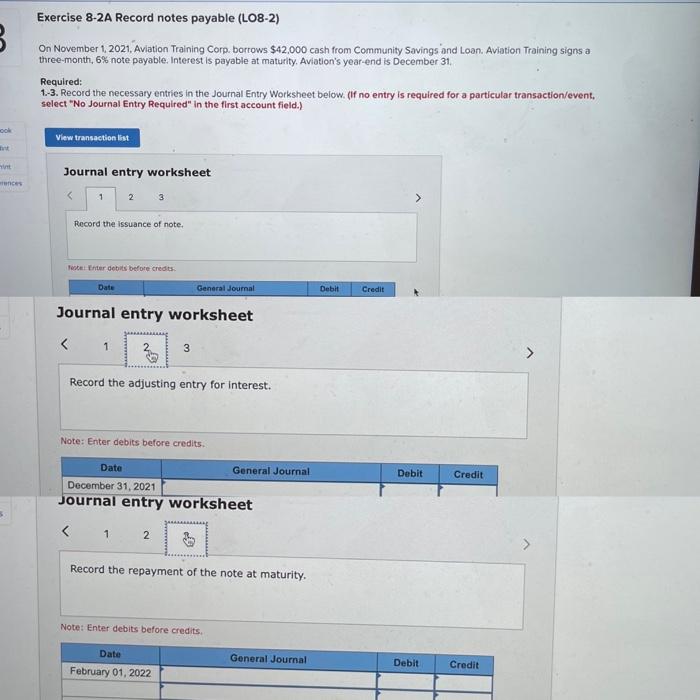

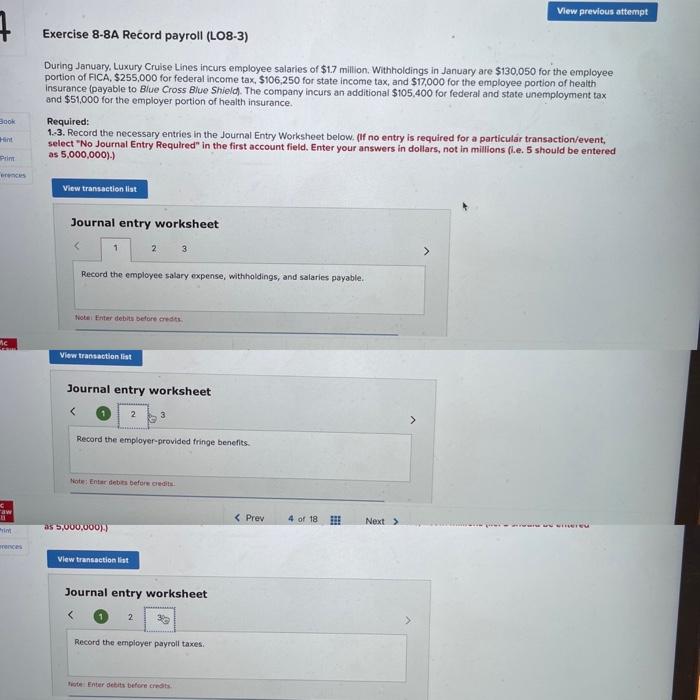

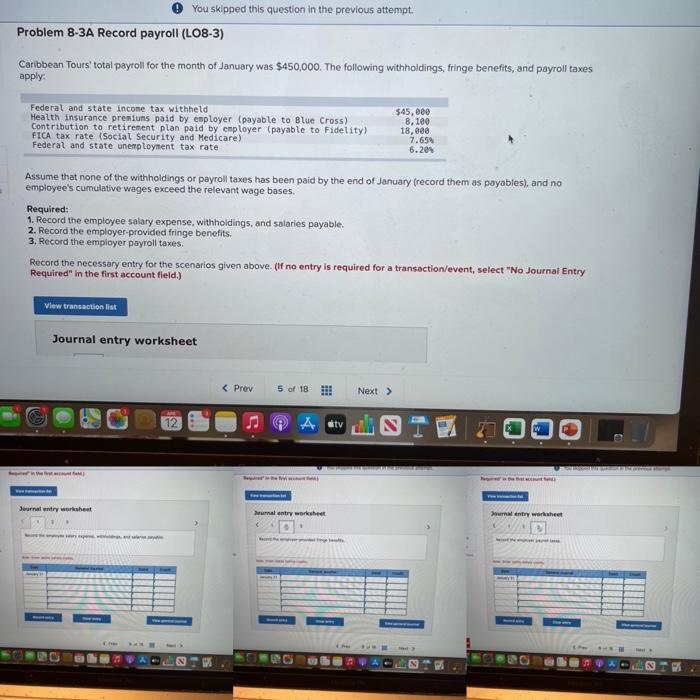

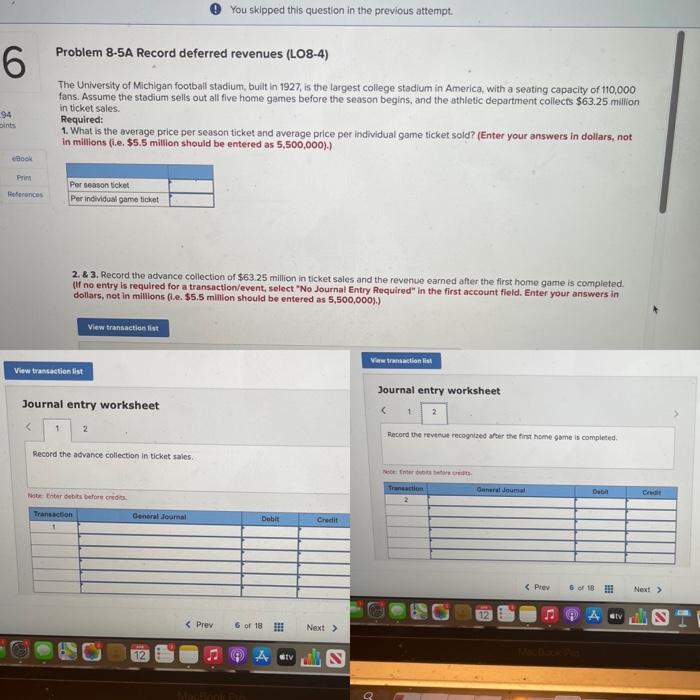

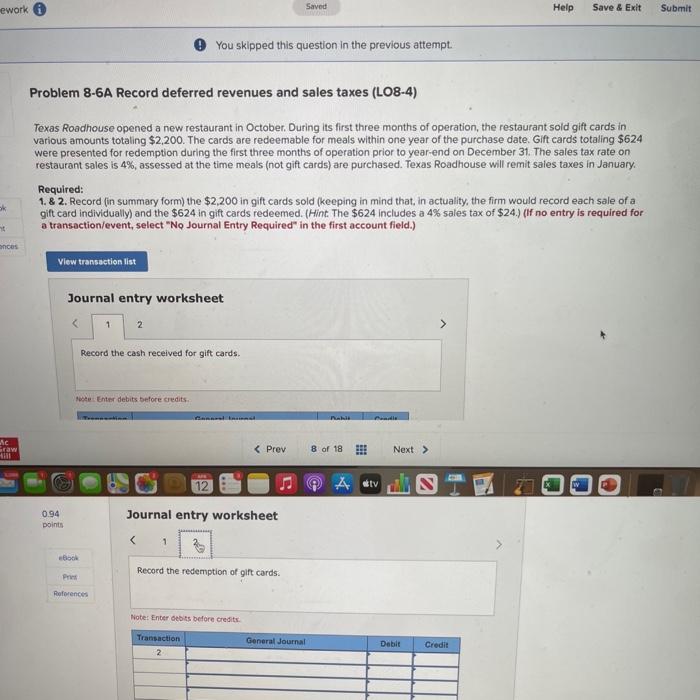

Exercise 8-2A Record notes payable (LO8-2) On November 1, 2021. Aviation Training Corp. borrows $42,000 cash from Community Savings and Loan Aviation Training signs a three-month, 6% note payable Interest is payable at maturity. Aviation's year-end is December 31, Required: 1-3. Record the necessary entries in the Journal Entry Worksheet below. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) ook View transaction list int unces Journal entry worksheet 2 3 > Record the issuance of note Toobal Enter debts before credits Date General Journal Debit Credit Journal entry worksheet as 5,000,000 rences View transaction list Journal entry worksheet 2 3 Record the employer payroll taxes Enter debits before credits You skipped this question in the previous attempt. Problem 8-3A Record payroll (L08-3) Caribbean Tours' total payroll for the month of January was $450,000. The following withholdings, fringe benefits, and payroll taxes apply Federal and state income tax withheld Health insurance premiums paid by employer (payable to Blue Cross) Contribution to retirement plan paid by employer (payable to Fidelity) FICA tax rate (Social Security and Medicare) Federal and state unemployment tax rate $45,000 8,100 18,000 7.654 6.205 Assume that none of the withholdings or payroll taxes has been paid by the end of January (record them as payables), and no employee's cumulative wages exceed the relevant wage bases Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer provided fringe benefits. 3. Record the employer payroll taxes Record the necessary entry for the scenarios given above. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 12 A tv w Journal entry worksheet Surnal entry worksheet Journal entry worksheet he You skipped this question in the previous attempt Problem 8-5A Record deferred revenues (L08-4) 6 94 The University of Michigan football stadium, built in 1927, is the largest college stadium in America, with a seating capacity of 110,000 fans. Assume the stadium sells out all five home games before the season begins, and the athletic department collects $63.25 million in ticket sales Required: 1. What is the average price per season ticket and average price per individual game ticket sold? (Enter your answers in dollars, not in millions (ie. $5.5 million should be entered as 5,500,000).) Book Prim References Persson ticket Per individual game ticket 2. & 3. Record the advance collection of $63.25 million in ticket sales and the revenue earned after the first home game is completed. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (l.e. $5.5 million should be entered as 5,500,000).) View transaction ist View transaction lit View transaction list Journal entry worksheet 12 Atv Saved ework Help Save & Exit Submit You skipped this question in the previous attempt. Problem 8-6A Record deferred revenues and sales taxes (L08-4) Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $2,200. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $624 were presented for redemption during the first three months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Texas Roadhouse will remit sales taxes in January Required: 1. & 2. Record (in summary form) the $2,200 in gift cards sold (keeping in mind that, in actuality, the firm would record each sale of a gift card individually) and the $624 in gift cards redeemed. (Hint. The $624 includes a 4% sales tax of $24.) (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) ok ances View transaction list Journal entry worksheet 1 2 > Record the cash received for gift cards. Noore Enter debits before credits Ac raw HH Atv dili s 0.94 points Journal entry worksheet