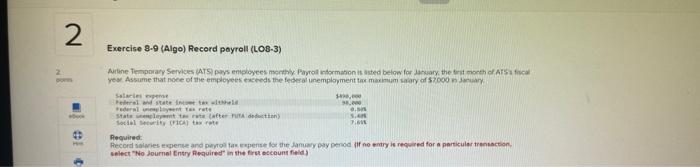

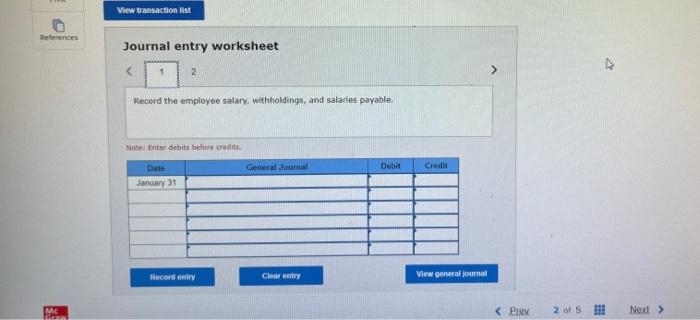

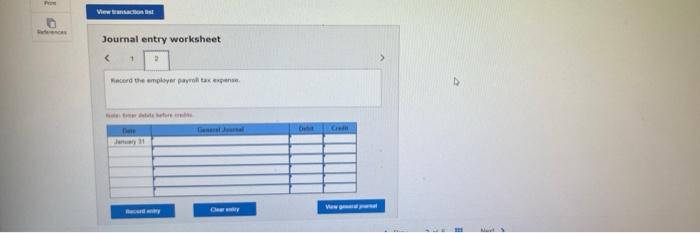

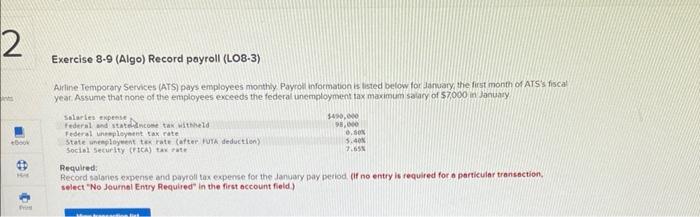

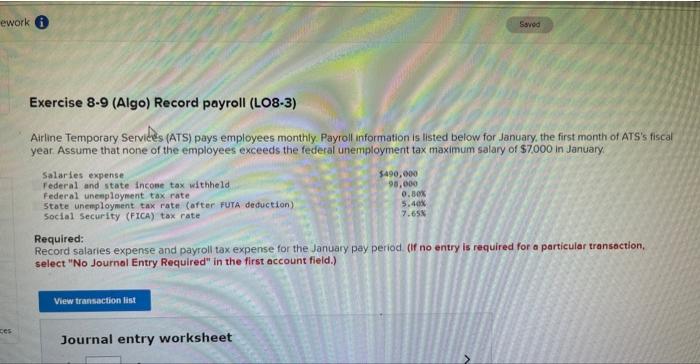

Exercise 8-9 (Algo) Record poyroll (LOB-3) yes. Assume that noce of the employees exceeds the fedeed unemplopment tar marmum satary of 5 fooo n b ancary Pecuired: Record salwies expente and pwyol tak expense fod the Jamuey oly penod it no entry is required for a perticuler treneacton. select "No bournel Entry fequired" in the frut becount field) Journal entry worksheet Record the empioyee salary. withholdings, and salanles payable. Noter Enter debits before credits. Journal entry worksheet Fetierd the employer parvnh tak engense Exercise 8-9 (Algo) Record payroll (LOB-3) Aurline Temporary Services (ATS) pays employees mionthly Payrolinformation is listed belowy for January the first month or ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum solary of 57000 in Januaty Required: Record solaries expense and paytoll tax expense for the January pay period. (if no entry is required for a particular transection. select "No dournol Enry Required" in the first occount field) Exercise 8-9 (Algo) Record payroll (LO8-3) Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January: Required: Record salaries expense and payroll tax expense for the January pay period (if no entry is required for a particular transoction, select "No Journol Entry Required" in the first account field.) Journal entry worksheet Exercise 8-9 (Algo) Record poyroll (LOB-3) yes. Assume that noce of the employees exceeds the fedeed unemplopment tar marmum satary of 5 fooo n b ancary Pecuired: Record salwies expente and pwyol tak expense fod the Jamuey oly penod it no entry is required for a perticuler treneacton. select "No bournel Entry fequired" in the frut becount field) Journal entry worksheet Record the empioyee salary. withholdings, and salanles payable. Noter Enter debits before credits. Journal entry worksheet Fetierd the employer parvnh tak engense Exercise 8-9 (Algo) Record payroll (LOB-3) Aurline Temporary Services (ATS) pays employees mionthly Payrolinformation is listed belowy for January the first month or ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum solary of 57000 in Januaty Required: Record solaries expense and paytoll tax expense for the January pay period. (if no entry is required for a particular transection. select "No dournol Enry Required" in the first occount field) Exercise 8-9 (Algo) Record payroll (LO8-3) Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January: Required: Record salaries expense and payroll tax expense for the January pay period (if no entry is required for a particular transoction, select "No Journol Entry Required" in the first account field.) Journal entry worksheet