Answered step by step

Verified Expert Solution

Question

1 Approved Answer

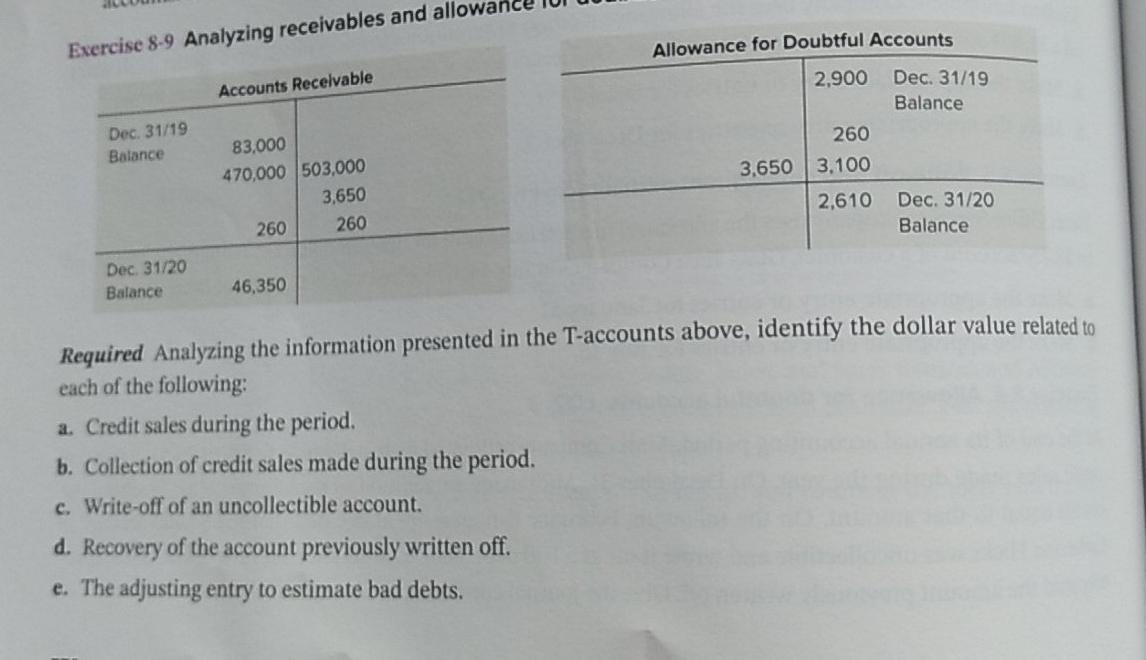

Exercise 8-9 Analyzing receivables and allow Allowance for Doubtful Accounts 2,900 Accounts Recelvable Dec. 31/19 Balance Dec. 31/19 Balance 3,650 83,000 470,000 503,000 3,650 260

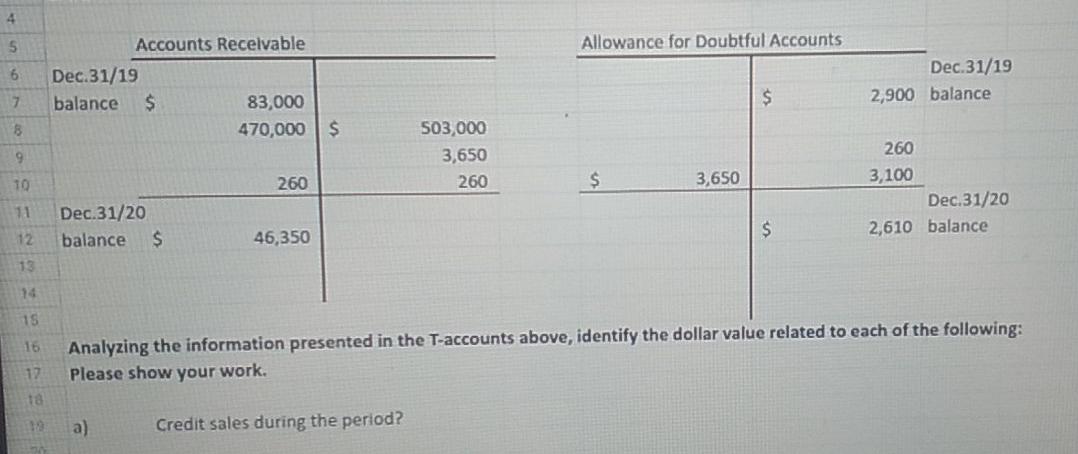

Exercise 8-9 Analyzing receivables and allow Allowance for Doubtful Accounts 2,900 Accounts Recelvable Dec. 31/19 Balance Dec. 31/19 Balance 3,650 83,000 470,000 503,000 3,650 260 260 260 3.100 2.610 Dec. 31/20 Balance Dec. 31/20 Balance 46,350 Required Analyzing the information presented in the T-accounts above, identify the dollar value related to each of the following: a. Credit sales during the period. b. Collection of credit sales made during the period. c. Write-off of an uncollectible account. d. Recovery of the account previously written off. e. The adjusting entry to estimate bad debts. 4 5 Allowance for Doubtful Accounts 6 Accounts Recelvable Dec.31/19 balance $ 83,000 470,000 $ Dec. 31/19 2,900 balance 7 $ 8 503,000 3,650 260 260 9 TO 260 $ 3,650 3,100 Dec. 31/20 2,610 balance 11 Dec. 31/20 balance $ $ 12 46,350 13 15 16 Analyzing the information presented in the T-accounts above, identify the dollar value related to each of the following: Please show your work. 12 18 a) Credit sales during the period? 128 JX A B D E F 19 20 a) Credit sales during the period? 21 22 23 24 b) Collection of credit sales made during the period? 25 28 29 c) Write-off of an uncollectible account? ay Recovery of the account previously written off? 350 37 35 39 e) The adjusting entry to estimate bad debts? 42 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started