Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 9-12 (Algo) Calculate gross profit, cost of goods sold, and selling price LO 9-2, 9-3 MBI Incorporated had sales of $40 million for fiscal

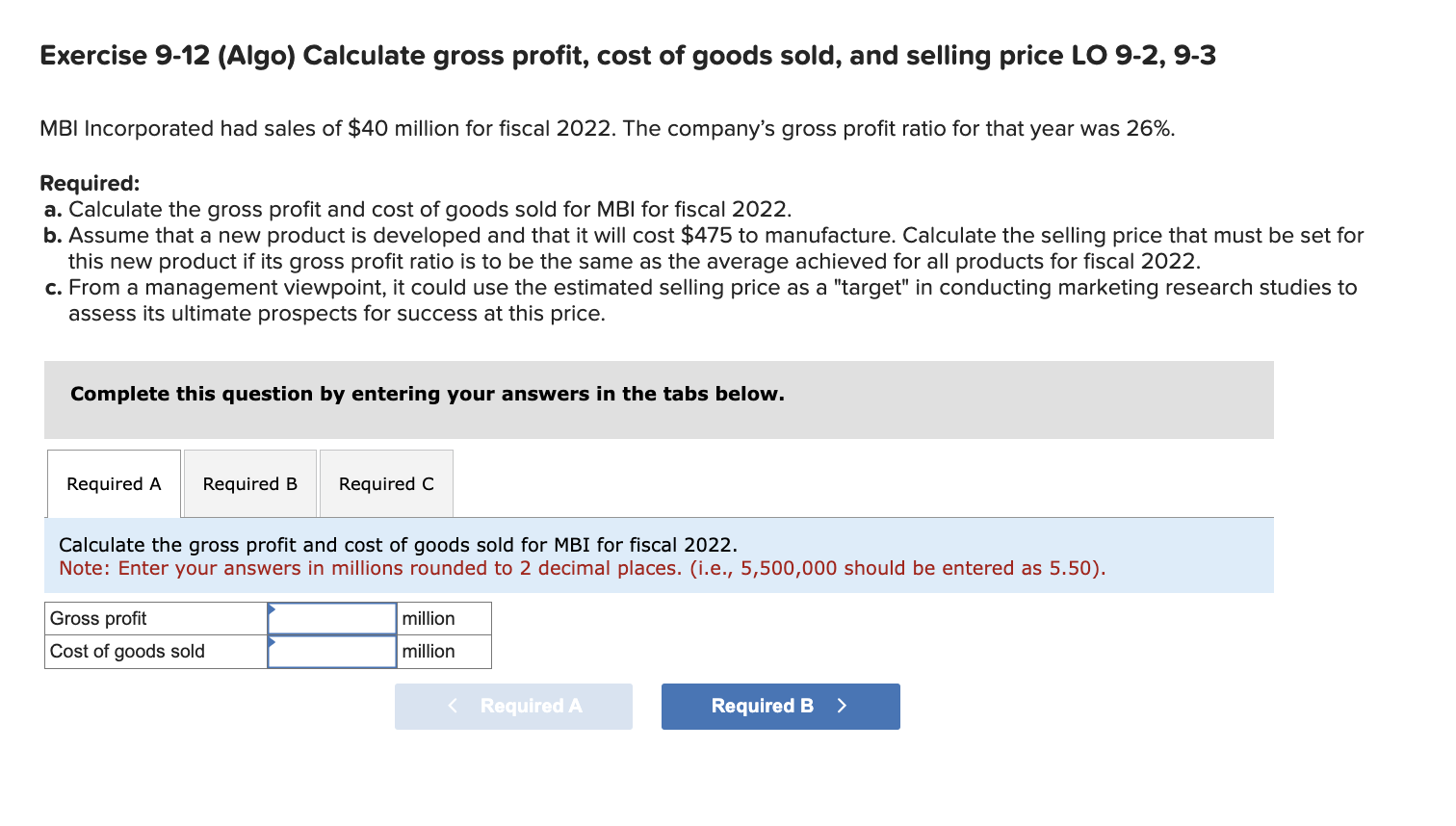

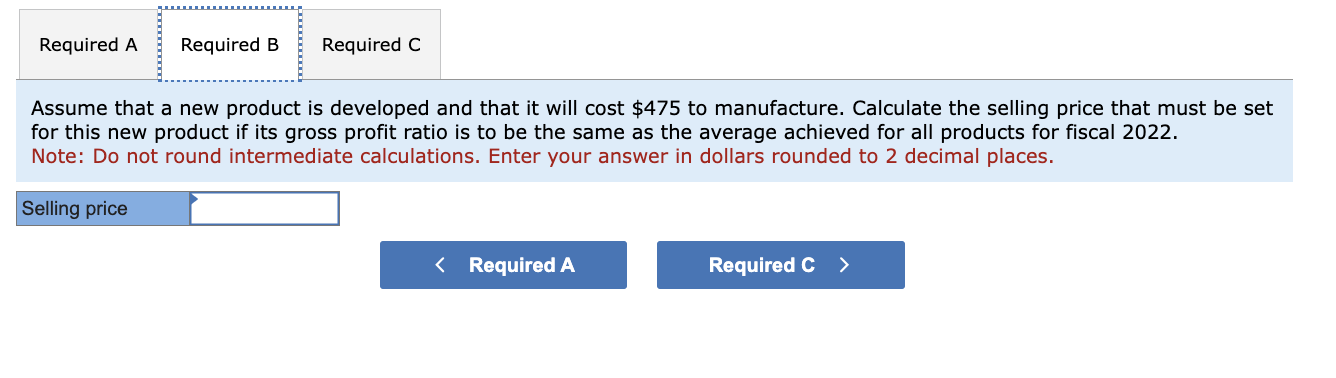

Exercise 9-12 (Algo) Calculate gross profit, cost of goods sold, and selling price LO 9-2, 9-3 MBI Incorporated had sales of $40 million for fiscal 2022. The company's gross profit ratio for that year was 26%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it will cost $475 to manufacture. Calculate the selling price that must be set fo this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. c. From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price. Complete this question by entering your answers in the tabs below. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. Note: Enter your answers in millions rounded to 2 decimal places. (i.e., 5,500,000 should be entered as 5.50 ). Assume that a new product is developed and that it will cost $475 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. Note: Do not round intermediate calculations. Enter your answer in dollars rounded to 2 decimal places. Fom a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies 0 assess its ultimate prospects for success at this price

Exercise 9-12 (Algo) Calculate gross profit, cost of goods sold, and selling price LO 9-2, 9-3 MBI Incorporated had sales of $40 million for fiscal 2022. The company's gross profit ratio for that year was 26%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it will cost $475 to manufacture. Calculate the selling price that must be set fo this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. c. From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price. Complete this question by entering your answers in the tabs below. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. Note: Enter your answers in millions rounded to 2 decimal places. (i.e., 5,500,000 should be entered as 5.50 ). Assume that a new product is developed and that it will cost $475 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. Note: Do not round intermediate calculations. Enter your answer in dollars rounded to 2 decimal places. Fom a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies 0 assess its ultimate prospects for success at this price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started