Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 9-14 (Algorithmic) (LO. 3) In November 2023, Kortney (who is a self-employed management consultant) travels from Chicago to Barcelona (Spain) on business. She is

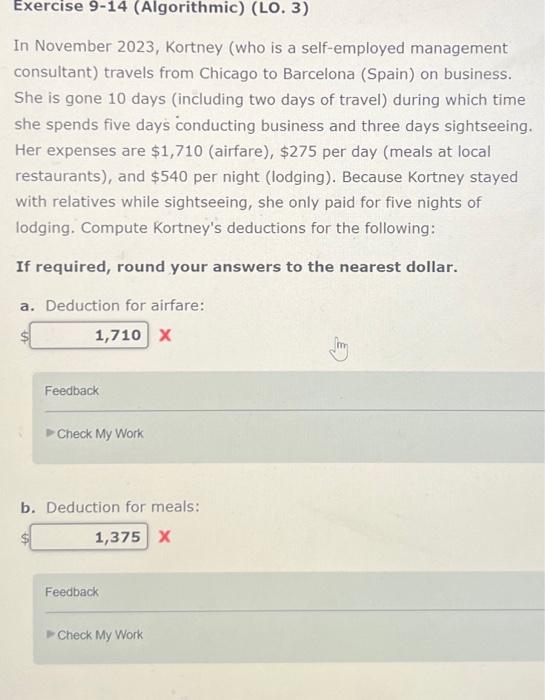

Exercise 9-14 (Algorithmic) (LO. 3) In November 2023, Kortney (who is a self-employed management consultant) travels from Chicago to Barcelona (Spain) on business. She is gone 10 days (including two days of travel) during which time. she spends five days conducting business and three days sightseeing. Her expenses are $1,710 (airfare), $275 per day (meals at local restaurants), and $540 per night (lodging). Because Kortney stayed with relatives while sightseeing, she only paid for five nights of lodging. Compute Kortney's deductions for the following: If required, round your answers to the nearest dollar. a. Deduction for airfare: 1,710 X Feedback Check My Work b. Deduction for meals: 1,375 X Feedback Check My Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started