Answered step by step

Verified Expert Solution

Question

1 Approved Answer

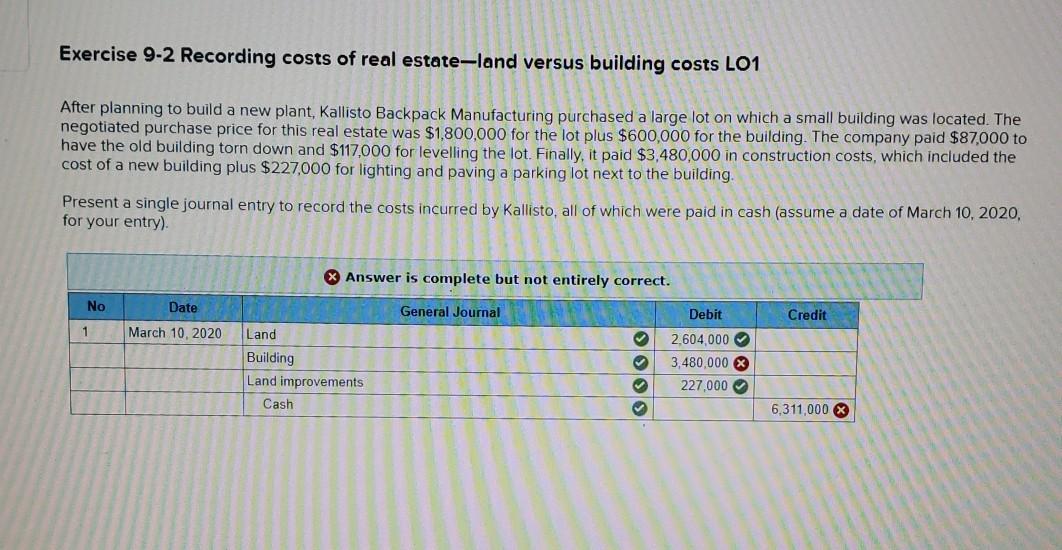

Exercise 9-2 Recording costs of real estate-land versus building costs LO1 After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot

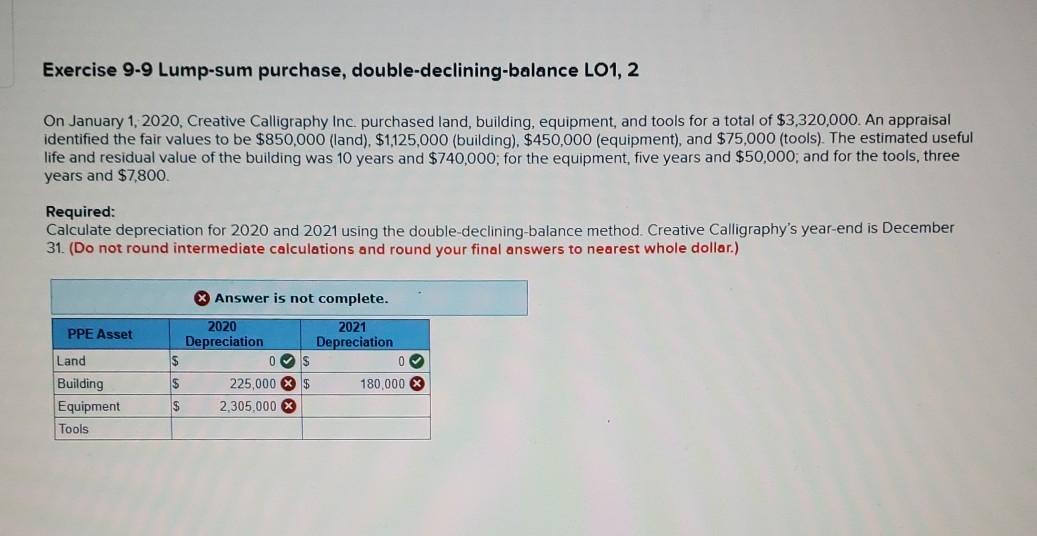

Exercise 9-2 Recording costs of real estate-land versus building costs LO1 After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot on which a small building was located. The negotiated purchase price for this real estate was $1,800,000 for the lot plus $600,000 for the building. The company paid $87,000 to have the old building torn down and $117,000 for levelling the lot. Finally, it paid $3,480,000 in construction costs, which included the cost of a new building plus $227,000 for lighting and paving a parking lot next to the building. Present a single journal entry to record the costs incurred by Kallisto, all of which were paid in cash (assume a date of March 10, 2020, for your entry) * Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 March 10, 2020 Land Building Land improvements Cash 2.604,000 3,480,000 X 227,000 6,311,000 X Exercise 9-9 Lump-sum purchase, double-declining-balance L01, 2 On January 1, 2020, Creative Calligraphy Inc purchased land, building, equipment, and tools for a total of $3,320,000. appraisal identified the fair values to be $850,000 (land) $1,125,000 (building). $450,000 (equipment), and $75,000 (tools). The estimated useful life and residual value of the building was 10 years and $740,000, for the equipment, five years and $50,000, and for the tools, three years and $7,800. Required: Calculate depreciation for 2020 and 2021 using the double-declining-balance method Creative Calligraphy's year-end is December 31. (Do not round intermediate calculations and round your final answers to nearest whole dollar.) Answer is not complete. PPE Asset Land Building Equipment Tools 2020 2021 Depreciation Depreciation $ 0 0 $ 225,000 X $ 180,000 X $ 2,305,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started