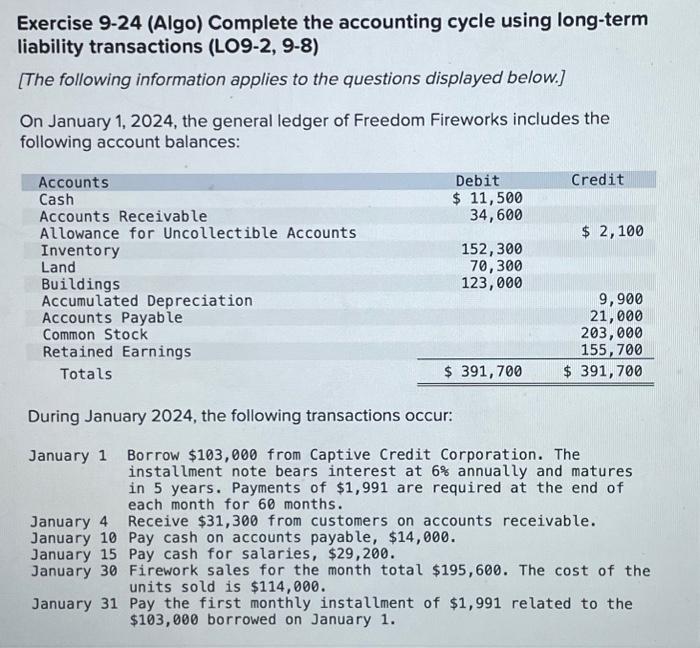

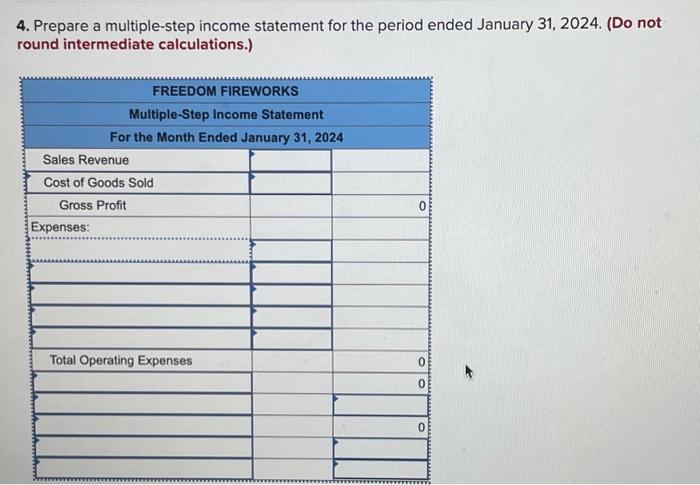

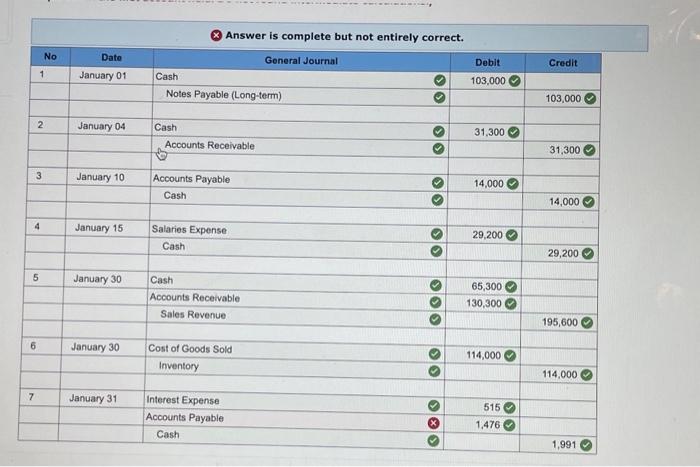

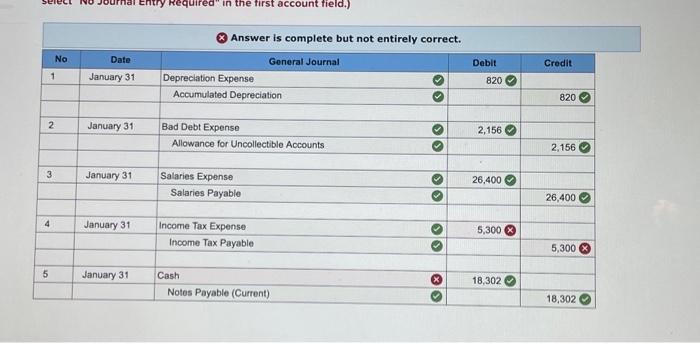

Exercise 9-24 (Algo) Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024 , the following transactions occur: January 1 Borrow $103,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $1,991 are required at the end of each month for 60 months. January 4 Receive $31,300 from customers on accounts receivable. January 10 Pay cash on accounts payable, $14,000. January 15 Pay cash for salaries, \$29,200. January 30 Firework sales for the month total $195,600. The cost of the units sold is $114,000. January 31 Pay the first monthly installment of $1,991 related to the $103,000 borrowed on January 1 . 4. Prepare a multiple-step income statement for the period ended January 31,2024 . (Do not round intermediate calculations.) Answar is ramnleta hut nat awblratu anmant Answer is complete but not entirely correct. Exercise 9-24 (Algo) Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024 , the following transactions occur: January 1 Borrow $103,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $1,991 are required at the end of each month for 60 months. January 4 Receive $31,300 from customers on accounts receivable. January 10 Pay cash on accounts payable, $14,000. January 15 Pay cash for salaries, \$29,200. January 30 Firework sales for the month total $195,600. The cost of the units sold is $114,000. January 31 Pay the first monthly installment of $1,991 related to the $103,000 borrowed on January 1 . 4. Prepare a multiple-step income statement for the period ended January 31,2024 . (Do not round intermediate calculations.) Answar is ramnleta hut nat awblratu anmant Answer is complete but not entirely correct