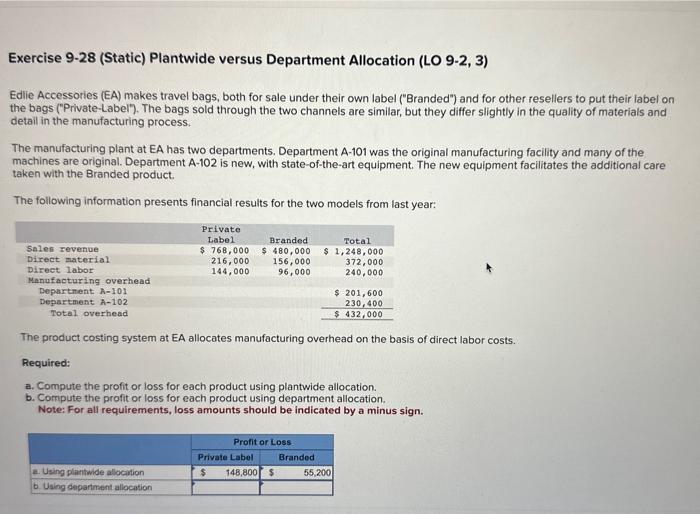

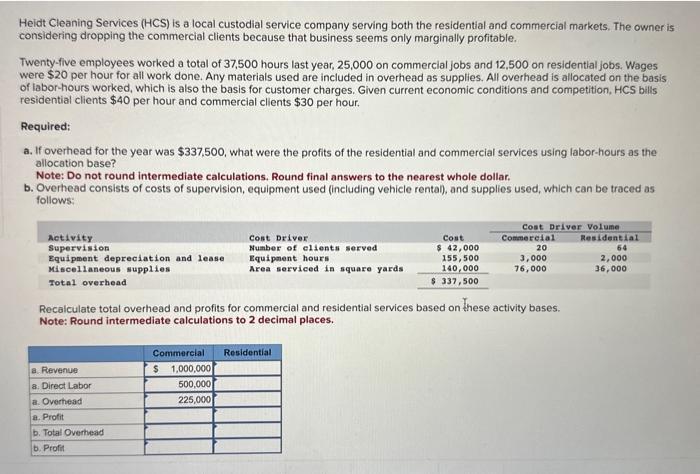

Exercise 9-28 (Static) Plantwide versus Department Allocation (LO 9-2, 3) Edlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for other resellers to put their label on the bags ("Private-Label"). The bags sold through the two channels are similar, but they differ slightly in the quality of materials and detail in the manufacturing process. The manufacturing plant at EA has two departments. Department A-101 was the original manufacturing facility and many of the machines are original. Department A-102 is new, with state-of-the-art equipment. The new equipment facilitates the additional care taken with the Branded product. The following information presents financial results for the two models from last year: The product costing system at EA allocates manufacturing overhead on the basis of direct labor costs. Required: a. Compute the profit or loss for each product using plantwide allocation. b. Compute the profit or loss for each product using department allocation. Note: For all requirements, loss amounts should be indicated by a minus sign. Heidt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets, The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees worked a total of 37,500 hours last year, 25,000 on commercial jobs and 12,500 on residential jobs. Wages were $20 per hour for all work done. Any materials used afe included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Given current economic conditions and competition, HCS bills residential clients $40 per hour and commercial clients $30 per hour. Required: a. If overhead for the year was $337,500, what were the profits of the residential and commercial services using labor-hours as the allocation base? Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. b. Overhead consists of costs of supervision, equipment used (including vehicle rental), and supplies used, which can be traced as follows: Recalculate total overhead and profits for commercial and residential services based on these activity bases. Note: Round intermediate calculations to 2 decimal places