Answered step by step

Verified Expert Solution

Question

1 Approved Answer

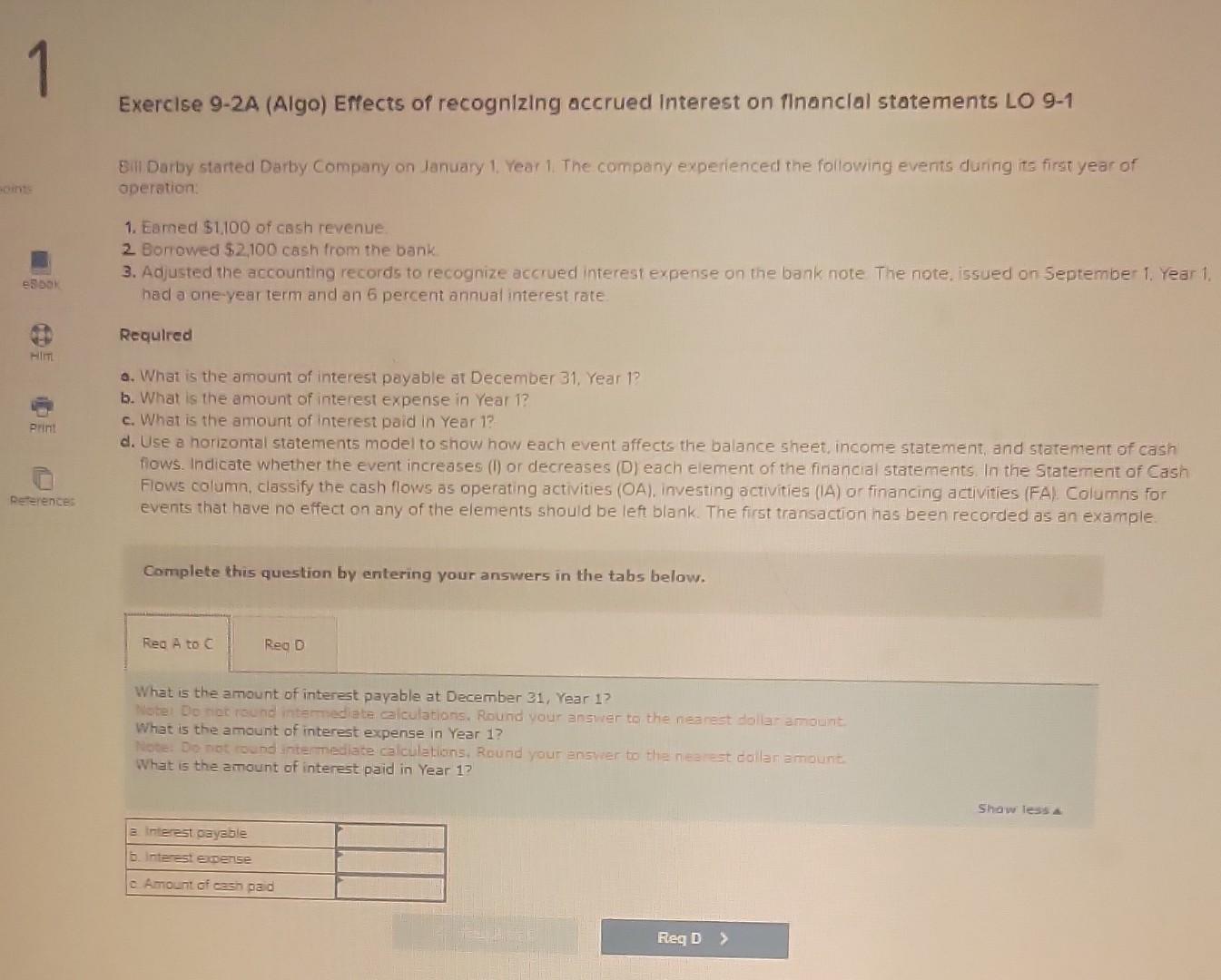

Exercise 9-2A (Algo) Effects of recognizing accrued Interest on flnanclal statements LO 91 Eill Darby started Darby Company on January 1. Year 1. The company

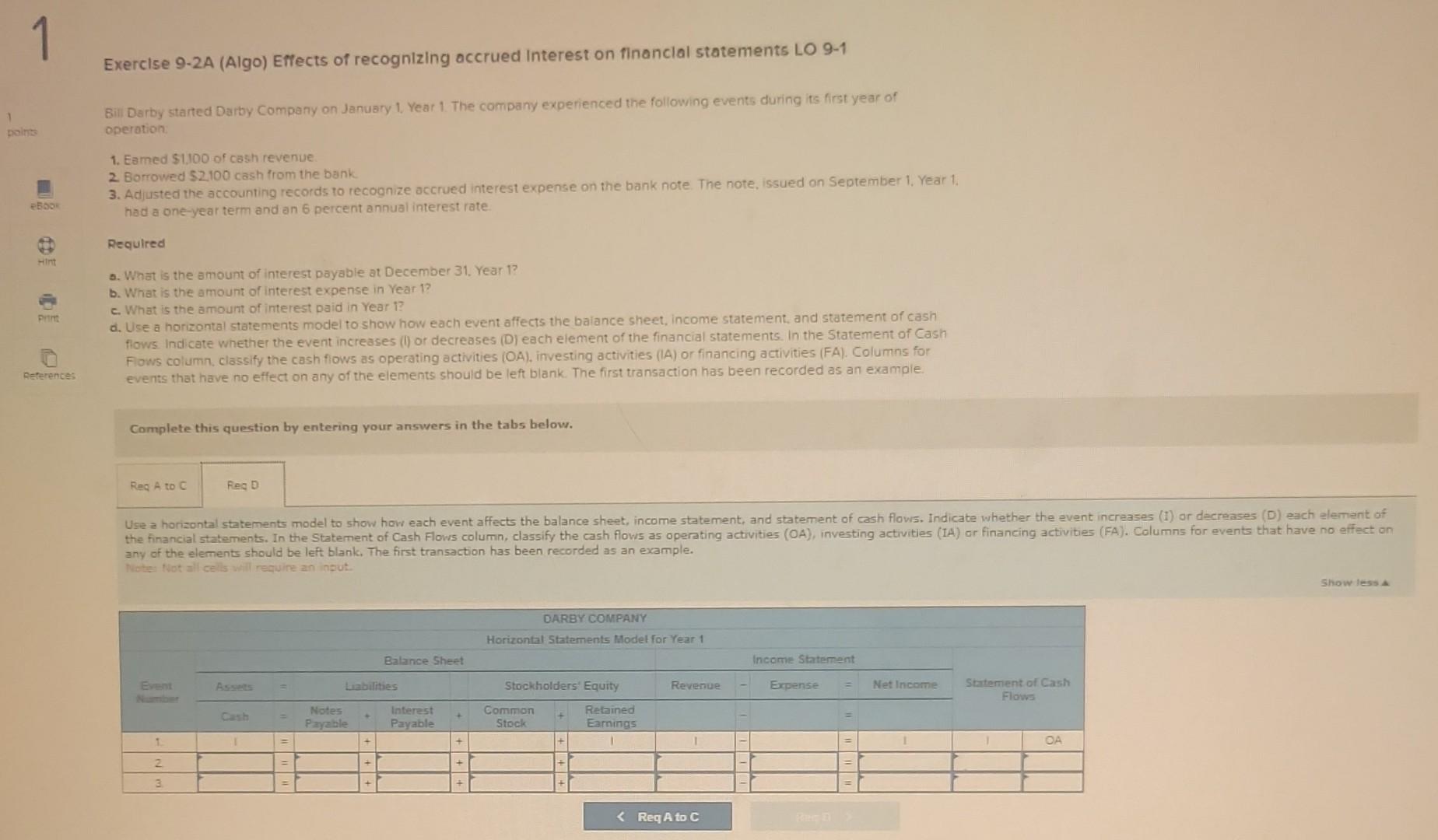

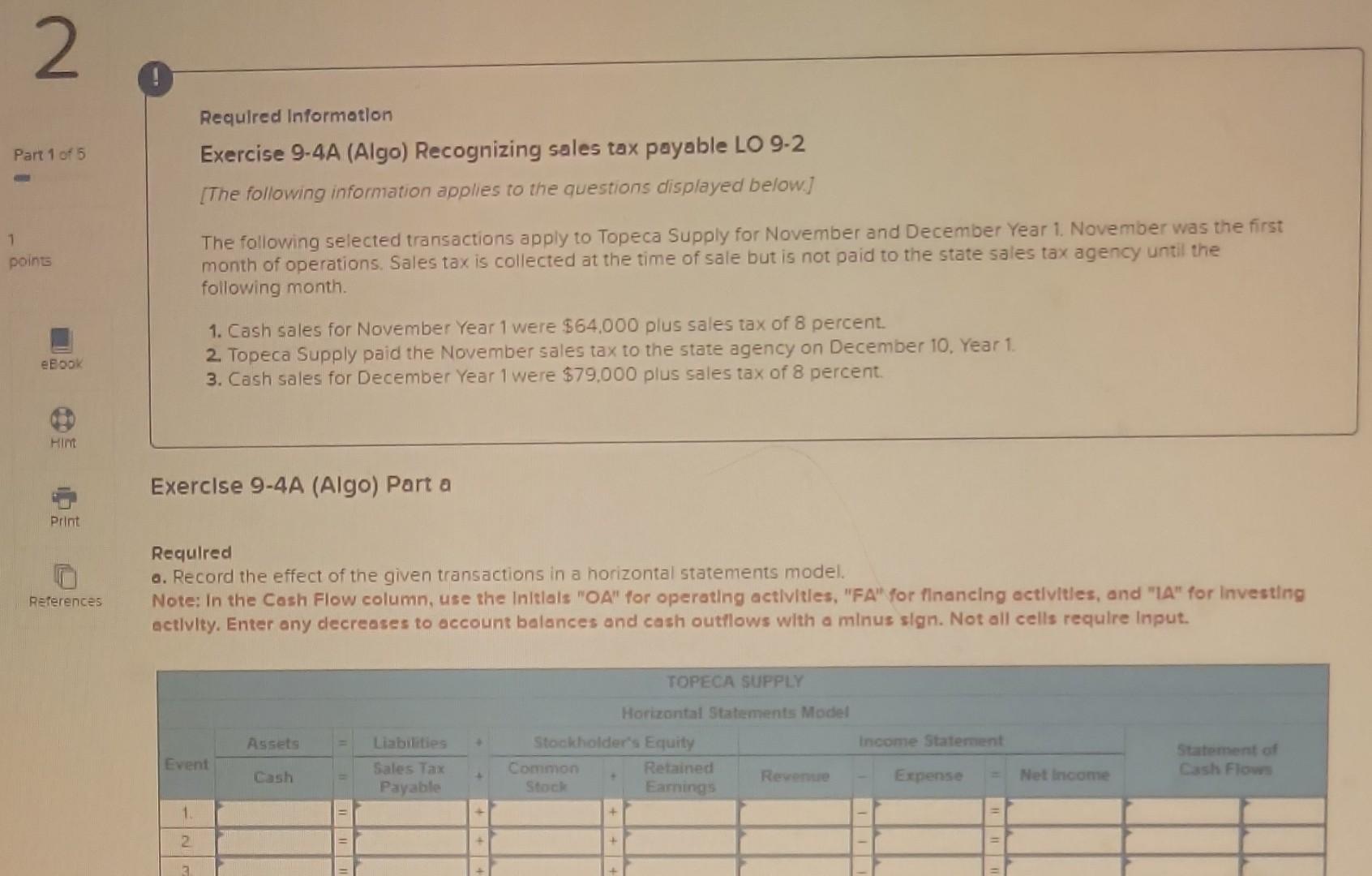

Exercise 9-2A (Algo) Effects of recognizing accrued Interest on flnanclal statements LO 91 Eill Darby started Darby Company on January 1. Year 1. The company experienced the following events during its first year of operation: 1. Earned $1.100 of cash revenue. 2. Borrowed \$2,100 cash from the bank 3. Adjusted the accounting records to recognize accrued interest expense on the bank note The note, issued on September 1 . Year 1 . had a one-year term and an 6 percent annual interest rate Requlred a. What is the amount of interest payable at December 31 , Year 1 ? b. What is the amount of interest expense in Year 1 ? c. What is the amount of interest paid in Year 1 ? d. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases (I) or decreases (D) each element of the financial statements. In the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA) or financing activities (FA). Columns for events that have no effect on any of the elements should be left blank. The first transaction has been recorded as an example. Complete this question by entering your answers in the tabs below. What is the amount of interest payable at December 31 , Year 1 ? What is the amount of interest expense in Year 1 ? What is the amount of interest expense in Year 1 ? What is the amount of interest paid in Year 17 ? What is the amount of interest paid in Year 17 Exerclse 9-2A (Algo) Effects of recognizing occrued Interest on financlal statements LO 9-1 Bili Darby started Darby Company on January 1, Year 1 . The company experienced the following events during its first year of operotion: 1. Eamed $1,100 of cash revenue. 2. Borrowed $2.100 cash from the bank 3. Adjusted the accounting records to recognize accrued interest expense on the bank note The note, issued on September 1 , Year 1. had a one-year term and an 6 percent annual interest rate. Required a. What is the amount of interest payable at December 31. Year 1? b. What is the amount of interest expense in Year 1 ? c. What is the amount of interest paid in Year 1 ? d. Use a horizontal statements model to show how each event affects the baiance sheet, income statement, and statement of cash flows ind cate whether the event increases (i) or decreases (D) each element of the financial statements. In the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA) or financing activities (FA). Columns for events that have no effect on any of the elements should be left blank. The first transaction has been recorded as an example. Complete this question by entering your answers in the tabs below. any of the elements should be left blank. The first transaction has been recorded as an example. Required Informetlon Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $64,000 plus sales tax of 8 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10 , Year 1. 3. Cash sales for December Year 1 were $79,000 plus sales tax of 8 percent. Exerclse 9-4A (Algo) Part a Required a. Record the effect of the given transactions in a horizontal statements model. Note: In the Cash Flow column, use the Initials "OA" for operating activitles, "FA" for financing activities, and "la" for Investing actlvity. Enter any decreases to account balances and cash outllows with a minus sign. Not all cells require Input. Required Informetion Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $64,000 plus sales tax of 8 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10 , Year 1 . 3. Cash sales for December Year 1 were $79,000 plus sales tax of 8 percent. Exerclse 9-4A (Algo) Part b b. What was the total amount of sales tax paid in Year 1? Requlred Informetlon Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1 . November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $64,000 plus sales tax of 8 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $79,000 plus sales tax of 8 percent. Exerclse 9-4A (Algo) Part C c. What was the total amount of sales tax collected in Year 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started