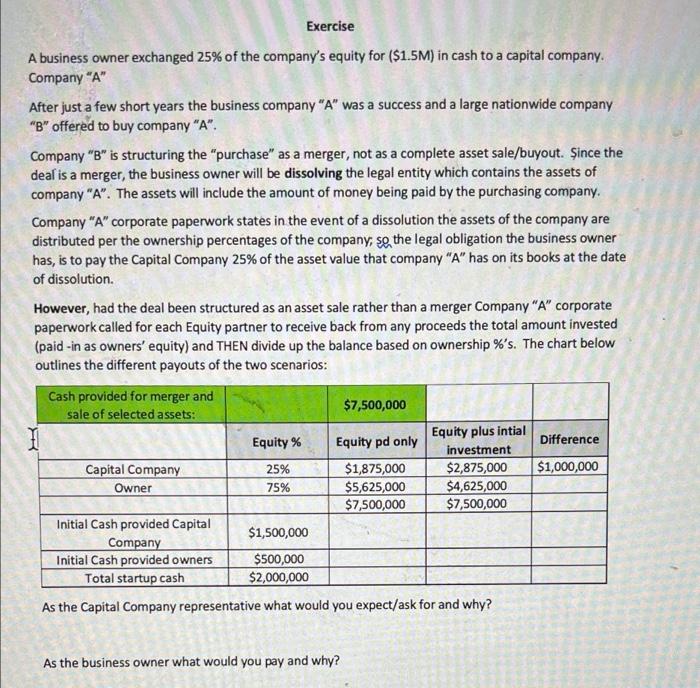

Exercise A business owner exchanged 25% of the company's equity for ($1.5M) in cash to a capital company. Company "A" After just a few short years the business company "A" was a success and a large nationwide company "B" offered to buy company "A". Company "B" is structuring the "purchase" as a merger, not as a complete asset sale/buyout. Since the deal is a merger, the business owner will be dissolving the legal entity which contains the assets of company "A". The assets will include the amount of money being paid by the purchasing company. Company "A" corporate paperwork states in the event of a dissolution the assets of the company are distributed per the ownership percentages of the company, so the legal obligation the business owner has, is to pay the Capital Company 25% of the asset value that company "A" has on its books at the date of dissolution. However, had the deal been structured as an asset sale rather than a merger Company "A" corporate paperwork called for each Equity partner to receive back from any proceeds the total amount invested (paid-in as owners' equity) and THEN divide up the balance based on ownership %'s. The chart below outlines the different payouts of the two scenarios: Cash provided for merger and sale of selected assets: $7,500,000 Equity plus intial Equity % Equity pd only Difference Capital Company $1,875,000 $2,875,000 $1,000,000 Owner $5,625,000 $4,625,000 $7,500,000 $7,500,000 Initial Cash provided Capital $1,500,000 Company Initial Cash provided owners $500,000 Total startup cash $2,000,000 As the Capital Company representative what would you expect/ask for and why? investment 25% 75% As the business owner what would you pay and why? Exercise A business owner exchanged 25% of the company's equity for ($1.5M) in cash to a capital company. Company "A" After just a few short years the business company "A" was a success and a large nationwide company "B" offered to buy company "A". Company "B" is structuring the "purchase" as a merger, not as a complete asset sale/buyout. Since the deal is a merger, the business owner will be dissolving the legal entity which contains the assets of company "A". The assets will include the amount of money being paid by the purchasing company. Company "A" corporate paperwork states in the event of a dissolution the assets of the company are distributed per the ownership percentages of the company, so the legal obligation the business owner has, is to pay the Capital Company 25% of the asset value that company "A" has on its books at the date of dissolution. However, had the deal been structured as an asset sale rather than a merger Company "A" corporate paperwork called for each Equity partner to receive back from any proceeds the total amount invested (paid-in as owners' equity) and THEN divide up the balance based on ownership %'s. The chart below outlines the different payouts of the two scenarios: Cash provided for merger and sale of selected assets: $7,500,000 Equity plus intial Equity % Equity pd only Difference Capital Company $1,875,000 $2,875,000 $1,000,000 Owner $5,625,000 $4,625,000 $7,500,000 $7,500,000 Initial Cash provided Capital $1,500,000 Company Initial Cash provided owners $500,000 Total startup cash $2,000,000 As the Capital Company representative what would you expect/ask for and why? investment 25% 75% As the business owner what would you pay and why